by Lance Roberts, STA Wealth Management

Over the weekend, I read a very interesting article by Ryan Puplava discussing the fundamental backdrop of the financial markets. As he states:

"I've been hearing the pushback to the market's gains, there are a few that are louder than the rest. I guess if you say something enough times; it becomes the truth."

Ryan argues against a list of fundamental criticisms of the bull market as follows:

- Stocks are overvalued

- Stocks are up because of the Fed

- Earnings are growing only because of buybacks

- Stocks are in a bubble

While Ryan's analysis is correct when using a 20-year data set, I would argue that the dataset is too small for proper analysis. Over the last twenty years, we have seen witnessed three stock market elevations and two deflations. Each bubble and subsequent collapse were driven by excess liquidity, willful blindness to fundamental underpinnings, Federal Reserve interventions, Governmental deregulation and interventions, relaxation of accounting standards, leverage, suppression of interest rates and the rise of capital cronyism. Never before in history have so many artificial supports been singularly focused, both domestically and internationally, on the inflation of asset prices.

Most importantly, as I discussed this past weekend, while "this time is not different" it is also "not the same."

While Ryan argues the "fundamental" underpinnings of the financial markets; the problem is that market "bubbles" are "behavioral" in nature. As I stated:

"Now, let me throw you for a bit of a loop.

'Stock market bubbles have NOTHING to do with valuations or fundamentals.'

I know. I know. That statement borders on the verge of heresy but let me explain.

If stock market bubbles are driven by speculation, greed and emotional biases – the valuations and fundamentals are simply a reflection of those emotions.

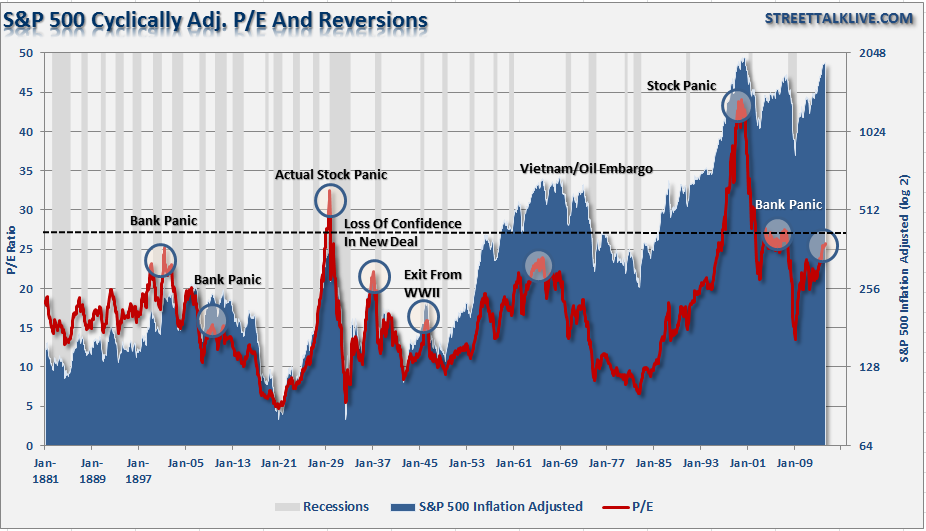

In other words, bubbles can exist even at times when valuations and fundamentals might argue otherwise. Let me show you a very basic example of what I mean. The chart below is the long-term valuation of the S&P 500 going back to 1871.

"First, it is important to notice that with the exception of only 1929, 2000 and 2007, every other major market crash occurred with valuations at levels equal to, or lower, than they are currently. Secondly, all of these crashes have been the result of things unrelated to valuation levels such as liquidity issues, government actions, rising interest rates, recessions or inflationary spikes. However, those events were only a catalyst, or trigger, that started the “panic for the exits” by investors.

Market crashes are an “emotionally” driven imbalance in supply and demand. You will commonly hear that “for every buyer there must be a seller.” This is absolutely true to a point. However, what moves prices up and down, in a normal market environment, is the price level at which a buyer and seller complete a transaction.

In a market crash, however, the number of people wanting to “sell” vastly overwhelms the number of people willing to “buy.” It is at these moments that prices drop precipitously as “sellers” drop the levels at which they are willing to dump their shares in a desperate attempt to find a “buyer." This has nothing to do with fundamentals. It is strictly an emotional panic which is ultimately reflected by a sharp devaluation in market fundamentals."

(Note: this is also the danger of excessive margin debt in the financial markets. Margin debt is comprised of “loans” based on the value of a stock portfolio. As prices plunge, the drop in valuations trigger “calls” on margin loans which then requires more sells. The additional selling triggers more selling, and so on.)

In a highly complacent market environment, as we have currently, there is little attention paid to geopolitical tensions, economic or fundamental data or a variety of other relevant risks. The emotional “greed” to chase returns overrides the sense of logic. “Warnings” that do not immediately lead to a market correction are simply viewed as wrong. However, as investors, are we not repeatedly told to "buy when there is blood in the streets." Yet, in order to be able to buy in times of "panic," one would have needed to have "sold" into "exuberance."

The point is simple. Stock market crashes are triggered by an “emotional panic,” rather than a fundamental data point. While fundamentals are indeed important in determining the long-term (10 years or more) return on an investment, they are terrible at predicting "emotionally driven" turning points in market prices. Like a crowded theatre, no one worries when one or two people exit the building. However, the problem comes when someone yells "fire" and everyone tries to exit the building at the same time. The rush for the exits sends share prices plummeting regardless of the underlying fundamentals.

As I discussed recently in "5 Cognitive Biases That Are Killing Your Returns:"

"Though we are often unconscious of the action, humans tend to 'go with the crowd.' Much of this behavior relates back to 'confirmation' of our decisions but also the need for acceptance. The thought process is rooted in the belief that if 'everyone else' is doing something, then if I want to be accepted, I need to do it too.

In life, 'conforming' to the norm is socially accepted and in many ways expected. However, in the financial markets the 'herding' behavior is what drives market excesses during advances and declines. As Howard Marks once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that 'being too far ahead of your time is indistinguishable from being wrong.)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian."

Moving against the 'herd' is where the most profits are generated by investors in the long term. The difficulty for most individuals, unfortunately, is knowing when to 'bet' against the stampede."

The current elevation in asset prices is clearly beginning to reach levels of exuberance particularly in high yield "junk" bonds. This time, like every other time before, will eventually end the same. However, while this time "is not different" in terms of outcome, the fundamental level from which the eventual "reversion to the mean" occurs will likely surprise most of the mainstream "bullish" clergy.

There one overriding advantage of the “always bullish” financial media is that they created "protective bubble” of never being wrong. When asset prices are rising they continue the “sirens song” of the bullish mantras of long term investing, buy and hold, and beating some random benchmark index. However, when it inevitably goes horribly wrong and costs individuals a major chunk of their life savings, the excuse is simply “well, no one could have seen that coming.”

In the end, we are just human. Despite the best of our intentions, it is nearly impossible for an individual to be devoid of the emotional biases that inevitably lead to poor investment decision making over time. This is why all great investors have strict investment disciplines that they follow to reduce the impact of human emotions. While fundamentals, valuations, and economics will have a significant impact on long-term returns, they are all extremely lousy tools for managing portfolio risk in the short term.

Take a step back from the media, and Wall Street commentary, for a moment and make an honest assessment of the financial markets today. If our job is to "bet" when the "odds" of winning are in our favor, then exactly how "strong" is the fundamental hand you are currently betting on?

This time could indeed be different, but are you willing to bet your retirement on it?

Copyright © Lance Roberts, STA Wealth Management