by Don Vialoux, Timing the Market

Economic News This Week

June Retail Sales to be reported at 8:30 AM EDT on Tuesday are expected to increase 0.6% versus a gain of 0.3% in May. Excluding auto sales, June Retail Sales are expected to increase 0.6% versus a gain of 0.3% in May.

July Empire Manufacturing Index to be reported at 8:30 AM EDT on Tuesday is expected to slip to 17.0 from 19.3 in June.

May Business Inventories to be reported at 10:00 AM EDT on Tuesday are expected to increase 0.6% versus a gain of 0.6% in April

June Canadian Existing Home Sales to be released at 9:00 AM EDT on Tuesday are expected to increase 7.5% on a year-over-year basis versus a gain of 4.8% in May.

Federal Reserve Chairman Janet Yellen is expected to appear before the Senate Banking Committee at 10:00 PM on Tuesday

June Producer Prices to be reported at 8:30 AM EDT on Wednesday are expected to increase 0.2% versus a decline of 0.2% in May. Excluding food and energy, June PPI is expected to increase 0.2% versus a decline of 0.1% in May.

Bank of Canada interest rate to be released at 10:00 AM EDT on Wednesday is expected to remain unchanged at 1.0%.

June Industrial Production to be reported at 9:15 AM EDT on Wednesday is expected to increase 0.3% versus a gain of 0.6% in May. June Capacity Utilization is expected to increase to 79.3 from 79.1% in May.

The July Beige Book is to be released at 2:00 PM EDT on Wednesday

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 310,000 from 304,000 last week.

June Housing Starts to be released at 8:30 AM EDT on Thursday are expected to increase to 1,020,000 units from 1,001,000 in May.

The July Philadelphia Fed Index to be released at 10:00 AM EDT on Thursday is expected to slip to 16.0 from 17.8 in June

June Canadian Consumer Prices to be released at 8:30 AM EDT on Friday are expected to increase 0.1% versus a gain of 0.5% in May. On a year-over-year basis June CPI is expected to increase 2.4% versus a gain of 2.3% in May.

The July Michigan Sentiment Index to be released at 9:55 AM EDT on Friday is expected to increase to 83.0 from 82.5 in June.

June Leading Economic Indicators to be released at 10:00 AM EDT on Friday are expected to increase 0.5% versus a gain of 0.5% in 0.5% in May.

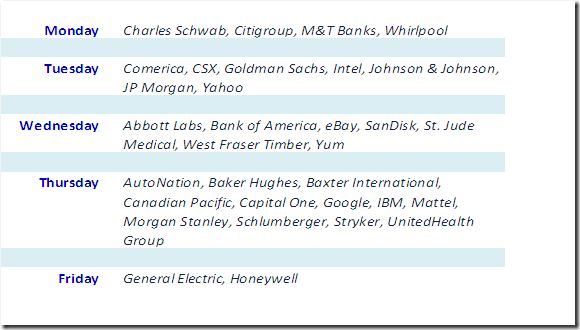

Earnings News

Equity Trends

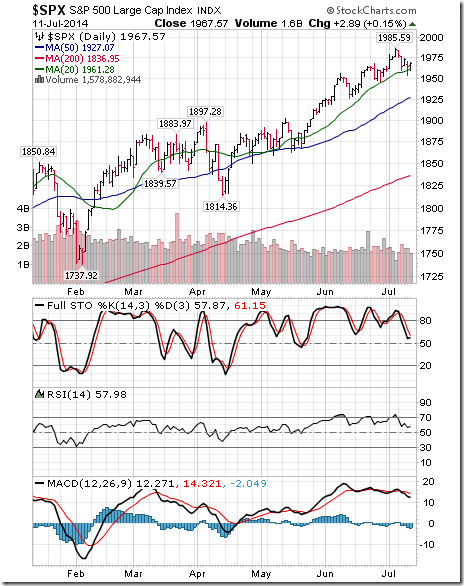

The S&P 500 Index fell 17.87 points (0.90%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day moving average plunged from 85.00% to 76.80%. Percent is intermediate overbought and trending down.

Percent of S&P 500 stocks trading above their 200 day moving average fell to 84.80% from 90.00%. Percent is intermediate overbought and trending down.

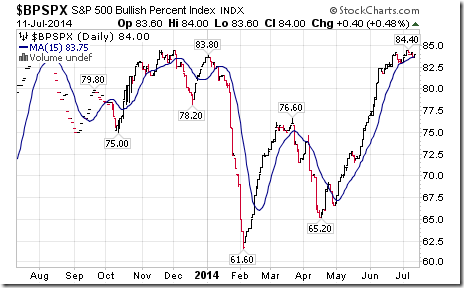

Bullish Percent Index for S&P 500 stocks slipped last week to 84.00% from 84.40% and remained above its 15 day moving average. The Index remains intermediate overbought.

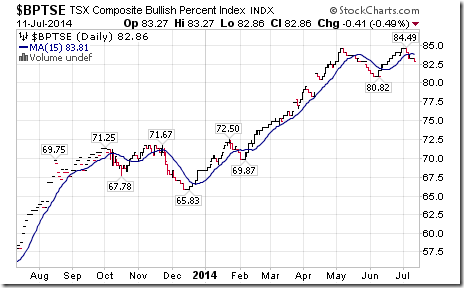

Bullish Percent Index for TSX Composite stocks slipped last week to 82.86% from 84.08% and fell below its 15 day moving average. The Index remains intermediate overbought and rolling over.

The TSX Composite Index lost 89.46 points (0.59%) last week. Intermediate trend remains up (Score: 1.0). The Index remains above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index remains neutral (Score: 0.5). Technical score based on the above indicators remains at 2.5 out of 3.0. Short term momentum indicators are trending down.

Percent of TSX stocks trading above their 50 day moving average plunged last week to 53.50% from 67.90%. Percent remains intermediate overbought and is trending down.

Percent of TSX stocks trading above their 200 day moving average slipped last week to 76.95% from 79.84%. Percent remains intermediate overbought and is starting to trend down.

The Dow Jones Industrial Average fell 124.45 points (0.73%) last week. Intermediate trend remains up. The Average remains above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending down.

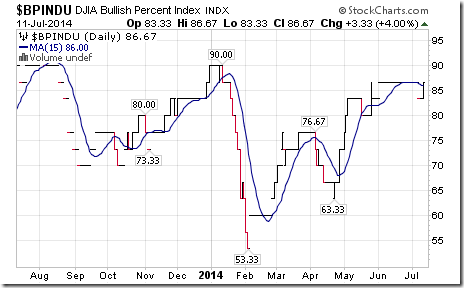

Bullish Percent Index for Dow Jones Industrial Average stocks remained at 86.67% last week. The Index is slightly above its 15 day moving average. The Index remains intermediate overbought.

Bullish Percent Index for NASDAQ Composite stocks fell last week to 60.47% from 62.78% and fell below its 15 day moving average. The Index remains intermediate overbought and has rolled over.

The NASDAQ Composite Index dropped 70.43 points (1.57%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score slipped to 2.5 from 3.0 out of 3.0. Short term momentum indicators are trending down.

The Russell 2000 Index dropped 48.22 points (3.00%) last week. Intermediate trend changed from neutral to negative on a move below 1154.33. The Index moved below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to negative. Technical score fell to 0.0 from 2.5 out of 3.0. Short term momentum indicators are trending down.

The Dow Jones Transportation Average dropped 40.43 points (0.49%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index improved to positive to neutral. Technical score improved to 3.0 out of 3.0. Short term momentum indicators are trending down.

The Australia All Ordinaries Composite Index dropped 37.22 points (0.68%) last week. Intermediate trend remains neutral. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from negative to neutral. Technical score improved to 2.0 from 1.5 out of 3.0. Short term momentum indicators are mixed.

The Nikkei Average dropped 273.09 points (1.72%) last week. Intermediate trend remains up. The Average fell below its 20 day moving average on Friday. Strength relative to the S&P 500 Index remains neutral. Technical score fell to 1.5 from 2.5 out of 3.0. Short term momentum indicators are trending down.

Europe 350 iShares plunged $1.66 (3.37%) last week. Trend changed from up to down on a move below $48.02. Units fell below their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score dropped to 0.0 from 1.5 out of 3.0. Short term momentum indicators are trending down.

The Shanghai Composite Index dropped 12.42 points (0.65%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score dropped to 1.5 from 2.5 out of 3.0. Short term momentum indicators are trending down.

iShares Emerging Markets dropped $0.27 (0.61%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to positive. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending down.

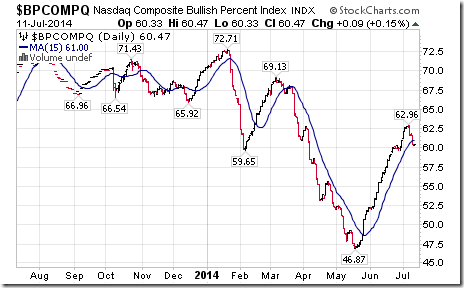

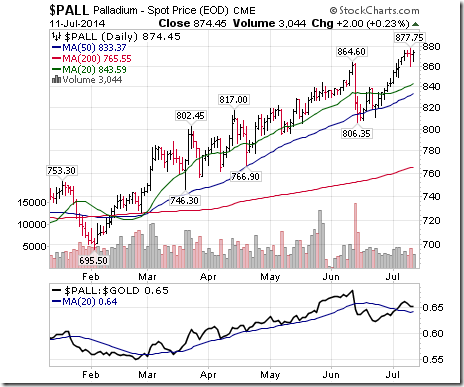

Summary of Weekly Seasonal/Technical Parameters for Equity Indices/ETFs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade

Red: Downgrade

Currencies

The U.S. Dollar slipped 0.05 (0.06%) last week. Intermediate trend remains neutral. The Dollar remains below its 20 day moving average. Short term momentum indicators have recovered to neutral.

The Euro slipped 0.01 (0.01%) last week. Intermediate trend remains neutral. The Euro slipped below its 20 day moving average. Short term momentum indicators have weakened to neutral.

The Canadian Dollar fell US 0.84 cents (0.89%) last week. Intermediate trend remains up. The Canuck Buck slipped below its 20 day moving average on Friday. Short term momentum indicators are trending down.

The Japanese Yen added 0.77 (0.77%) last week. Intermediate trend remains down. The Yen moved above its 20 day moving average. Short term momentum indicators are mixed.

Commodities

The CRB Index fell another 9.67 points (3.15%) last week. Intermediate trend changed from up to down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.0 from 1.0 out of 3.0.

Gasoline dropped $0.11 per gallon (3.64%) last week. Intermediate trend remains up. Gasoline fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 1.0 from 2.0 out of 3.0.

Crude oil fell another $3.60 per barrel (3.46%) last week. Intermediate trend remains up. Crude remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are oversold, but have yet to show signs of bottoming.

Natural Gas dropped another $0.25 (5.69%) last week. Intermediate trend changed from up to down. Natural Gas remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.0 from 1.0 out of 3.0. Short term momentum indicators are oversold, but have yet to show signs of bottoming.

The S&P Energy Index dropped 13.13 points (5.69%) last week. Intermediate trend changed from up to down on a move on Friday below 718.70. The Index fell below their 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to negative. Technical score dropped to 0.0 from 2.5 out of 3.0. Short term momentum indicators are trending down.

The Philadelphia Oil Services Index dropped 9.77 points (3.14%) last week. Intermediate trend remains up. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to negative. Technical score fell to 1.0 from 3.0 out of 3.0. Short term momentum indicators are trending down.

Gold gained $19.60 per ounce (1.48%) last week. Intermediate trend changed from neutral to up on a move above $1,331.40. Gold remains above its 20 day moving average. Strength relative to the S&P 500 Index improved positive from neutral. Technical score improved to 3.0 from 1.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Silver added $0.33 per ounce (1.56%) last week. Intermediate trend remains up. Silver remains above its 20 day moving average. Strength relative to the S&P 500 Index and Gold remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The AMEX Gold Bug Index gained 7.51 points (3.13%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index and Gold remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Platinum gained $14.10 per ounce (0.94%) last week. Trend remains up. Platinum remains above its 20 day moving averages. Strength relative to the S&P 500 Index remains positive. Strength relative to Gold remains neutral.

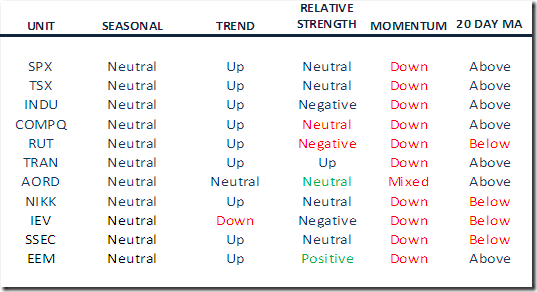

Palladium gained $15.40 (1.79%) last week. Trend remains up. PALL remains above its 20 day MA. Strength relative to S&P 500 is positive. Strength relative to Gold is neutral.

Copper was unchanged last week. Intermediate trend remains up. Copper remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The TSX Metals & Mining Index added 22.42 points (2.48%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Lumber fell $4.30 (1.27%) last week. Trend remains down. Lumber remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive.

The Grain ETN lost another $3.27 (7.66%) last week. Trend remains down. Units remain below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains 0.0 out of 3.0.

The Agriculture ETF fell $1.33 (2.39%) last week. Intermediate trend changed from up to down on a move below $54.08 and $53.98. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score changed to 0.0 from 2.0 out of 3.0. Short term momentum indicators are trending down.

Interest Rates

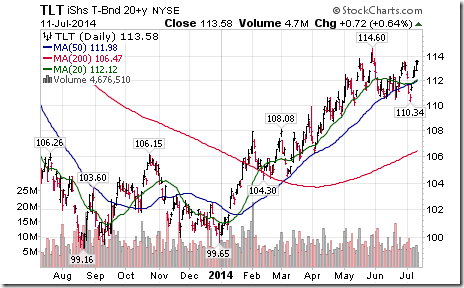

The yield on 10 year Treasuries fell 12.8 basis points (4.83%) last week. Trend changed from up to neutral on a move below 2.507. Yield fell below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF added $2.90 (2.62%) last week. Units moved above their 20 day moving average.

Other Issues

The VIX Index jumped 1.76 (17.1%) last week. Trend changed from down to up. The Index moved above its 20 and 50 day moving averages. ‘Tis the season for the Index to move higher!

Economic news this week is expected to be mixed.

Second quarter results are a focus this week. Consensus is that earnings by S&P 500 stocks will increase 6.5% on a year-over-year basis. Consensus for revenues is 4.0%. Consensus for earnings by TSX 60 companies is 6.8%. Sector focuses this week are on Financial and Technology companies.

The U.S. Independence Day Holiday trade wound down early last week.

Liquidity in North American equity markets is expected to remain below normal.

Short and intermediate technical indicators for most equity markets and sectors are trending down.

Look out for surprising, non-recurring events that can trigger an intermediate correction (e.g. a bank in Portugal running into difficulties, growing military intervention in the Middle East).

The Bottom Line

Technical action by most equity markets and sectors last week imply the start of at least a short term correction. Traders should respond accordingly. Exceptions exist (e.g. precious metals).

Mr. Vialoux’ appearance on BNN on Friday

Following are links:

http://www.bnn.ca/Video/player.aspx?vid=396986

http://www.bnn.ca/Video/player.aspx?vid=396991

http://www.bnn.ca/Video/player.aspx?vid=397007

http://www.bnn.ca/Video/player.aspx?vid=397022

http://www.bnn.ca/Video/player.aspx?vid=397023

http://www.bnn.ca/Video/player.aspx?vid=397024

http://www.bnn.ca/Video/player.aspx?vid=397025

http://www.bnn.ca/Video/player.aspx?vid=397068

Weekly ETF Column published at Globeinvestor.com

(Published on Friday. Authors are Don and Jon Vialoux)

Headline reads, “Six ETFs to capture gold’s seasonal strength”. Following is a link:

Special Free Services available through www.equityclock.com

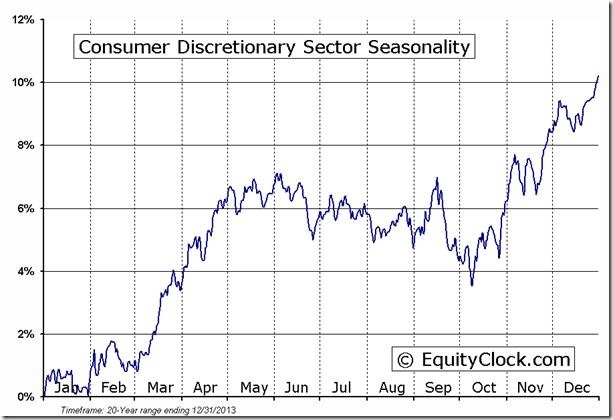

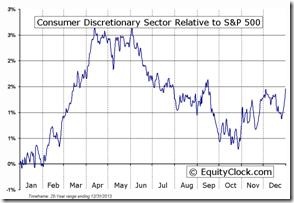

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

DISCRETIONARY Relative to the S&P 500  |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

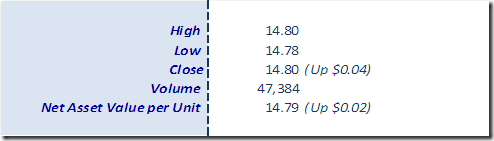

Horizons Seasonal Rotation ETF HAC July 11th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray