by Lance Roberts of STA Wealth Management,

"Ah, is it just me or does anybody see

The new improved tomorrow isn't what it used to be

Yesterday keeps comin' 'round, it's just reality

It's the same damn song with a different melody

The market keeps on crashin'

Tattered jeans are back in fashion

'Stead of records, now it's MP3s

I tell you one more time with feeling

Even though this world is reeling

You're still you and I'm still me

I didn't mean to cause a scene

But I guess it's time to roll up our sleeves

The more things change, the more they stay the same."

Bon Jovi

This week's "Things To Ponder" is focused on things that, in my opinion, far too many individuals are ignoring. Bob Farrell once wrote that "when all experts and forecasts agree; something else is bound to happen." Today, that is the case as much as it ever was. Despite rising geopolitical risks, weak economic data, deteriorating fundamentals and softer internals - the overwhelming belief is "equities are the only game in town."

Of course, we have seen this mentality many times in past history whether it was 1929, 1987,2000 or 2007. While ever market peak was different, there were all the same.

Once portfolios are invested, riding the "bull market" wave is the easy part. What the majority of analysts and media forget is that as an investor I do not need information telling me why the market is going up. I am already invested. What I need is information that helps me identify when the wave will crest. Today, I wanted to share some things I will be reading and thinking about over the weekend that we should at least be considering in regards to managing potential portfolio risk.

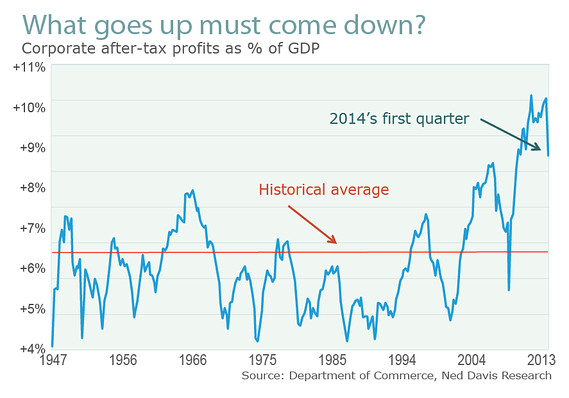

1) The Beginning Of The End Of The Bull Market? by Mark Hulbert via WSJ Marketwatch

"Few paid attention a couple of weeks ago when the government announced that corporate profitability had declined markedly last quarter.

Yet future historians may eventually look back and pinpoint that report as the beginning of the end of this aging bull market. That’s because the first-quarter’s decrease could signal the long-awaited return to historically average profitability levels. If so, the stock market will have to struggle mightily just to keep its head above water over the next five years.

Once we make these assumptions, calculating the stock market’s return over the next five years becomes a matter of simple math. The picture isn’t pretty: Its five-year return, annualized, is minus 2.8%."

2) Ultra-Easy Monetary Policy Could Be The Medicine That Kills by Katy Barnato via CNBC

"'Monetary accommodation, to the point of ignoring the stresses and strains of financial stability and what they mean for asset markets and credit markets, is something that needs to be seriously rethought,' the Stephen Roach, Yale lecturer and former chairman of Morgan Stanley Asia told CNBC.

'As long as the Fed remains as widely accommodative as a $4.25-4.50 trillion dollar-balance sheet would suggest, there is good reason to question the Fed's commitment to financial stability and there is good reason to believe that we could, in the not too distant future, find ourselves in another mess'"

This concern echoed that of Wilbur Ross, who is also concerned of the potential "bubble" in sovereign debt.

"I've felt for some time that the ultimate bubble, when we look back a few years from now, is going to be sovereign debt, both U.S. and other, because it's way below any sort of reversion to the mean of interest rates,"

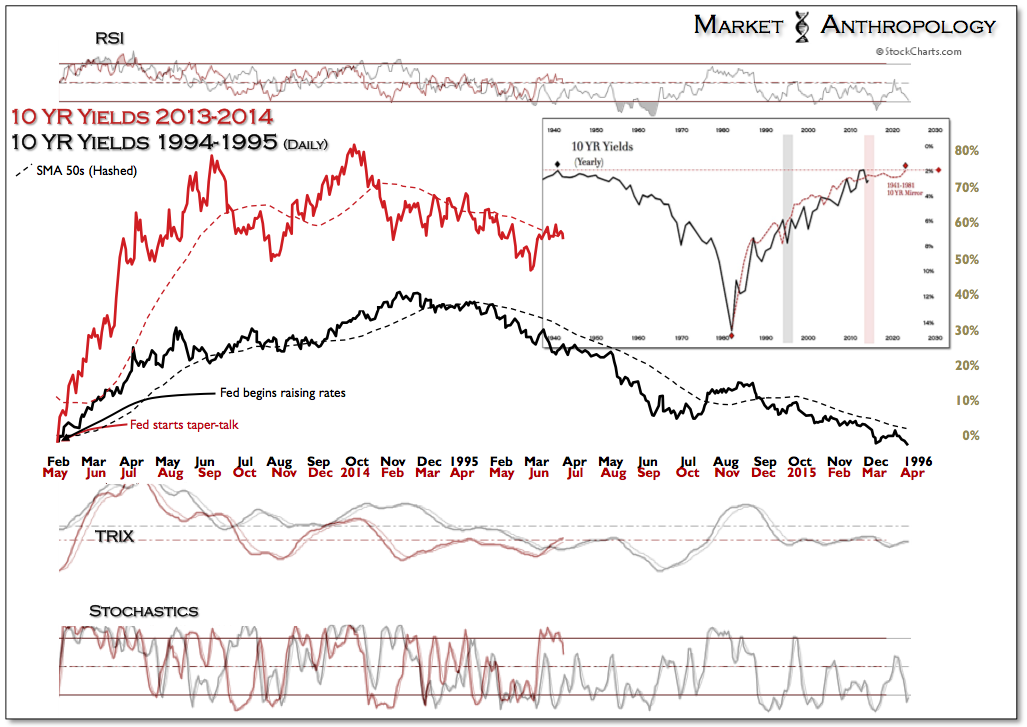

3) What We Can Learn From The History Of Interest Rates by Market Anthropology

"We believe that where a complicated market becomes even more so, is when one considers 1.) the relative extreme in yields that was reached at the end of last year, 2.) the uniqueness of the capital markets relative to what the Fed has provided over the past five years; and 3.) the rear-view proximity, density and casualties in participants memories to the spectrum of financial bubbles and crises from LTCM to GFC."

"Although a contraction in the US equity markets has so far failed to materialize, we do expect one to gain traction as the Fed steps further away from their extraordinary measures this fall. Similar to expectations in the mid to late 1940's, we anticipate that investors will continue to support the Treasury market even in the face of inflation - as the broader underlying skepticism of their collective anxieties will finally be realized when equity market conditions pivot lower without extraneous assistance."

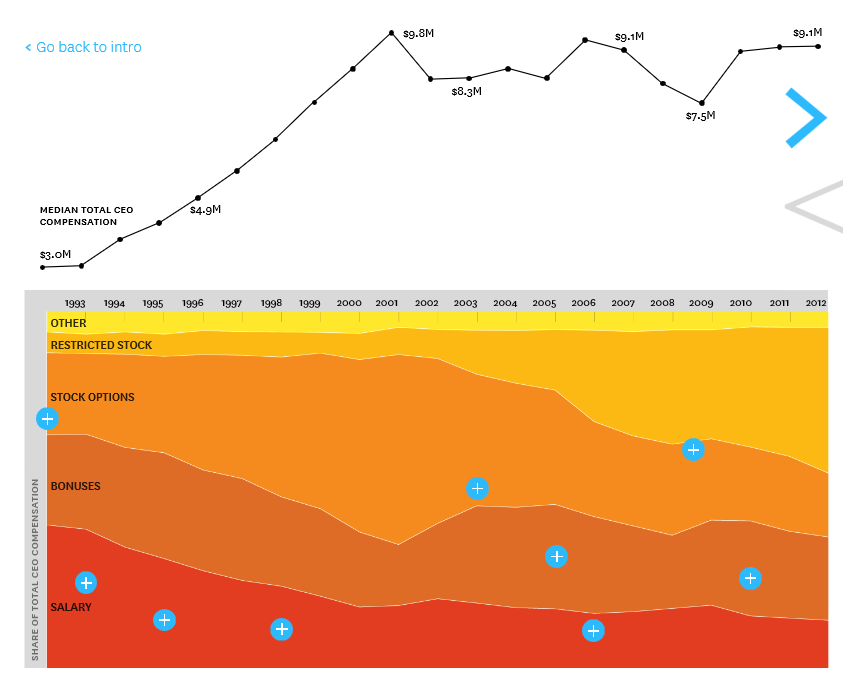

4) Q2 Buyback Announcements Lowest In 7 Quarters by Cullen Roche via Pragmatic Capitalist

"'Stock buyback announcements in the second quarter are on track to be the lowest in seven quarters,' said David Santschi, Chief Executive Officer of TrimTabs. 'Buybacks in June have sunk to just $11.5 billion, the lowest level since May 2012.'

'The sharp slowdown in buybacks is a negative sign for the U.S. stock market,' Santschi said. 'Share repurchases are the main way companies reduce the float of shares. Perhaps fewer companies like what they see when they look into the future.'

TrimTabs explained that the decline in buybacks is not the only cautionary sign for U.S. equity investors. Merger activity has skyrocketed, while companies are selling new shares at the fastest pace since last autumn. 'Our liquidity indicators aren’t as positive for U.S. equities as they were a month ago,' said Santschi. 'While the bull market isn’t necessarily ending, investors should be more cautious on the long side.'"

Also Read: Why Corporate Executives Love Stock Buybacks via Harvard Business Review

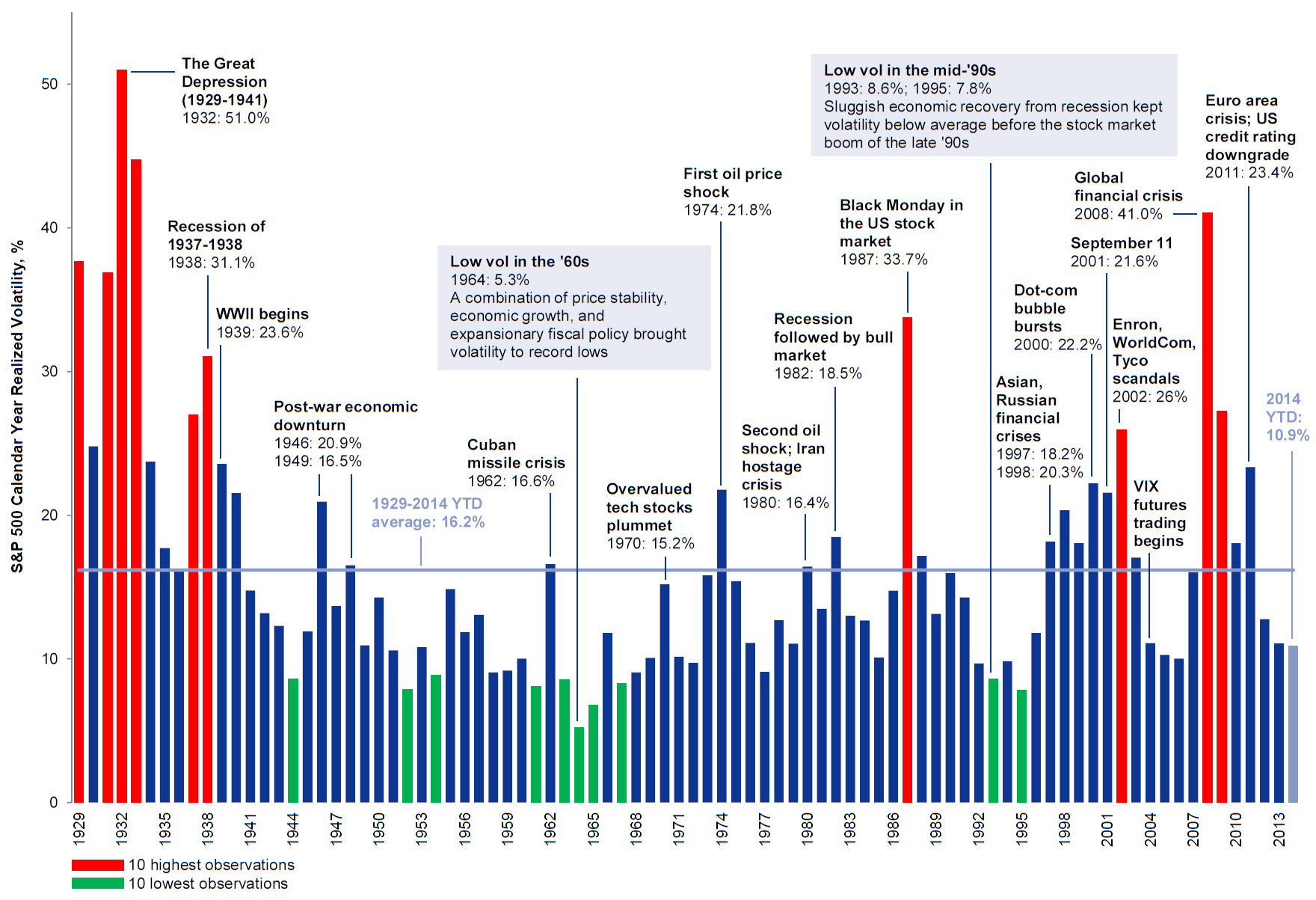

5) Annotated History Of Global Volatilityvia ZeroHedge

"The decline in economic and asset market volatility this year from already low levels in 2013 has been striking, which as Markus Brunnermeier states, means 'the whole system is more prone to a financial crisis when measured volatility is low, which tends to lead to a build-up of risk in the background – the so-called 'volatility paradox'.

"When measured market volatility is low, people feel empowered to take on more leverage and more liquidity mismatch, which leaves the whole system more prone to sharp movements. This dynamic occurred during the 'Great Moderation.' During that period, fundamental and asset volatility was generally low and market participants took on much more leverage."

Copyright © http://streettalklive.com