A close friend of mine and a business partner has a one-liner that popped out once upon a time in a meeting. These days we all love to remind him of it and laugh about the whole thing. The quote is “Seriously guys, there is no risk” as we discussed business opportunities away from financial market investments. Well, today we focus on the global macro performance, which as of late has been without any risk (as my good friend would say).

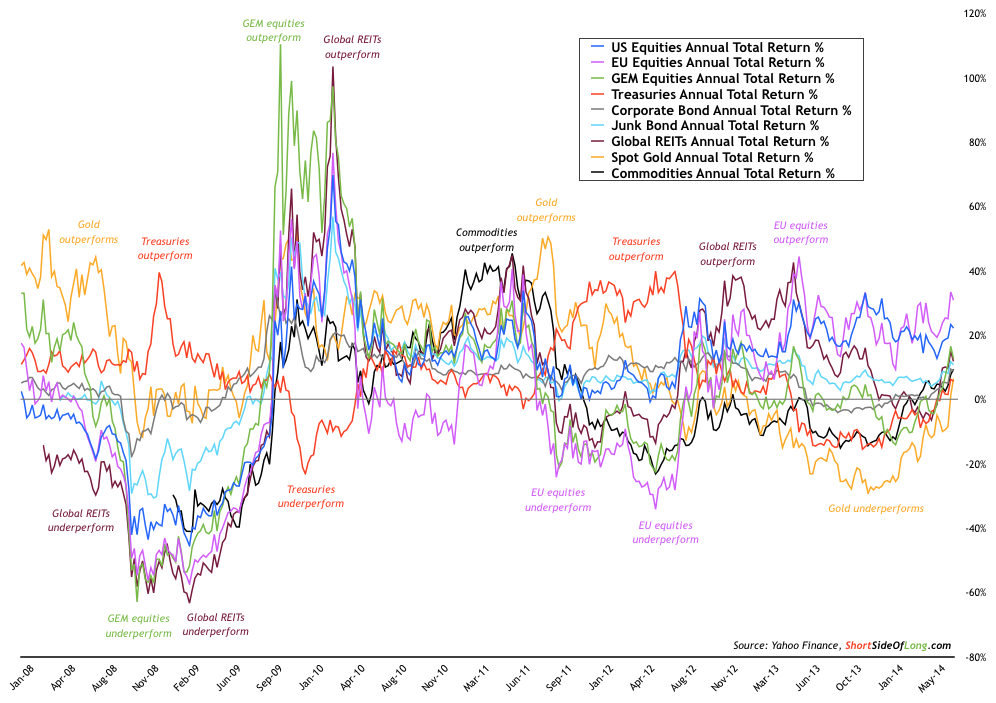

Chart 1: Every single major asset class is posting positive performance!

Looking at the chart above, one should be able to observe that every single major asset class has performed positively over the last 12 months. In plain english, whichever asset you bought a year ago and held until today, is returning some kind of a positive gain. Performance ranges between 5 to 8 percent on the low side (Treasuries, Commodities and Gold) toward 20 or even 30 percent on the high side (developed markets and in particular EU stocks).

The reason this condition is rare is because positive returns by all asset classes usually occurs near major market peaks, when volatility is very low. We saw this in 2007 (not shown in the chart above) and also in 2011 prior to a major risk asset sell off.

As a side note, this closely links to last weeks post, which showed that every single major asset class wasn’t anywhere close to being technically oversold. All in all, financial markets are very much enjoying low volatility and positive gains. The question is, what waits for us around the corner?

Copyright © The Short Side of Long