by Don Vialoux, Timing the Market

Interesting Charts

More fallout from Yellen’s comments late on Thursday!

· The U.S. Dollar continued to move lower.

· Weakness in the U.S. Dollar triggered a stampede into gold,

silver and precious metal stocks. Their moves above resistance

levels encouraged additional technical buying.

Extraordinary swings were recorded by Far East markets.

Technical action by Individual Equities

Yesterday

Technical action by S&P 500 stocks remained mildly bullish.

Nine stocks broke resistance (OMC, PSX, DTE, EIX, NU, PNW, KMB,

CCE, CELG) and one stock broke support (CAG). Once again,

utility stocks were prominent on the list of stocks breaking

resistance. Celgene (CELG) moved higher following news of a two

for one stock split.

Among TSX 60 stocks, Gildan Activewear broke to an all-time

high.

Tis the season for earnings warnings prior to release of second

quarter results!

After the close AK Steel and Smith & Wesson also released

an earnings warning.

Weekly Technical Review of Select Sector

SPDRs

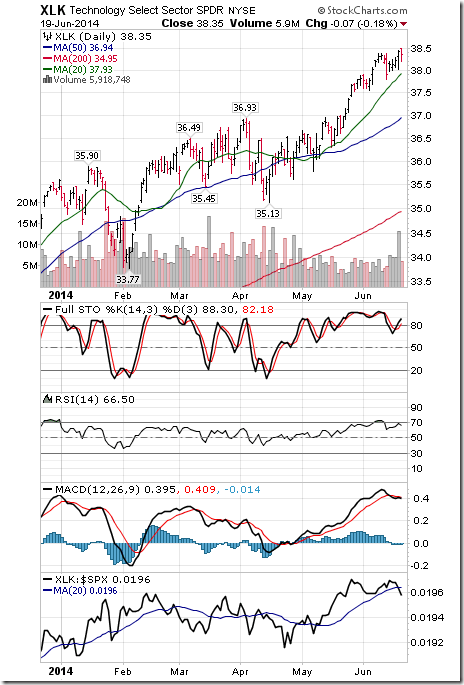

Technology

· Intermediate trend remains up (Score: 1.0)

· Units remain above their 20 day moving average (Score: 1.0)

· Strength relative to the S&P 500 Index changed from

positive to negative (Score: 0.0)

· Technical score based on the above indicators slipped to 2.0

from 3.0 out of 3.0

· Short term momentum indicators have rolled over and are

trending down.

Materials

· Intermediate trend remains up

· Units remain above their 20 day moving average.

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 2.0 out of 3.0

· Short term momentum indicators are trending down.

Industrials

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

neutral to negative

· Technical score slipped to 2.0 from 2.5 out of 3.0

· Short term momentum indicators are trending down.

Consumer Discretionary

· Intermediate trend remains up

· Units remain above their 20 day moving average.

· Strength relative to the S&P 500 Index changed from

neutral to negative

· Technical score slipped to 2.0 from 2.5 out of 3.0

· Short term momentum indicators are trending down

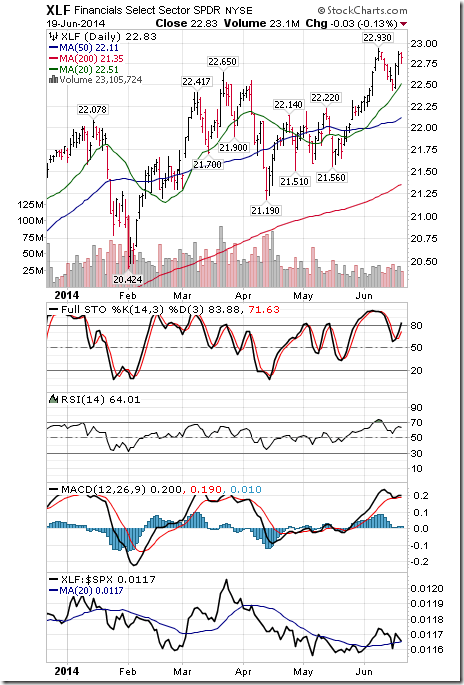

Financials

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

positive to neutral

· Technical score slipped to 2.5 from 3.0 out of 3.0

· Short term momentum indicators are trending down.

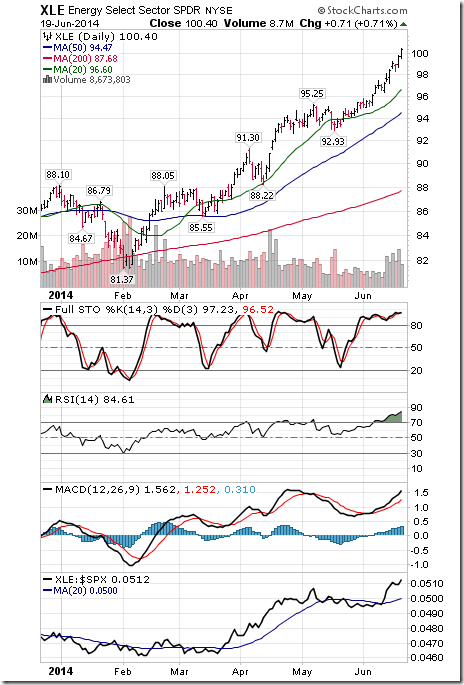

Energy

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains positive

· Technical score remains at 3.0 out of 3.0

· Short term momentum indicators are trending up, but are

overbought

Consumer Staples

· Intermediate trend remains up.

· Units remain above their 20 day moving average.

· Strength relative to the S&P 500 Index changed from

negative to neutral

· Technical score improved to 2.5 from 2.0 out of 3.0

· Short term momentum indicators are mixed.

Health Care

· Intermediate trend remains up

· Units remain above their 20 day moving average

· Strength relative to the S&P 500 Index remains negative

· Technical score remains at 2.0 out of 3.0.

· Short term momentum indicators are trending down

Utilities

· Intermediate trend remains up

· Units moved above their 20 day moving average

· Strength relative to the S&P 500 Index changed from

negative to positive

· Technical score improved to 3.0 from 1.0 out of 3.0.

· Short term momentum indicators are trending up, but are

overbought.

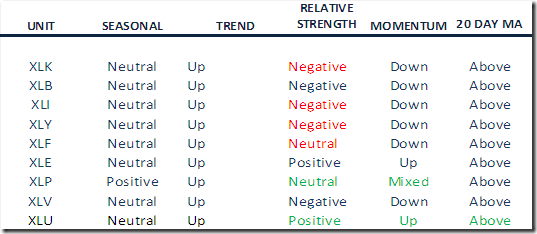

Summary of Weekly Seasonal/Technical Parameters

for SPDRs

Key:

Seasonal: Positive, Negative or Neutral on a relative

basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive,

Negative or Neutral

Momentum based on an average of Stochastics, RSI and

MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade from last

week

Red: Downgrade from last

week

Editor’s Note: All of the economic sensitive sectors

(Technology, Materials, Industrials, Consumer Discretionary,

Financials) other than Energy have negative strength relative

to the S&P 500 Index.

Special Free Services available

through www.equityclock.com

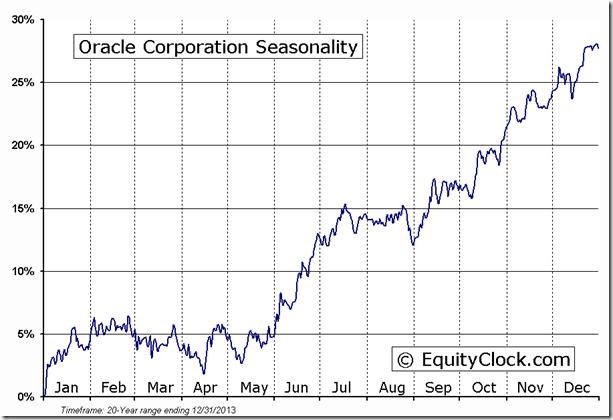

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

(Editor’s Note: After the close yesterday, Oracle

reported lower than consensus fiscal fourth quarter revenues

and earnings. Seasonal influences are near the end of their

period of seasonal strength)

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada) Inc.

All of the views expressed herein are the personal views of the

authors and are not necessarily the views of Horizons ETFs

Management (Canada) Inc., although any of the recommendations

found herein may be reflected in positions or transactions in

the various client portfolios managed by Horizons ETFs

Management (Canada) Inc.

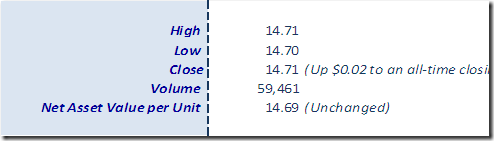

Horizons Seasonal Rotation ETF HAC June

19th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray