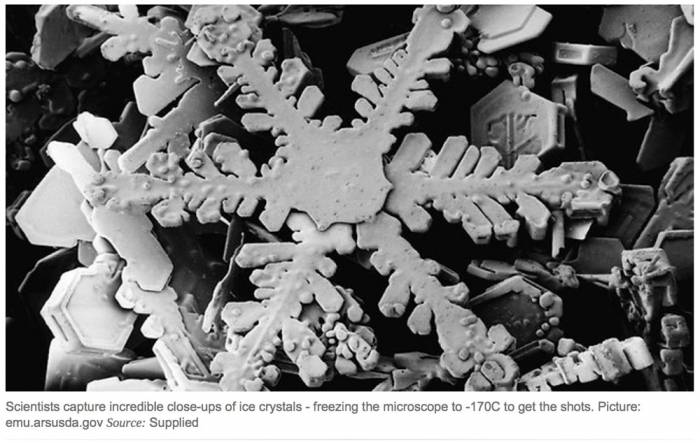

Markets are like snowflakes; different time periods can share common traits and might even look alike, but no two are exactly the same. Rather than grasping at straws from a hilariously small sample size, we would be much better served if we would accept the reality; often times we’re navigating unchartered waters. With such a limited pool of data, it would be like rolling a 46 sided die 100 times and thinking you’ve seen all the possible outcomes.

Markets are complex organisms that are constantly evolving. Consider just a few of the changes we’ve witnessed over the years: new investing products, geographies and indices, investing styles, accounting rules, political regimes, even brand new industries. And yet, we see them making comparisons all the time. What is interesting is that it’s not just from one school of thought. We hear people pointing to similar fundamentals just as often we see people comparing lines on a chart.

- "This is just like 1929 because if you wildly distort the Y-axis and squint hard enough, you can almost sort of see the lines match up.”

- "This is shaping up to be a lot like 1994 because interest rates."

- "This is just like that time where stocks went up for longer than they should have and overbought RSI’s persisted even though the economic backdrop was mediocre but things were improving and stocks were reasonably priced and policy and regime and rates and and and."

There are an endless list of factors that affect markets and the thing that is lost on people is that the weight with which these variables impose their influence is never the same. Comparing two time periods because one or even two variables are similar is extremely foolish. Take a look at just a few of the many variables to consider:

- interest rates (movement, speed of movement, shape of the curve, from what levels are they rising/falling),

- economic trends

- valuation (kinda, over long stretches of time)

- investors moods, what they’re willing to pay for $1 of earnings

- geopolitics (sometimes, unless markets don’t really care about them, sort of like today)

Unfortunately, we just can’t help it; this compulsion to compare different time periods. Heaven forbid we accept the reality that market outcomes are unknown. Rather than manufacture stories, I suggest you manage risk; diversify your portfolios, use stop losses, buy stocks with a margin of safety. Whatever you do, don’t make decisions because of what happened last time.

Copyright © Clear Eyes Investing