by Vadim Zlotnikov, AllianceBernstein

Longer-dated oil futures contracts have been on the rise so far in 2014, and we think there’s a good case to be made that they’ve got further to go. The potential for an upside oil-price surprise may point to investment opportunity.

After declining steadily since 2011, the prices of long-dated oil futures—based on contracts for 2019 deliveries of West Texas Intermediate (WTI) crude oil—have been climbing recently. In January, the price was $75 per barrel; by the end of May, it was more than $83. This contradicts a broadly held view that in the absence of a geopolitical calamity, oil pricing tends to skew lower.

Examining the Bearish Thesis for Oil

The bearish argument for petroleum goes like this: US oil production is rising, with almost a million barrels per day of production added in each of the past three years—and there’s more potential production from Iran, Iraq and Libya. These trends point to more supply. On the demand side, China’s needs have fallen back a bit. Conservation and competing power sources in OECD countries are also reducing demand.

But we see cracks in this bearish scenario.

Massive capital spending by exploration and production companies is starting to slow, as their capacity to take on debt falls. This could temper new capacity. Also, the management teams of major integrated oil companies are being disciplined about investing new capital, and investors are rewarding them for it. We believe that these developments will eventually slow oil-supply growth.

Of course, there’s evidence that technology and experience are making oil wells more productive, but we think this will be countered by depletion rates applied to a large and rising production base. As a result, we think the growth in US petroleum production is almost certain to slow from the rates we’ve seen over the past three years. In our view, this would put upward pressure on oil prices. As a cyclical industry, oil presents investment opportunities when there’s falling supply and robust demand.

We’ve already made the case for lower supply—what about higher demand?

From the first quarter of 2007 to the first quarter of 2014, overall per-day demand in OECD member countries fell by an astonishing 4 million barrels, to 45.8 million. But maybe more astonishing is that demand from non-OECD countries increased by more than twice as much over the same time period, to 9.5 million barrels per day. This growth is likely to continue, given demographic and income trends. Also, the International Energy Agency may have understated demand (or overstated supply), given inventory growth that was much lower than expected.

Long-Dated Price Risk Skewed to the Upside

In either case, we think the risks for long-dated oil prices are skewed to the upside. The downside, in our estimation, is probably $3–$5 per barrel, which would take the price down to $78–$80, the marginal cost of shale production. The upside, meanwhile, is perhaps another $15–$20, which would take prices nearly to the current spot price. So, there’s potential that oil prices in 2018 will be well above the $83 per barrel reflected in futures prices.

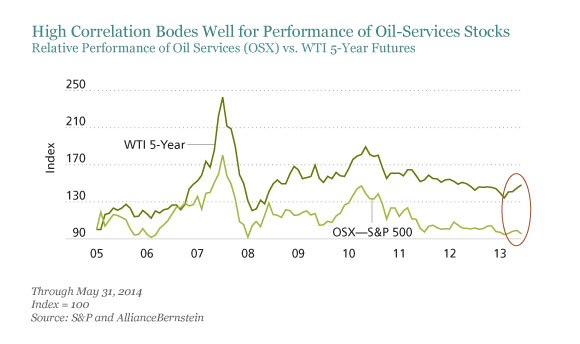

One straightforward way to benefit from this scenario is to simply buy oil futures. But stock pickers can get exposure, too. Oil-services stocks have historically had a fairly high correlation with oil prices, tending to follow the path of futures contracts. But this relationship has weakened in recent months, with oil-services stocks lagging the futures run-up (Display).

This trend points to potential in oil-services stocks—with a caveat. They’re not cheap. In fact, they’re trading at the upper end of their historical valuation ranges based on price/cash-flow ratios. Using price/book-value ratios, they’re neutral at best. However, we think there are opportunities in select oil-services stocks, as well as in exploration and production companies whose businesses have significant exposure to oil production.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist and Co-Head of Multi-Asset Solutions at AllianceBernstein (NYSE: AB).