by Lance Roberts of STA Wealth Management,

If you had fallen asleep at your desk recently due to the absolute lack of anything noteworthy happening, this past week should have woken you up. A massive upset in the Virginia primary dethroned House Majority Leader Eric Cantor which sent moderate Republicans scurrying to shore up their voting bases. Al-Queda backed forces, ISIS, have advanced through Iraq and are not closing in on Baghdad which has sent oil prices rocketing higher this past week. Lastly, the mainstream media was completely baffled by the "sea of red" on their monitors which caused one anchor to quip:

"Wow...stocks really can go down."

This weekend's reading list contains a smattering of topics from GDP to why we underestimate change. As I stated earlier this week in "More Signs Of Bullish Excess:"

"Stocks have not 'reached a permanently high plateau' nor will 'this time be different.' As with all late cycle bull markets, irrationality by investors in the financial markets is not new nor will it end any differently than it has in the past. However, it is also important to realize that these late cycle stages of bull markets can last longer, and become even more irrational, than logic would dictate.

Understanding the bullish arguments is surely important, however, the risk to investors is not a continued rise in price, but the eventual reversion (change) that will occur. Unfortunately, since most individuals are only told to consider the 'bull case,' they never see the 'train coming.'"

With that in mind, let's get to our reading.

1) Q1 Economic Contraction Could Be Even Worse Than Thought by Ben Leubsdorf via WSJ

"The U.S. economy may have contracted more than previously thought during the first three months of 2014, private economists said Wednesday based on new health care-sector data from the government.

Some analysts said economic output may have contracted at a 2% pace in the first quarter. That would be its worst performance since the recession."

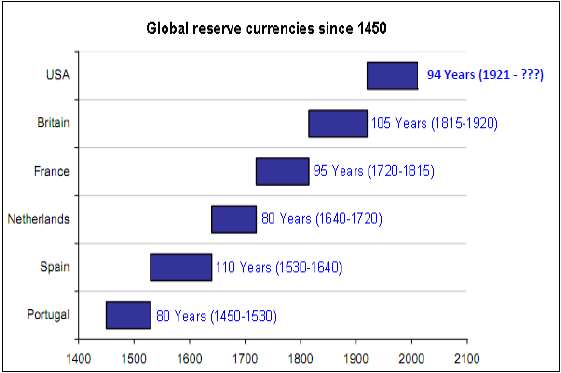

2) How Much Longer With The Dollar Remain King by Cullen Roche via Pragmatic Capitalist

"So, will the USA lose its reserve currency status at some point? Yes. In fact, it’s already starting to lose its reserve status to Europe and China. Will it be the end of the world and will it cause everyone to suddenly ditch the dollar?

Probably not. It just means the USA will produce a lower proportion of global output and therefore, as a matter of accounting, the rest of the world will hold a lower percentage of US dollar denominated financial assets as a percentage of global output. It’s not the end of the world. It’s just a sign that market shares change and when you’re #1, well, there’s only one direction to go."

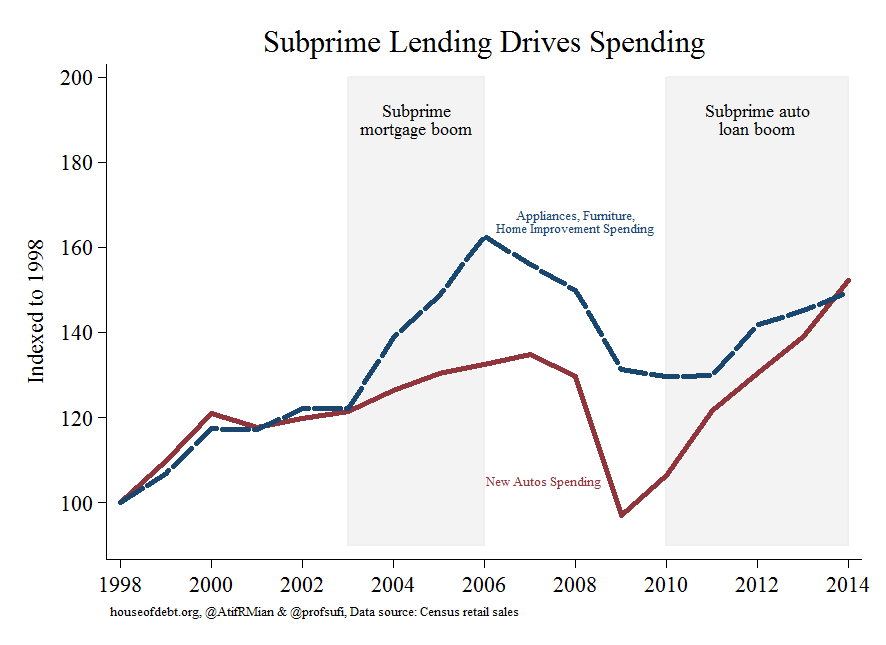

3) Subprime Lending Drives Spending by Atif Mian and Amir Sufi via House Of Debt

"It appears that the key to boosting spending in the U.S. economy is subprime lending. The financial system was lending against homes before the Great Recession, and now it has moved to lending against cars. But the basic message is the same."

4) Fed Prepares To Maintain Record Balance Sheet For Years by Craig Torres and Matthew Boesler via Bloomberg

"Federal Reserve officials, concerned that selling bonds from their $4.3 trillion portfolio could crush the U.S. recovery, are preparing to keep their balance sheet close to record levels for years.

Central bankers are stepping back from a three-year-old strategy for an exit from the unprecedented easing they deployed to battle the worst recession since the Great Depression. Minutes of their last meeting in April made no mention of asset sales.

Officials worry that such sales would spark an abrupt increase in long-term interest rates, making it more expensive for consumers to buy goods on credit and companies to invest, according to James Bullard, president of the Federal Reserve Bank of St. Louis.

The Fed is testing new tools that would allow it to keep a large balance sheet even after it raises short-term interest rates, a step policy makers anticipate taking next year. They would use these tools to drain excess reserves temporarily from the banking system.

'It is pretty clear they are anticipating operating in a situation with a lot of reserves and a high balance sheet for a long time,' said former Fed governor Laurence Meyer, a co-founder of Macroeconomic Advisers LLC, a St. Louis-based forecasting firm."

5) Why We Underestimate Change by Nick Colas via ZeroHedge

“Human beings are works in progress that mistakenly think they’re finished”. That bit of pithy wisdom comes from Harvard professor of psychology Daniel Gilbert.

It is in that final point where the link to the investment process makes an entrance. The standard construct of any capital allocation process centers on forecasting. We predict everything from inflation to corporate earnings to risk tolerances to preferences in the market for growth or value or some blend of the two. But if we find it hard to predict the thing we should know best – ourselves- what level of hubris do you need to reach to believe you can forecast the actions of other market participants?

The ultimate point here is not to be negative on risk assets like stocks, but rather to provide a fresh construct to understand why we underestimate change until it is right on top of us. As the Gilbert research shows, predicting how we ourselves will change is a very large blind spot in our psychological makeup. Yes, perhaps when we look outside ourselves some of our biases fall away and we can do better. But not a lot better, if current market dynamics are any guide."

Bonus Chart: