by Don Vialoux, Timing the Market

Economic News This Week

May Canadian Housing Starts to be released at 8:15 AM EDT on Monday are expected to fall to 185,000 units from 195,300 in April.

April Wholesale Inventories to be released at 10:00 AM EDT on Tuesday are expected to increase 0.3% versus a gain of 1.1% in March.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 315,000 from 312,000 last week

May Retail Sales to be released at 8:30 AM EDT on Thursday are expected to increase 0.7% versus a gain of 0.1% in March. Excluding auto sales, May Retail Sales are expected to increase 0.5% versus no change in April.

April Business Inventories to be released at 10:00 AM EDT on Thursday are expected to increase 0.4% versus a gain of 0.4% in March.

May Producer Prices to be released at 8:30 AM EDT on Friday are expected to increase 0.2% versus a 0.6% gain in April. Excluding food and energy, May PPI is expected to increase 0.1% versus a gain of 0.5% in April.

June Michigan Sentiment Index to be released at 9:55 AM EDT on Friday is expected to increase to 82.9 from 81.9 in May.

Earnings Reports This Week

No significant reports.

Equity Trends

The S&P 500 Index gained 25.87 points (1.34%) last week. Intermediate trend remains up. The Index remains above its 20, 50 and 200 day moving average. Short term momentum indicators are trending up, but are overbought.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 88.20% from 78.20%. Percent remains intermediate overbought. A rollover from above 80% historically has led to an intermediate correction by the S&P 500 Index.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 87.60% from 83.60%. Percent remains intermediate overbought.

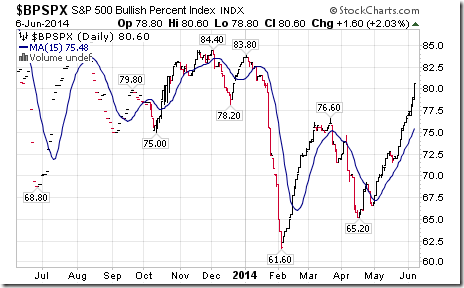

Bullish Percent Index for S&P 500 stocks increased last week to 80.60% from 76.60% and remained above its 15 day moving average. The Index remains intermediate overbought.

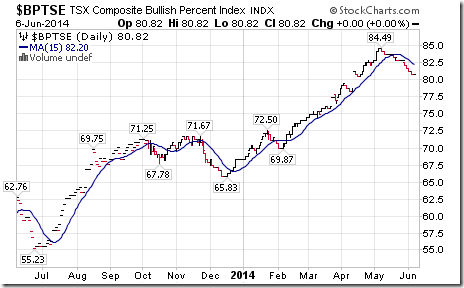

Bullish Percent Index for TSX Composite stocks slipped last week to 80.82% from 81.63% and remained below its 15 day moving average. The Index remains intermediate overbought and trending down.

The TSX Composite Index gained 234.74 points (1.61%) last week. Intermediate trend remains up (Score: 1.0). The Index recovered above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index remains negative (Score: 0.0). Technical score based on the above indicators remained at 2.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Percent of TSX stocks trading above their 50 day moving average increased last week to 60.25% from 49.18%. The Index has returned to an intermediate overbought level.

Percent of TSX stocks trading above their 200 day moving average increased last week to 71.31% from 69.26%. Percent remains intermediate overbought.

The Dow Jones Industrial Average gained 207.11 points (1.24%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

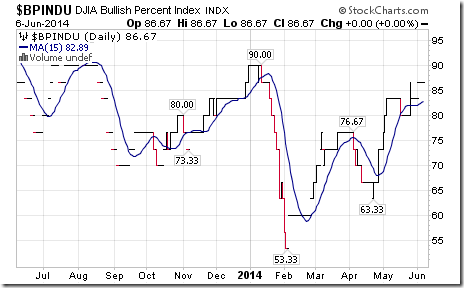

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 86.67% from 83.33% and remained above its 15 day moving average. The Index remains intermediate overbought.

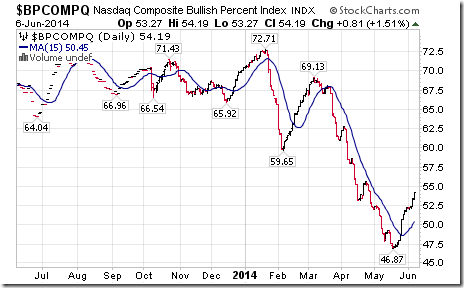

Bullish Percent Index for NASDAQ Composite stocks increased last week to 54.19% from 52.28% and remained above its 15 day moving average. The Index remains intermediate overbought.

The NASDAQ Composite Index gained 78.78 points (1.86%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Russell 2000 Index added 30.71 points (2.71%) last week. Intermediate trend changed from down to neutral on a move above 1,157.87. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to positive. Technical score improved to 2.5 from 1.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Dow Jones Transportation Average advanced 105.41 points (1.30%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remained at 3.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Australia All Ordinaries fell 30.30 points (0.55%) last week. Intermediate trend remains neutral. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.5 from 1.5 out of 3.0. Short term momentum indicators are trending down.

The Nikkei Average gained 444.86 points (3.04%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index improved from neutral to positive. Technical score improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Europe 350 iShares gained $0.55 (1.10%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Shanghai Composite Index slipped 9.25 points (0.45%) last week. Intermediate trend remains neutral. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.5 from 1.5 out of 3.0. Short term momentum indicators are mixed.

iShares Emerging Markets added $1.01 (2.37%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are mixed.

Summary of Weekly Seasonal/Technical Parameters for Equity Indices/ETFs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade

Red: Downgrade

Currencies

The U.S. Dollar Index was unchanged last week. Intermediate trend changed from down to neutral on a move above 80.77. The Index remains above its 20 day moving average. Short term momentum indicators are rolling over from overbought levels.

The Euro added 0.03 (0.02%) last week. Intermediate trend remains neutral. The Euro remains below its 20 day moving average. Short term momentum indicators are recovering from oversold levels.

The Canadian Dollar fell US 0.76 cents (0.82%) last week. Intermediate trend remains up. The Canuck Buck fell below its 20 day moving average. Short term momentum indicators are trending down.

The Japanese Yen fell 0.71 (0.72%) last week. Intermediate trend remains down. The Yen fell below its 20 day moving average. Short term momentum indicators are trending down.

Commodities

The CRB Index slipped 0.23 (0.08%) last week. Intermediate trend changed from up to down on a move below 304.30. The Index fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative.

Gasoline slipped $0.03 per gallon (1.01%) last week. Intermediate trend remains up. Gas fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to negative.

Crude Oil slipped $0.05 per barrel (0.05%) last week. Intermediate trend remains neutral. Crude remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to negative. Technical score fell to 0.5 from 2.0 out of 3.0. Short term momentum indicators are trending down.

Natural Gas added $0.17 per MBtu (3.74%) last week. Intermediate trend remains neutral. Gas remains above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up.

The S&P Energy Index gained 9.67 points (1.39%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

The Philadelphia Oil Services Index added 5.48 points (1.88%) last week. Intermediate trend remains down. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from negative to neutral. Technical score improved to 1.5 from 1.0 out of 3.0. Short term momentum indicators are trending up, but are overbought.

Gold added $6.90 per ounce (0.55%) last week. Intermediate trend remains down. Gold remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are oversold and showing early signs of bottoming.

Silver added $0.31 per ounce (1.66%) last week. Intermediate trend remains down. Silver remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Strength relative to Gold has turned positive. Short term momentum indicators are oversold and showing early signs of bottoming.

The AMEX Gold Bug Index added 2.38 points (1.15%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Strength relative to Gold improved to neutral from negative. Short term momentum indicators are recovering from oversold levels.

Platinum added $0.30 per ounce (0.02%) last week. Intermediate trend remains up. Platinum remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Strength relative to Gold remains positive

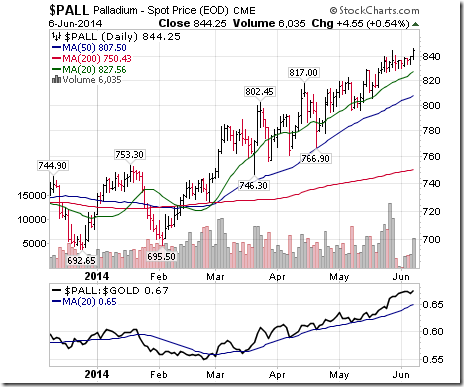

Palladium added $8.60 per ounce (1.03%) last week. Trend remains up. PALL remains above its 20 day MA. Strength relative to the S&P 500 Index and Gold remains positive.

Copper fell $0.07 per lb. (2.24%) last week. Intermediate trend remains up. Copper fell below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 1.0 from 2.0 out of 3.0. Short term momentum indicators are trending down.

The TSX Metals & Mining Index fell 9.83 points (1.15%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are trending down.

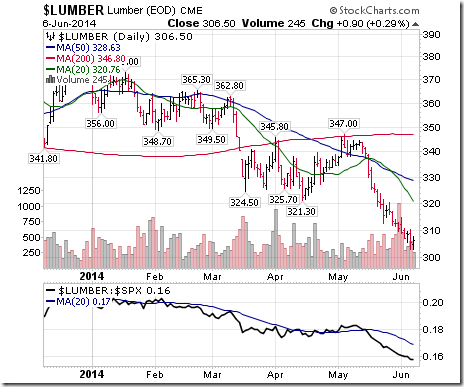

Lumber dropped another $5.80 (1.86%) last week. Trend remains down. Lumber remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative.

The Grain ETN fell $0.66 (1.38%) last week. Trend remains up. Units remain below their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0.

The Agriculture ETF added $0.21 (0.38%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 2.0 out of 3.0. Short term momentum indicators are mixed.

Interest Rates

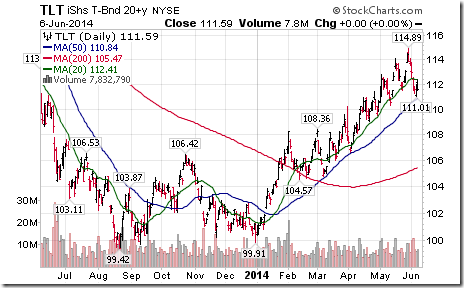

The yield on 10 year Treasuries increased 14 basis points (5.70%) last week. Intermediate trend remains down. Yield moved above its 20 day moving average. Short term momentum indicators are trending up.

Conversely, price of the long term Treasury ETF fell $2.51 (2.20%) last week. Intermediate trend remains up. Units fell below its 20 day moving average.

Other Issues

The VIX Index fell 0.67 (5.88%). The Index closed at an 8 year low.

Earnings reports are not relevant this week

Economic news is quieter this week. May Retail Sales are the focus.

A surprising positive response to economic news on Thursday and Friday (European Central Bank news and the U.S. May employment report) could help equity prices early this week.

Short and intermediate technical signals for most equity markets and sectors generally are overbought, but have yet to show signs of peaking. U.S. equity markets have “gone parabolic”. Typically during parabolic moves, guessing the top is not possible, but downside risk is greatly increased. Strongest sectors last week were economically sensitive sectors (e.g. Industrial, Materials, Consumer Discretionary) implying that the parabolic move is not over yet. A few cracks appeared, most notably in Metals & Mining.

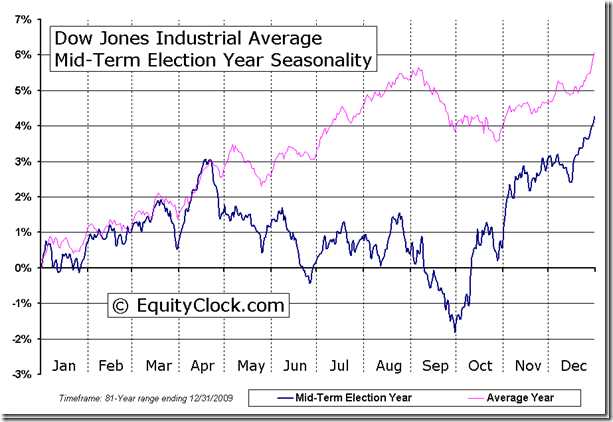

Low market volumes are expected to decline further during the World Cup tournament starting near the end of this week and continuing to mid-July. History shows that equity markets turn more volatile during the tournament. The tournament also coincides with the U.S. mid-term election. The VIX Index is expected to be a leading indicator when the intermediate correction occurs. Stay tuned.

Although equity market moved higher last week, the month of June historically has been the second weakest month of the year based on data for the past 63 years.

Seasonal influences for most equity markets in the world have entered into a Neutral phase between May and October, a period of greater volatility, lower volumes and mixed returns.

The Bottom Line

Strength in equity markets during the latter part of last week was not expected. Equity markets recently entered into a period of higher than average volatility and lower returns. Caution is recommended, particularly in economic sensitive sectors.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

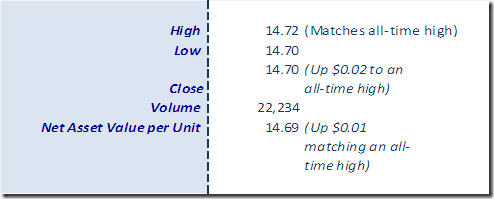

Horizons Seasonal Rotation ETF HAC June 6th 2014

.

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/967636d07edc34a5245f12e4539cfb7f.png)