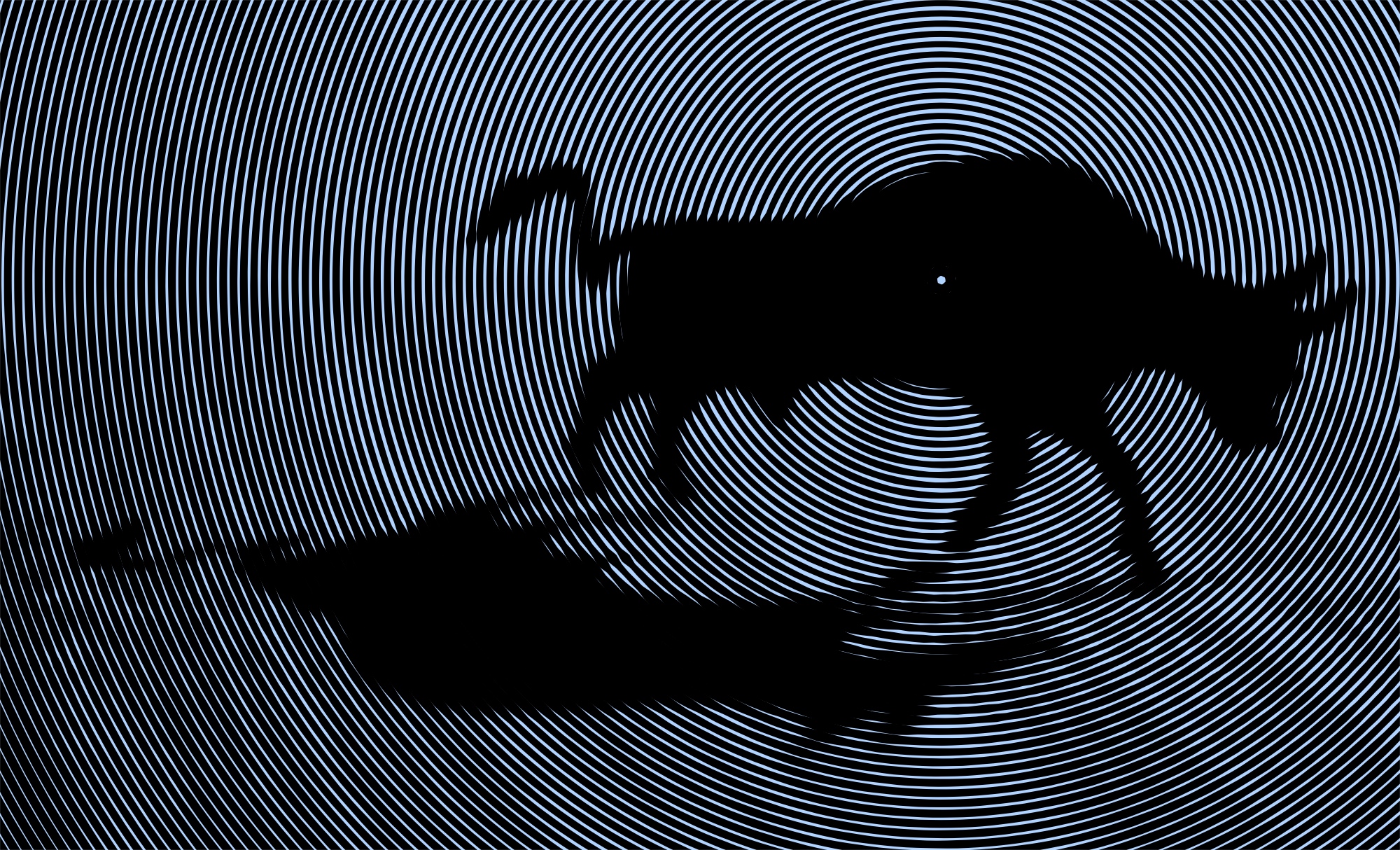

Chart 1: The current market rally has spent 80 weeks above its 200 MA!!!

We have discussed the following themes on the blog over the last few months. S&P 500 has almost tripled from the 06th of March 2009 lows. The 5 year rolling return has been 5th best in 140 years (only beaten by 1929, 1937, 1987 and 2000). The bull market is currently the second longest in the last 80 years.

Shiller’s CAPE and Q Ratio valuations show an overvalued price and predict flat returns over the next decade. Finally, the current rally has now spent 80 weeks above the 200 day moving average, a phenomenon we only saw once during the roaring 90s. Over the last half century, no other rally lasted this long.

I’m sure the bulls will argue that we are repeating the 1990s all over again and to be honest… maybe we are. However, I’m very very skeptical and do not like thinking that “once in 100 year historical anomalies” occur every few years. I’ll leave that type of thinking to the perma-bulls.

Click on the chart above to enlarge the image.

Copyright © The Short Side of Long