by David Stockman via Contra Corner blog,

You can smell this one coming a mile away:

The European Central Bank and Bank of England on Friday outlined options to reinvigorate the market for bundled bank loans, which was “tarnished” by the global financial crisis, saying a better-functioning market for asset-backed securities can help boost lending to the private sector, particularly small businesses.

Yes, the ECB is now energetically trying to revive the a market for asset-backed commercial paper (ABCP) - the very kind of “toxic-waste” that allegedly nearly took down the financial system during the panic of September 2008. The ECB would have you believe that getting more “liquidity” into the bank loan market for such things as credit card advances, auto paper and small business loans will somehow cause Europe’s debt-besotted businesses and consumers to start borrowing again thereby reversing the mild (and constructive) trend toward debt reduction that has caused euro area bank loans to decline by about 3% over the past year.

What they are really up to, however, is money-printing and snookering the German sound money camp. That is, the ECB is getting set to launch QE in financial drag by purchasing or discounting ABCP while loudly proclaiming that it’s not “monetizing” any stinking sovereign debt!

And that gets to the heart of monetary central planning. It doesn’t matter what the central bank buys with the digital credits it transfers to sellers. Purchasing government debt, Fannie Mae securities, IBM bonds or corporate equities, as has been done by the BOJ and Bank Of Israel under the new Fed Vice-Chairman, has a common effect. That is, it raises the price of the purchased “assets” relative to what would obtain in the unfettered market, and injects fiat liquidity into the financial system in a manner that promotes speculation and excessive risk-taking.

Thus, if some clever Wall Street operators could figure out how to bundle sea shells and securitize them, central bank purchase of the resulting ABCP would be no different than purchase of treasury notes or Fannie Mae paper.

Unfortunately, the German keepers of the flame of financial orthodoxy have been too narrow in their focus on central bank “monetization” of government debt. To be sure, they are correct in maintaining that central bank purchase of sovereign debt inexorably promotes fiscal profligacy among the politicians. The fact that the debt of nearly ever DM government has soared to 100% of GDP and beyond since the era of monetary central planning got going in the 1990s is undeniable evidence.

But the true economic sin lies in the fiat credit generated by central banks monetization, not the particular type of “asset” purchase by which it is accomplished. Stated differently, debt which is priced at honest market rates and is funded by new savings from businesses or households is economically healthy; it involves a deferral of current consumption in order to finance a longer-lived project or productive asset that promises a return in excess of the funding cost.

By contrast, central bank balance sheet expansion - that is, monetization of government debt or asset-backed sea shells - results in borrowing without saving; investment without honest hurdle rates; and the re-rating of existing asset prices based on carry trades, not an elevation of expected economic returns.

So in clearing the way to “monetization” of ABCP, the ECB is simply heading down the path of Bernanke/Yellen style quantitative easing though a transparent gimmick that may or may not bamboozle the Germans. But it most certainly will succeed in snookering the financial press as the post below from the ever gullible Brian Blackstone of the WSJ clearly conveys.

But here’s the thing. The ABCP market is not a place where hard-pressed business borrowers or consumer’s can find a new source of credit outside the banking system. Instead, it is a financial engineering arena in which banks will have a chance to mint phony overnight profits through an accounting expedient known as “gain-on-sale”.

What that means is that when credit card receivables or small business loans are “bundled” by their commercial bank issuers and sold into an off-balance conduit which issues ABCP against these “assets”, the life-time profits of these loans can be booked instantly. Indeed, modern technology allows the credit card swipe to be booked as a profit nearly the same nanosecond as it happens, and accounting convention allows the profits from a 7-year car loan issued at 110% of the vehicle’s value to be recorded virtually at the time it rolls off the dealer lot.

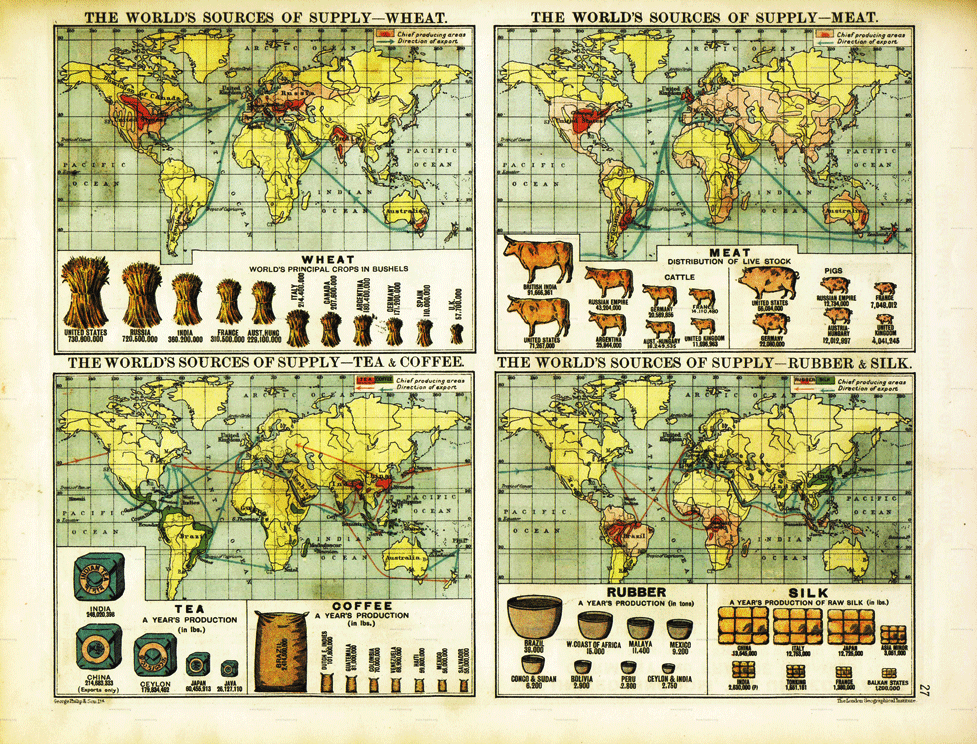

The smoking gun with respect to the current ECB ploy is contained in the graph below for the US ABCP market. As is evident, it went parabolic in the run-up to the 2008 meltdown, but has virtually vanished since. In fact, current outstandings of about $250 billion are 80% below the July 2007 peak.

But there is nary a word in the financial press about credit card or auto loans being too “tight” in the US for a simple reason. Banks are more than happy to issue new loans to credit-worthy business and consumer borrowers and hold them to maturity on their own balance sheets. After all, with $2.7 trillion of “excess reserves” parked at the New York Fed, “funding” is not an issue. Moreover, the whole point of the Fed’s interest rate repression regime is to create an artificially large profit spread on bank loan books in order to revive dodgy balance sheets.

So we get back to the same old ritual of Keynesian central banking: namely, if you only have a hammer, everything looks like a nail. In truth, the only tool that central banks actually have is monetization of existing assets and sea shells. Accordingly, they invent excuses for more of the same, and devise clever stratagems to disguise what they are doing.

In the present instant, the ECB and its acolytes have been gumming for several months now about “low-flation”. But that is ridiculous—if the claim is viewed in any context except the run-rate of the last few hours or quarters.

Yes, during the last 12 months, euro area inflation has come in near what used to be viewed as salutary price stability at 0.8%. But in the three years before that it averaged about 1.9% or about as close to the ECB’s so-called inflation target as your can get. Indeed, moderate inflation is endemic in the European economies. It has averaged 1.8% since the eve of the 2008 crisis and essentially the same since 1997.

In short, Europe has more than enough inflation and doesn’t need a revived ABCP market to generate loans for the un-creditworthy. Today’s announcement is just part of Draghi’s desperate attempt to deliver QE next week in a manner which will not elicit a loud “nein!” from his German overseers.