Orignally aired March 28, 2014

CONSUELO MACK: This week on WealthTrack…How do you hit the investment jack pot? Wintergreen fund’s David Winters explains his trifecta formula of buying companies with growing earnings, shareholder friendly managements and low prices. Great Investor David Winters is next on Consuelo Mack WealthTrack.

Hello and welcome to this edition of WealthTrack, I’m Consuelo Mack. Those of you who are regular viewers know that more often than not our guests march to the beat of a different drummer. No matter what the economic, or market climate they each have their own distinctive and disciplined investment approach from which they do not deviate. Their consistent research and analytical skills might lead them to different types of investments and securities over the years but how they get there does not change.

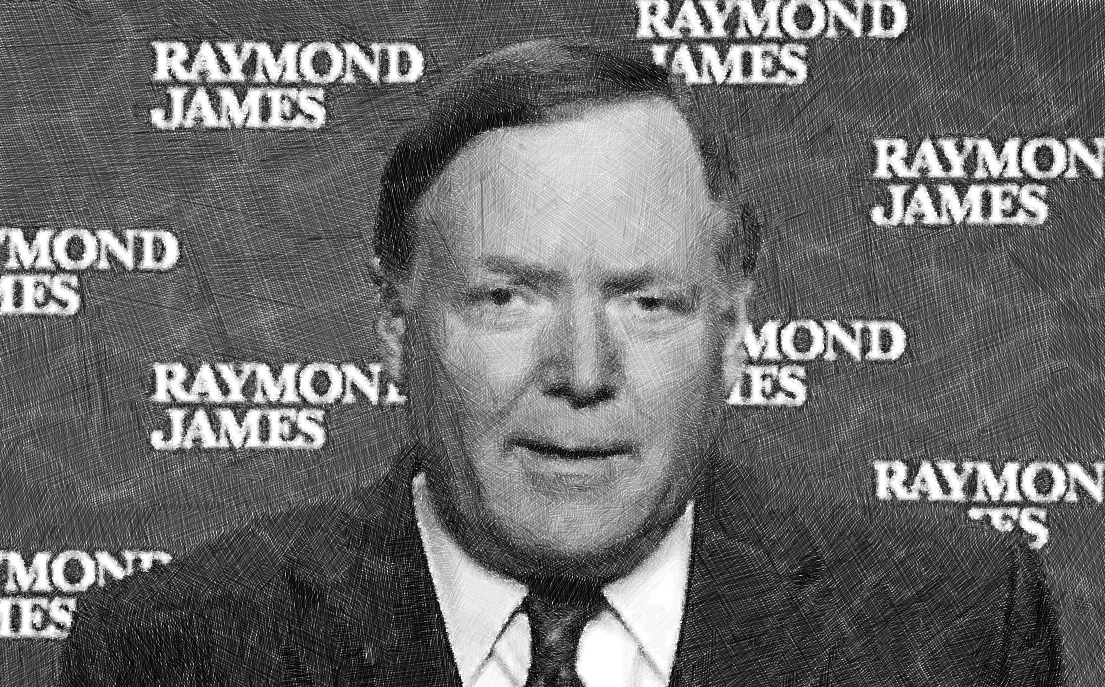

As you will discover in a moment this week’s guest is a prime example. So what tunes have the Wall Street crowd been playing? Here are a few current commonly heard themes: If you must be in the stock market, and many investors are not convinced you should in any size, the U.S. Stock market is the best place to invest. The expression I have heard many times is the “U.S market is the cleanest shirt in a dirty laundry”. Growth and momentum are in… hence the popularity of social media stocks. Value and quality are out, which is why many blue chip stocks have languished. Emerging markets are the worst place to invest. Well these are not the sentiments of this week’s guest. As a matter of fact he is on the opposite side of these popular themes. He is David Winters, portfolio manager of the value oriented Wintergreen Fund which he founded in 2005 with the flexibility to invest like a hedge fund. It can go anywhere around the globe and invest in just about any asset class including distressed securities and arbitrage. Winters was nominated for Morningstar’s international stock fund manager of the year award in both 2011 and 2010.

When I taped the interview with noted value investor, David Winters he spoke of his sizable position in Coca Cola because of its improving business, cheap stock, and shareholder friendly dividend and stock buyback programs. This week however Winters turned from a management fan to a critic over the company’s proposed 2014 executive compensation plan and publically complained to Coke’s board and largest shareholder, Warren Buffet’s Berkshire Hathaway.

CONSUELO MACK: Coke disagrees with Winters’ analysis and says it is “misinformed and does not reflect the facts.” We’ll have links with more in-depth information on our website, wealthtrack.com Now Wintergreen is one of WealthTrack’s sponsors but his track record speaks for itself. I began the interview by asking him why his focus continues to be overseas considering the U.S. Market’s strong showing.

CONSUELO MACK: One of the interesting things is that when you look at what markets have been very popular and what markets have been unpopular, at one point three or four years ago, the emerging markets were just… everybody wanted to be in emerging markets. Nobody wanted to be in the developed markets. So what does that tell you about market sentiment now, the fact that no one wants to be in the emerging markets?

CONSUELO MACK: Another part of the Wintergreen kind of culture is in not being an index, is the fact that you also decide not only where you want to invest but where you don’t want to invest, and so one of the things that you told me recently, which I did not realize, is that you don’t invest typically in companies that are based in the European Union. Why are you boycotting the EU? Why are you boycotting companies that are based in France and Germany, for instance?

CONSUELO MACK: How important is it where a company is domiciled, where it is based?

CONSUELO MACK: When you look at the bureaucracy that is the EU, is that a negative as far as you’re concerned?

CONSUELO MACK: Let me ask you about the big picture before we again delve into what you’re specifically doing at Wintergreen. We are five years into a bull market. The S&P had the best year since 1997 last year, and in your shareholder letter, the 2013 shareholder letter, you pointed out that the top 10 best performing S&P stocks in 2013 had average P/E multiples of 58. What does that tell you about the valuations in the market right now?

CONSUELO MACK: Are you confident about the strength of the global recovery that we’ve seen?

CONSUELO MACK: I always ask you when you’re on WealthTrack about the fact that you look for companies that have a trifecta, and so remind us again of what that trifecta is.

CONSUELO MACK: So the momentum players that are very much followed, high-frequency traders, you don’t think that that is an effective long-term strategy.

CONSUELO MACK: One of the things that you mentioned in your annual letter as well is the fact that instead of just looking at the stock price, which you do … I mean, obviously value matters a lot, but the performance of the stock price, you are looking at these companies on a total return basis as well.

CONSUELO MACK: You recently bought … I mean, this was last year … a Hong Kong property developer, I guess the largest Hong Kong property developer and landlord in Hong Kong called Sun Hung Kai Properites. How does that fit into your trifecta approach?

CONSUELO MACK: You recently have done some things, speaking of your tool bag, that I’m intrigued by, and one of them was that you bought long-dated call options on Nestlé. Nestlé is a big holding of yours. Why buy the call options?

CONSUELO MACK: You are a low-risk investor. Options are considered on the face of them to be more risky than owning the common stock.

CONSUELO MACK: Another strategy that you employed last year was that you participated in an arbitrage situation where Berkshire Hathaway was taking over NV Energy, and so you arbitraged that. Again, thinking of what I know about David Winters and the Wintergreen Fund, you had kind of a hedge fund type of past, but you’re doing this kind of thing in the Wintergreen Fund as well. Why? Why take that chance? It’s an arbitrage. It might not work out at all. It did, but it might not have.

CONSUELO MACK: Berkshire.

CONSUELO MACK: You mentioned distressed investing which you do have a very successful history in. What else is distressed, looking around the world?

CONSUELO MACK: So long-term value investing is a distressed sector right now.

CONSUELO MACK:So are you going to continue to hold Berkshire, and would there be any reason because you have traded in and out of Berkshire over the years. Is there any reason as the size of the company starts to impede its future performance? Is there any reason not to own Berkshire or own less of it? How do you decide when to buy or when to sell or when to reduce a position or when to add to a position?

CONSUELO MACK: Where is it now as far as net asset value?

CONSUELO MACK: When we see that your turnover is so low, and it has been since the beginning … it’s under 20 percent. Is it 14 percent turnover a year? And yet last year you sold two big holdings that we have talked about in the past and one was Schindler Holdings which every elevator I go into I always look to see if it was a Schindler elevator, and the other one was Imperial Tobacco. Why did you sell those two after holding them for so long?

CONSUELO MACK: One of the issues that some viewers have raised with us is they listen to you on WealthTrack and elsewhere and they say, “We really are intrigued by what Wintergreen’s doing. We like his approach, but why are his expenses so high?” and Morningstar says that 95 percent of no-load funds, you are more expensive than 95 percent of no-load funds with a 1.8 percent expense ratio.

Why?

CONSUELO MACK:One point four percent.

CONSUELO MACK: One investment for a long-term diversified portfolio. What would you have all of us own some of?

CONSUELO MACK: Cash position now is what at Wintergreen?

CONSUELO MACK: That’s such a refreshing attitude, and you’re always optimistic about investing, David Winters, always a treat to have you on WealthTrack. Thanks so much.

you build and protect your wealth over the long term.

In this week’s action point we are taking our cue from David Winters’ comment that the most distressed investment these days is long-term investing. This week’s action point is stick with investors and companies that are built to last. Winters and other guests, Ed Perks, Wally Weitz and Tom Russo come to mind most recently, all think long-term and look for companies with businesses and corporate cultures that think in years, not months and are managed to grow and last for generations of customers and shareholders. These money managers also tend to invest in businesses for years. Yes they trim or add to their positions to take advantage of price fluctuations, but they see themselves as owners as well. I for one want to invest with funds that intend to last.

Next week we will sit down with two of the top personal finance journalists in the country. Jonathan Clements and Jason Zweig will discuss the greatest financial challenges facing individuals and how to overcome them.

Also we want to alert you to a new feature we will soon be introducing on our website. It’s called “WealthTrack women”, investment pros who specialize in advising women clients will answer questions vital to their financial health.

In the meantime have a great weekend and make the week ahead a profitable and a productive one.