by Kara Lilly, Mawer Investment Management

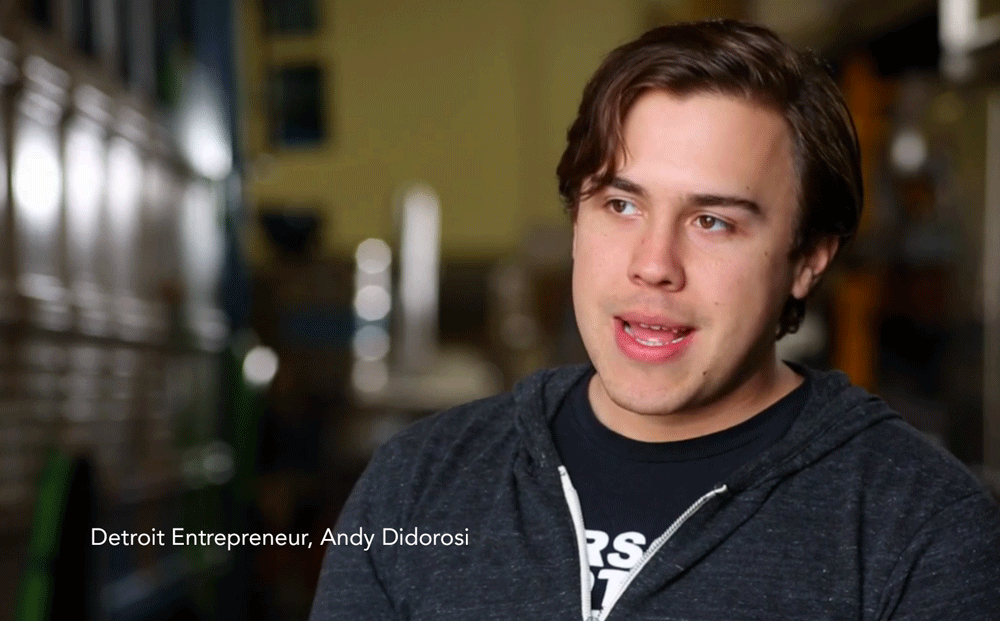

A scrappy, twenty-something-year old from Detroit, Andy Didorosi does not fit into the typical image of American capitalism. Wearing neither a Wall Street power suit nor the dark-rimmed glasses and plaid shirt typical of a Silicon Valley startup, Andy is, simply, himself. That is to say, he looks and sounds every bit what a Canadian might expect from someone who has spent his whole life in Detroit.

Recently, I had the opportunity to listen to Andy’s story when I was in New York City. I was impressed to hear his many tales of buying underutilized assets and transforming them into those people valued. At only 27, Andy is the founder of The Detroit Bus Company, Eight & Sand, Thunderdrome!, Paper Street, as well as a handful of other businesses. But what really sets Andy apart is that he symbolizes what is good about American capitalism at a time when “capitalist” seems to have become a dirty word.

Understanding why Andy’s achievements are remarkable necessitates an examination of the place where he is making his mark; a city that most view as a basket case rather than a hub of entrepreneurial activity: Detroit.

The Yin and Yang of Detroit

Detroit is a city with well-documented challenges. Not only is Detroit the murder and violent crime capital of America, it struggles with the aftermath of a staggering decline in population.In the last 60 years, the population of Detroit has shrunk from 1.8 million inhabitants to around 700,000 and between 2000 and 2010, it has plunged 25%. According to a recent article in Fast Company, there are now over 100,000 vacant lots on 139 square miles in the city and roughly 45,000 housing units are abandoned, equivalent to a fourth of all housing stock. At $27,862, the household income is barely half the national level, which helps to explain an unemployment rate of 18%, more than double the national average. This rate increases above 50% if you count all of the people who have simply stopped looking for work. Moreover, Detroit has now won the unenviable title of the largest city in America to go bankrupt.

Clearly, Detroit has issues. Yet if these challenges are the yin in the current state of Detroit, there is also a yang. As the city’s asset prices have plummeted and property has flooded the market, entrepreneurially minded individuals have stepped in. Detroit’s crisis has created opportunity for those who can spot value in its depressed assets. In Detroit, the median sales price of a house is around $11,000, less than what many people pay for cars, and the minimum bid for a house on auction is only $500. Meanwhile, huge empty buildings create opportunities to cheaply house a business. So while many might balk at living or working in Detroit, there are some who view it as a land of opportunity.

This tribe includes creative capitalists like Andy Didorosi.

The Art of Finding Value

Andy was young when he got his first taste of buying undervalued assets. While working as a bus boy making only $4.25 per hour, his friend invited him to a police auction for abandoned vehicles. When a beat-up, ugly car came up for only $200 he jumped at the offer, figuring that $200 is a pretty good deal for a car. Never mind that he knew nothing about cars or fixing them up. Andy paid his $200, learned how to fix it up, and eventually sold it for $1,200 on Craigslist.

This experience taught him that he could create value by fixing up undervalued assets. It also taught him to just try. Andy quit his low-paying restaurant job and started buying and selling used cars. He was 16 years old.

Since his initial foray into asset buying, Andy has made a career of uncovering value. A good example being The Detroit Bus Company, the public transportation company he began after seeing Detroit suffer one too many closures of its public transportation routes. After purchasing some buses on the cheap, The Detroit Bus Company started servicing areas where public transportation was sorely missed. He also began a joint venture where his buses shuttled children to and from Detroit’s many after-school programs, allowing kids to attend who would otherwise be unable to because of safety concerns (over half of the streetlights in the city don’t work). By running buses only when there is demand, The Detroit Bus Company claims to save 90% on costs. And this is just one example of a handful of initiatives in which Andy has had a hand.

While defenders of the “American Way” love to give theoretical rationale for capitalism as a social structure, Andy is out making the world better in practice. No one told this man to found his companies or turn around assets for more productive uses. There was no committee. He simply saw opportunities and started to create. For all of the criticisms sometimes thrown at capitalists, entrepreneurs like Andy demonstrate an audacious creativity that is inspiring. In current entrepreneur-speak, he is out there “hustling.”

Andy also highlights a trait that is relevant to investors: being able to see value in assets that others do not. Andy’s mind is geared to be creative and to see the inconspicuous. In our experience, this mindset is an invaluable trait within the management teams of companies in which we invest. Managers who exhibit this kind of mindset create opportunities for their businesses. Often, these opportunities are not anticipated by investors and result in unexpected value.

While a creative, entrepreneurial mindset is not the only trait we look for in a company leader, it certainly is a great starting point.

Kara Lilly

Copyright © Mawer Investment Management