by Eddy Elfenbein, Crossing Wall Street

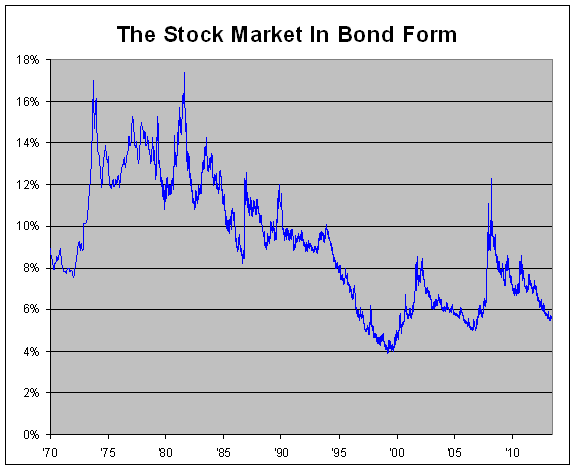

Here’s an update to one of my more off-the-wall ideas. I was curious to see what the historical performance of the stock market looks like, but in the form of a bond.

Crazy? Let me explain.

I took all of the historical market performance of the Wilshire 5000 (including dividends) and invented a hypothetical long-term bond that matched the market’s daily gains step-for-step.

I assumed that it’s a bond of infinite maturity and pays a fixed coupon.

There’s one hitch, though. I have to choose a starting yield-to-maturity for the beginning of the data series in December 1970. So this isn’t a completely kosher experiment because the starting point is based on my guess.

If I choose a number that’s too high, the historical performance won’t be able to keep up, and the yield-to-maturity would grow higher and higher and soon leave orbit. Conversely, if my starting YTM is too low, the yield would gradually get pushed down to microscopic levels.

Fortunately, the data makes my job easy. After four decades, the window I have to work with is pretty narrow. Starting with 10% is too high, and 8% is too low. After playing with the numbers, I finally settled on 8.93%.

Even though this “bond” is completely make-believe, it reflects what the actual stock market really did for the past 43 years. Through yesterday, the “bond’s” yield stood at 5.63%.

Here’s what the actual stock market looks like, expressed in the form of a bond:

Copyright © Eddy Elfenbein