by James Paulsen, Chief Investment Strategist, Wells Capital Management

While bond yields seem mostly benign so far this year, investors should not be overly complacent about the potential for yields to rise significantly yet in 2014. Several forces are aligning which are darkening the environment surrounding the fixed income market. Indeed, we highlight 10 reasons why the 10-year Treasury yield may still near 4% this year suggesting recent bond market action may simply represent the calm before the storm. Are bonds cruising for another bruising in 2014? 1. Bond yields are not yet fully reconnected to the economic cycle!

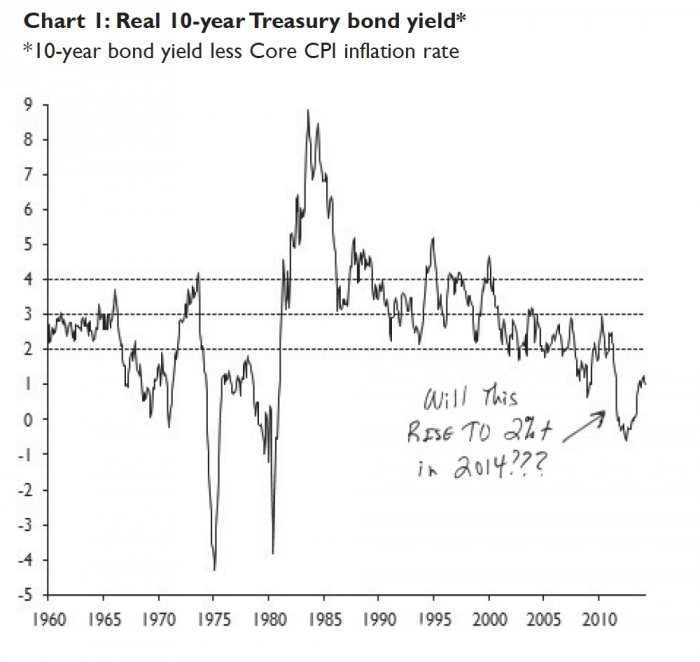

Chart 1 illustrates the historical valuation of the 10-year bond yield relative to the annual rate of core consumer price inflation. Since 1960, when fairly valued, the 10-year yield has oscillated between 2% and 4% above the rate of inflation. That is, the dotted lines in this chart suggest an “equilibrium” yield level—one whereby bonds seem appropriately priced for the economic recovery.

Yields were too low in the late-1960s throughout the 1970s as they remained significantly divorced from rising inflation realities. Similarly, during much of the 1980s, yields were consistently too high relative to inflation. A consensus priced bonds through the rear view mirror of the 1970s experience rather than based on the current inflation reality through the windshield.

After a period of mostly being appropriately priced (i.e., between 1985 and 2007 the 10-year bond yield was typically between the dotted lines), bond yields have again become divorced from the economic cycle since the 2008 crisis. The severity of the crisis sent investors flocking into “safe-haven” government bonds pushing yields far below levels justified by fundamentals. However, since the 10-year yield reached an all-time low in 2012, the bond market has started reconnecting with the economic cycle. Last year, the 10-year yield rose to about 3% cutting the gap to the lower equilibrium band in Chart 1 by nearly one-half.

Despite this improvement, bond yields currently remain significantly below fair fundamental levels. With an annual core consumer price inflation rate of 1.7%, the 10-year bond yield would need to rise to 3.7% (about 1% higher than its current level) just to reach the lower-end of “normal” and to reconnect with the current economic recovery. To reach the middle dotted line (i.e., 3% above the current core inflation rate) requires a 10-year yield of 4.7%—2% above current levels! Yields have finally started to reconnect with the recovery and Chart 1 illustrates how much more potential damage bond investors may face before yields can again be considered fairly priced.

You may read/download the entire report from the slidedeck below: