Navigating a Big Ship

by Tom Brakke, Research Puzzle

Financial Advisor had kind of an odd headline the other day: “Fidelity’s Top-Performing Danoff Takes Steps to Improve Returns.” The confusion in the wording results from a timing difference; Fidelity Contrafund (FCNTX), managed by William Danoff, is “top-performing” over some longer time periods, but has been in a relative slump the last few weeks.

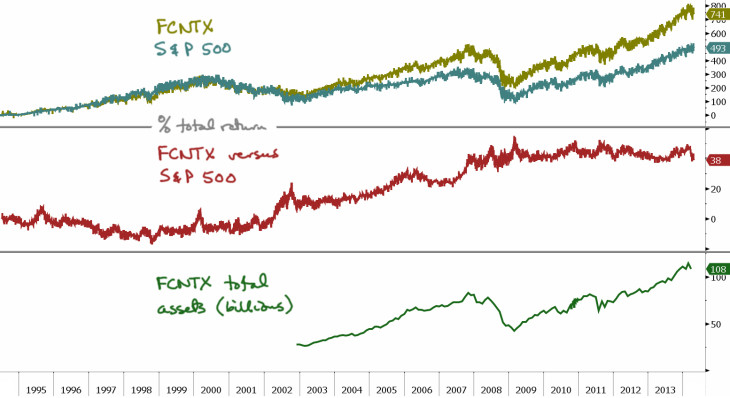

Some background: The fund has been around since 1967 and Danoff has been managing it since taking over from Jeff Vinik in 1990. The data on Bloomberg used in the chart above starts in mid-1994 in terms of returns and the end of 2002 for fund total assets.

The FA piece said that “Danoff has been one of the best stock pickers over the past 20 years.” That’s the time frame shown above, but notice (look at the relative performance in the middle panel) that all of the positive movement was during the period from 2002 through 2008. It was a market fund before that and a slightly-worse-than-market fund after it.

In recent months, relative performance steadily improved from the end of July through February (a total of 6% outperformance), and then all of that plus a little more was given back in a few weeks. While the article indicates that Danoff is frustrated and a bit concerned, he made it clear that he’s not about to get cautious: “There are big opportunities in the next couple years. We don’t want to batten down the hatches and say we’re closed for business. We’re definitely open for business.”

The last pix talked about the bloat ratio, one measure of how difficult it is for a manager to move a fund around. The article on which it was based (you can find it in the online Morningstar magazine) references Contrafund as one of the funds that has a huge asset base and a “very high” bloat ratio.

For whatever the reason, despite the “top-performing” description, Contrafund hasn’t done much for a while. Shareholders have to ask themselves whether now is the time to be in a fund with more than a hundred billion in assets, much of it in “momo” names (including more than 8% in Google and huge positions in Biogen, Amazon, Facebook, etc.).

The fund’s description says, “Our investment approach seeks companies we believe are poised for durable multiyear earnings growth that is not accurately reflected in their current valuation.” Things that fit that description have gotten more and more scarce as the market has been repriced.

If we get into more treacherous waters, piloting a ship loaded with past winners might be a bit of a challenge. (Chart: Bloomberg terminal.)

Copyright © Research Puzzle