by Don Vialoux, Timing the Market

Interesting Charts

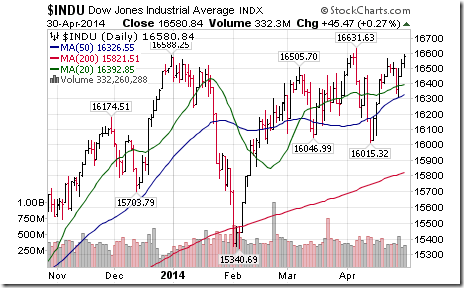

The Dow Jones Industrial Average closed at an all-time closing

high, surpassing its previously all-time closing high at 16,576

set on December 31st 2013. Inter-day all-time high

is 16,631.63 set on April 4th 2014

A contributing influence on the Dow was weakness in the U.S.

Dollar Index. Once again the Index is testing long term support

just above 79. Possible head and shoulders pattern?

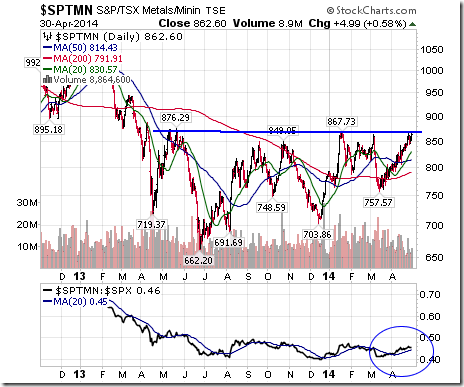

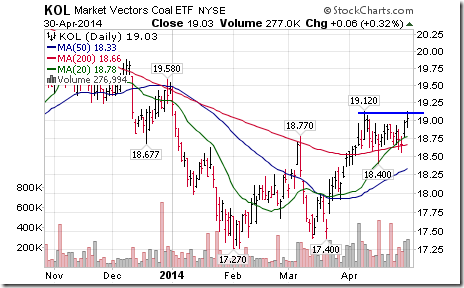

Weakness in the U.S. Dollar also helped commodity based ETFs.

The TSX Metals and Mining Index briefly broke above resistance

at 867.73.

Tweets Released Yesterday

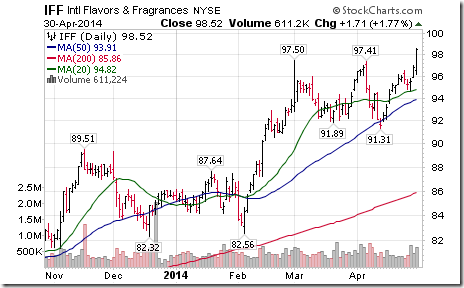

Mixed technicals by S&P this morning! 6 stocks broke

resistance: $GRMN,$FISV,$TSS,$IFF,IP,SEE. 5 broke support:

$BBBY,$BSX,$ESRX,$EBAY,$JBL

No significant breakout or breakdowns by S&P 500 stocks

following the FOMC announcement.

Technical Action by Individual Equities

Yesterday

By the end of the day, eight S&P 500 stocks broke

resistance and five stocks broke support. Notable were BBBY and

EBAY on the downside and IFF and SEE on the upside.

Special Free Services available

through www.equityclock.com

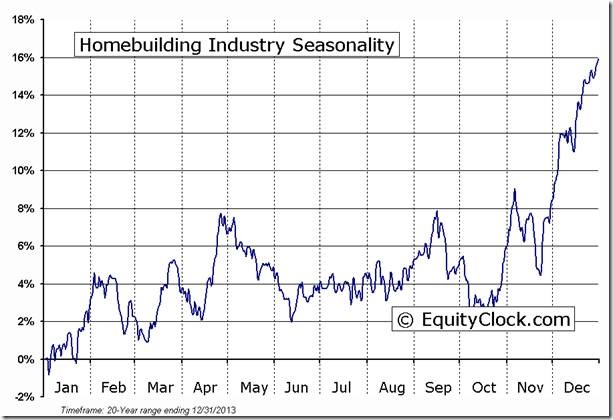

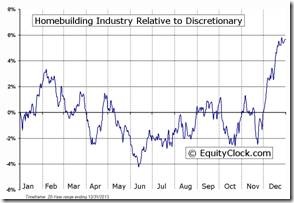

Equityclock.com is offering free access to a data base showing

seasonal studies on individual stocks and sectors. The data

base holds seasonality studies on over 1000 big and moderate

cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

= = = = = = = = = = = = = = = = = = = = =

|

|

Trading on the Edge

By Adrienne Toghraie, Trader’s Success

Coach

Most everyone who has a passion for trading would like to

experience exceptional results consistently. Very few, however,

will do what is necessary to reach this level of success.

Excellence requires a high level of trust in a strategy and in

yourself and then goes one step beyond that. I think of it as

the “Let go, let God” method. You see many examples of this in

champion levels of sports, the performing arts and in science.

While the prize of greatness is tempting, it is not for

everyone. Those who not only want to conquer their technique

but also are willing to conquer themselves are few.

A Diamond in the Rough

Ray came from a neighborhood on the Chicago south side where if

you graduated from high school it was considered a major

achievement. His parents were both factory workers who had a

strong work ethic, which they passed on to their son. While

this was an admirable inheritance, they also believed that you

should not expect too much out of life. This protected them

from disappointment.

Ray was saved from a life of being in a gang because his

parents encouraged him to be active in their church. He was at

a meeting with another church group from the better side of

town when he met Matt. They instantly became buddies. Matt’s

father was a floor trader and took both his son and Ray under

his wing to teach them the trading business. Ray’s work ethic

was good for Matt and Matt’s mantra that the sky was the limit

was good for Ray. Eventually, they both became good floor

traders. While Ray was happy with his new station in life,

there was a part of him that knew that he wanted to be like the

best traders.

I spoke at the Chicago Mercantile Exchange where both Matt and

Ray attended. Matt made fun of what I had to say and wanted to

leave, but Ray encouraged him to stay and listen. My workshop

led to Ray purchasing my course and taking my Trader’s

Evaluation. What we discovered was that while Ray had many

attributes that would sustain good trading practices, he

limited his success by some of the beliefs he inherited from

his parents. I worked with Ray privately without Matt knowing

about it. Ray began to show extraordinary results, which he

tried to keep undercover from Matt. Several of Ray’s colleagues

noticed that Ray was taking larger positions that became

winners and wanted to know what the reason was for his good

results. These were traders who were too busy with happy hour

to come to my workshop. Ray just said that he was becoming more

comfortable taking larger risk.

After taking all I had to offer, Ray called me and said that he

wanted to kick it up a notch because he was still leaving money

on the table. In my twenty-one year career, I have had less

than twenty people who wanted to take trading to the highest

level. For the next three years we worked one to two days each

year. Now Ray is one of those elite traders who lives on the

edge between excellence and mastery.

The Superconscious Mind

When I work with a trader privately for the first time, my main

focus is on eliminating the self-sabotage that comes from past

issues. If and when I see a person privately a second time, we

work on any residual issues of self-sabotage that come between

them and their next level of success. If they are ready and

willing, we take it to the next performance level by working on

the superconscious mind. Part of this can entail reprogramming

core values of the past such as how they see themselves as

traders who are willing to accept mastery in their lives. Now,

it is important to note that this is not for everyone, because

this can dramatically change every part of a person’s life.

For Ray going for a state of mastery this was not an issue. He

did not have a wife and children and other members of his

family were on board for any changes for the better he wanted

to make. It did, however, affect his relationship with his

friend Matt. While Matt would claim that he believed that the

sky was the limit, he did not believe it for himself, and he

was uncomfortable that Ray had achieved it without him.

Conclusion

If trading mastery is your goal, realize that it is not a path

for everyone. It takes not only being an exceptional trader but

also mastering yourself.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

= = = = = = = = = = = = = = = = = = = = =

Disclaimer: Comments, charts and opinions

offered in this report by www.timingthemarket.ca

and www.equityclock.com

are for information only. They should not be

considered as advice to purchase or to sell mentioned

securities. Data offered in this report is believed to be

accurate, but is not guaranteed. Don and Jon Vialoux are

Research Analysts with Horizons ETFs Management (Canada)

Inc. All of the views expressed herein are the personal

views of the authors and are not necessarily the views of

Horizons ETFs Investment Management (Canada) Inc., although any

of the recommendations found herein may be reflected in

positions or transactions in the various client portfolios

managed by Horizons ETFs Investment Management (Canada)

Inc.

Twitter comments (Tweets) are not offered on

individual equities held personally or in HAC.

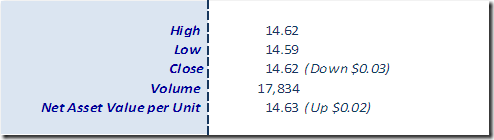

Horizons Seasonal Rotation ETF HAC April

30th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray