by

One of the big themes for us this year has been to stay on the long side of the Commodities market . Coming into 2014, stocks were generally an asset class that we wanted to avoid on an absolute basis, but since commodities had essentially become the forgotten asset class, we felt it was where we preferred to be.

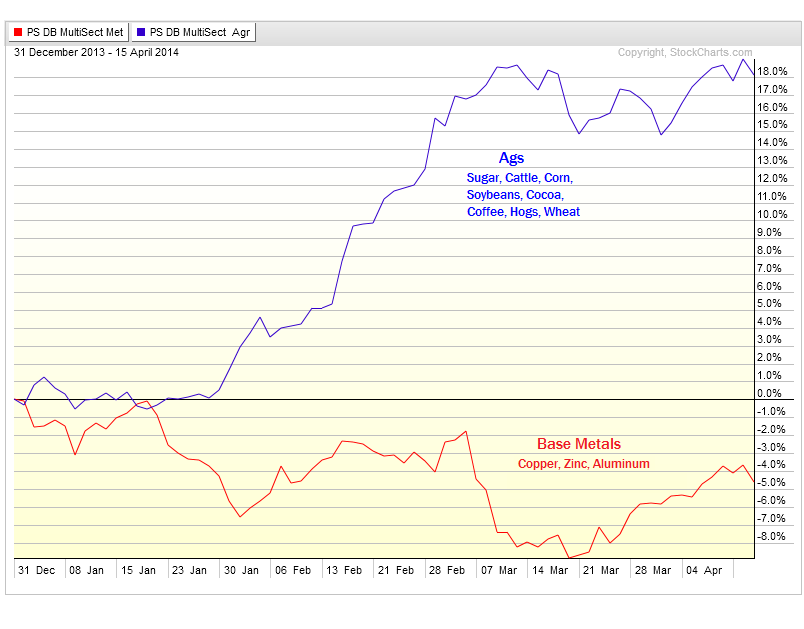

Now, within that commodities space, the strength has really come from the agricultural names rather than the base metals. Look at the chart below that shows the year-to-date performance of the Ags vs the Base metals:

This is a fascinating development that points us towards the demand for agricultural names. Call it a coincidence perhaps, but the Agribusiness ETF is setting up very nicely as well.

Take a look at the weekly chart of $MOO where we can see a steady series of higher lows since 2010. Meanwhile, prices continue to bump up against this overhead supply. The more times that a level is tested, the higher the likelihood that it breaks:

If you look a little bit closer, we can see some interesting developments in the short-term as well. First we have a nice clean downtrend line from the highs last January. Earlier this year we had a temporary breakdown back below that downtrend line. Do you see how quickly it recovered to head back up towards this $54.50 resistance?

I love it when longs get stopped and then have to get back in. This is how some of my favorite squeezes develop. We’re looking for a breakout above this key level as a signal that the sellers have dried up.

The Agribusiness names probably stand out the most on a relative basis. Here is a chart showing the MOO/SPY spread getting crushed all of last year. But with momentum already putting in higher lows, we are now waiting for a bullish divergence confirmation. In my opinion, we have this once we’re above 293.

I’m still a big fan of our investing themes for this year. We’re sticking with commodities, sticking with bonds, and trying to stay away from stocks. I think there are some individual less correlated names that can do well, but for the most part I’d rather own stocks on a relative basis.

The Agribusiness space is one area that definitely stands out. Plus, it fits right in to our bullish thesis about commodities. Here are some the biggest holdings for the ETF broken down by percentage of the fund: