by James Picerno, Capital Spectator

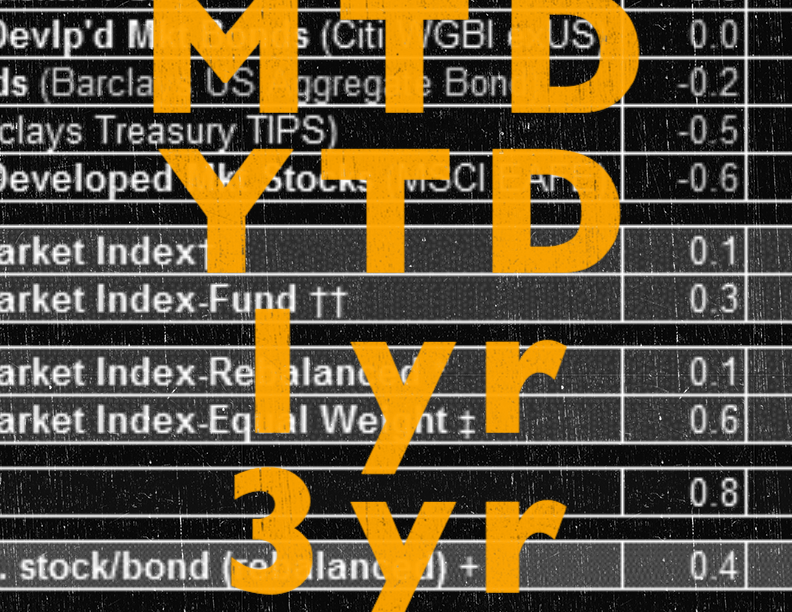

March brought another round of healing for assets in emerging markets. For the second month in a row, stocks and bonds in these nations posted handsome gains. Equities led the way in the first quarter’s closing stretch: the MSCI Emerging Markets Index advanced 3.1% last month, closely followed by government bonds in emerging nations, which added 2.8% (Citigroup ESBI). At the other end of the performance spectrum, stocks in developed markets led the red-ink parade by shedding 0.6% in March, based on the MSCI EAFE Index.

Meanwhile, broad diversification managed to eke out a gain last month. The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, increased 0.1% in March. That leaves GMI ahead by 1.8% for the year so far, or roughly in line with the US stock market’s performance through the close of this year’s first quarter.

For the moment, emerging markets are grabbing the crowd’s attention (and quite a lot of the investment flows)… again. So it goes when price momentum reverses direction in favor of the bulls. “I am not sure what has made emerging-market stocks so attractive to investors over the past few weeks, but many long-forgotten markets such as Turkey and Brazil are back above key moving averages,” notes a columnist for Barron’s. “And some, such as pan-Middle East, have been stealthily leading global markets for months.”

One theory for the latest buying spree in emerging markets is that the world suddenly looks a bit less threatening. “If there was any geopolitical risk, it’s calmed down and we’re showing some economic momentum,” says James Paulsen, chief investment strategist at Wells Capital Management. The change in perception, reasonable or not, appears to be reviving the crowd’s love affair with markets that have taken a beating before the latest mood swing kicked in. “The sentiment is becoming less negative at the margin for emerging-market equities,” observes Morgan Harting, a portfolio manager at AllianceBernstein. “At some point, valuation just starts to matter. The gap between emerging equities and developed equities had become extremely wide.”

Copyright © Capital Spectator