by Lance Roberts, STA Wealth Management

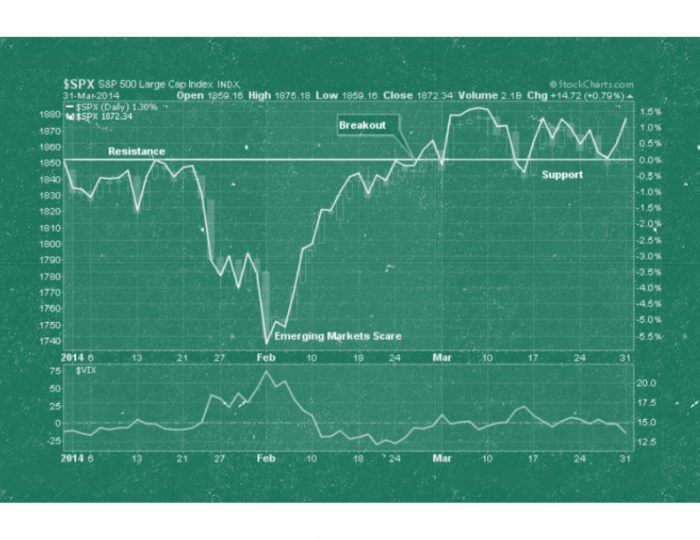

It has been a bumpy ride for the S&P 500 since the new year began as the markets were impacted by an early emerging markets scare as the Federal Reserve continued extract liquidity from the markets, international intrigue as Russia annexed Crimea, and a slate of weak economic data. While volatility picked up early in the quarter, it quickly faded as investor "complacency" continues to push extreme levels.

As shown in the chart below, the markets struggled early on with overhead resistance. However, in late February, the market was able to break out to new highs. However, since then the market has worked to consolidate that push higher between 1850 and 1880.

For the quarter, the S&P 500 managed to finish in the green advancing by roughly 1.3%. Such an advance is about the average of all first quarters in history going back to 1900. The table below, which uses Dr. Robert Shiller's data, shows the monthly statistical data of returns which I will use for the remainder of this missive.

Using the data above, let's take a look at what we might expect for the month of April.

Historically, April is the 4th best performing month for stocks on average yielding an average return of 0.79% and a median return of 1.02%.

(Interesting note: as you will notice in the table above and chart below, average returns are heavily skewed by outlier events. For example, while October is considered the "worst month" with an average return of -0.27%, the median return is actually a positive 0.58% which makes it only the 4th worst performing month of the year beating out February [the worst], May and June.)

April, as shown in the above, also represents the end of the "seasonally strong" period for stocks. As the markets roll into the early summer months May and June tend to be some of weakest months of the year along with September. This is where the old adage of "Sell In May" is derived from. Of course, while not every summer period has been a dud, history does show that being invested during summer months is a "hit or miss" bet at best.

Like October, April's monthly average is also skewed by sharply negative returns during the "Great Depression." However, in more recent years returns have been primarily contained, with only a couple of exceptions, within a +/- 5% return band as shown below.

However, before you slip into a warm bath of investment bliss, it is important to remember that just because the data suggests that April will "probably" be a positive return month for the market, there is also the "possibility" it will not. The chart below depicts the number of positive and negative returns for the market by month. With a ratio of 43 losing months to 72 positive one, there is a 37% chance that April will yield a negative return.

From a bullish perspective, it would appear that the markets are consolidating the advance from the lows of February which should allow markets to stage another advance into late spring. That analysis would align with both seasonal tendencies and the fact that the Fed is still pushing liquidity into the financial markets presently.

It is for these reasons that we are currently keeping our allocation models aligned with the overall market.

However, one should not extrapolate a potentially positive month, into a long term trend. There are clearly rising risks to the markets in a variety of areas as I discussed yesterday with regards to "Profit Margins And Stock Market Reversions:"

If corporate profits as a percentage of GDP are indeed peaking, as the chart above would suggest, then there is potentially trouble ahead for investors. This is not a "bearish" prediction of an impending economic crash, but rather just a realization that all economic, and earnings, forecasts, are subject to the overall business cycle. The problem with earnings forecasts, or even the CBO's 10 year economic growth projections, is that they fail to factor in the probability of an average economic recession. That mistake has always eventually produced a very disappointing outcome.

That view was supported by the highly respected value investor, and fund manager, Seth Klarman who recently penned:

Someday, professional investors will come to work and fear will have come to the markets and that fear will spread like wildfire. The news flow will be bad, and the markets will be tumbling.

Six years ago, many investors were way out over their skis. Giant financial institutions were brought to their knees...

The survivors pledged to themselves that they would forever be more careful, less greedy, less short-term oriented.

But here we are again, mired in a euphoric environment in which some securities have risen in price beyond all reason, where leverage is returning to rainy markets and asset classes, and where caution seems radical and risk-taking the prudent course. Not surprisingly, lessons learned in 2008 were only learned temporarily. These are the inevitable cycles of greed and fear, of peaks and troughs.

Can we say when it will end? No. Can we say that it will end? Yes. And when it ends and the trend reverses, here is what we can say for sure. Few will be ready. Few will be prepared.

Today is definitely not that day. The problem remains that from one day to the next market action simply cannot be anticipated with any given degree of certainty. No one has that answer. What we do know, is that eventually prices will take a turn for the worse and history shows that there will be little warning, fanfare or acknowledgement that something has changed. As the trend reverses, it will initially be met with denial, followed by hope and ultimately acknowledgement but only well after the fact.

With our portfolios fully invested at the current time, it makes little sense to focus on what could go right. You can readily find that case in the mainstream media which is biased by its needs for advertisers and ratings. However, by understanding the impact to portfolios when something goes "wrong" is inherently more important. If the market rises, terrific. It is when markets decline that we truly understand the "risk" that we take. A missed opportunity is easily replaced. However, a willful disregard of "risk" will inherently lead to the destruction of the two most precious and finite assets that all investors possess – capital and time.