You Can’t Avoid Asset Allocation… Even If You Try

by James Picerno, Capital Spectator

Some investors are under the illusion that they’re immune to asset allocation and all it implies for choosing how to design and manage a strategy. I frequently read stories in the financial press that suggest that the framework of a multi-asset-class portfolio is optional, perhaps even irrelevant, depending on the article. It’s not, although it’s easy to delude yourself into thinking otherwise. The romance of the money game is always tempting us to behave like artists; in fact, we should focus on acting more like engineers.

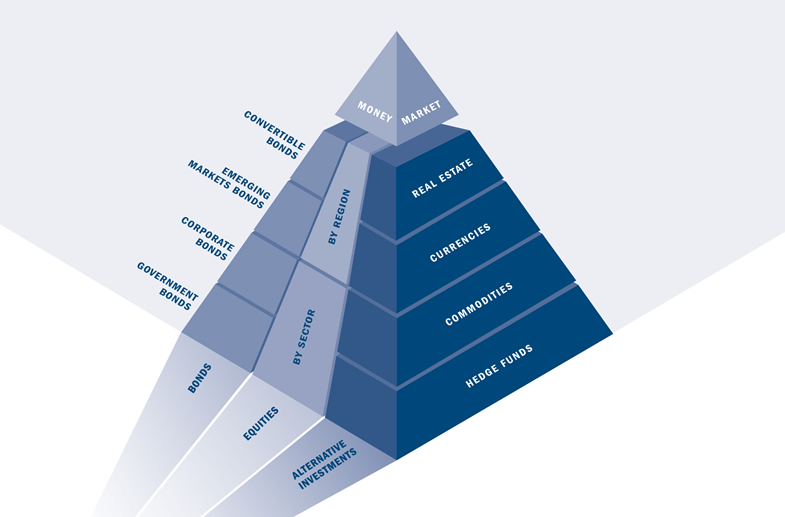

Why does this matter? Because every portfolio strategy, no matter how exotic, extreme or clever has an embedded bias related to asset allocation. In other words, you’re making asset allocation decisions, whether you realize it or not. Let’s say that you’ve decided to hold 10 stocks, each chosen independently with a screening methodology that you believe is a short cut to relatively high expected returns. Maybe so, but this strategy’s outcome will, in part, be tightly linked with the underlying asset allocation choice: a portfolio weight of 100% stocks.

The key assumption here is that the superiority of the security selection will dominate if not override the asset allocation choice. An investor using this strategy probably isn’t thinking in those terms, but that’s the dynamic in play, recognized or not. As a side note, most efforts on this front will probably fail to add value over a relevant index—the S&P 500, for example, if the 10 stocks are drawn from a pool of US large-cap equities. But that’s not the point, at least not here. Rather, it’s essential to understand the risk structure that defines and drives your portfolio. Why? Because flying blind and hoping for the best is never a foundation for success with financial decisions.

When you think clearly about the true nature of the portfolio-design process, you’ll make better choices. The first order of business is appreciating how the game is played, recognizing the rules as written by the markets, and using that clear grasp of reality for figuring out how to proceed in a way that stacks the odds in your favor to the fullest extent possible. Ultimately that leads us to see every portfolio as a preference about asset allocation. There’s a spectrum of possibilities beyond this initial factor, of course, including the question of how to manage an asset mix through time (rebalancing)—a topic that warrants quite a lot of discussion and research. But not here. Rather, my only point now is that it’s vital to see the asset allocation framework that’s inherent and unavoidable in every portfolio.

This is crucial because once we can objectively see the tactical and strategic choices before us, we can move ahead in a productive way that’s likely to satisfy our specific investment goals. This is a subtle but powerful point because if you can recognize the true nature of the portfolio options available, the resulting burst of clarity will help us make intelligent choices. The truth shall set you free. This is less about hitting home runs vs. avoiding high-risk bets with low odds for success.

Thinking in these terms will keep you focused on the risks you’re taking. That alone is worth a lot–much more than most folks know. Let’s say that you’re convinced that you can identify individual securities with above-average expected returns. Perhaps that inspires a larger-than-average bet on this skill. In the extreme, this view leads you to shun diversification across the major asset classes. That’s a risky bet, but as long as you’re making an informed choice, and understand what that choice entails, you’re at least in control of the risks you’re willing and able to assume rather than the other way around.

Overall, it’s (still) all about risks, and deciding how they compare and which ones you’re intent on emphasizing and avoiding for portfolio design. There’s a sea of possibilities. Global minimum variance, risk parity, equal weighting, fundamental weighting, cap-weighting, etc. Or your own home-grown strategy–sidestepping broad asset class diversification and betting the farm on security selection within a single asset pool, for instance.

Pick your poison… carefully, intelligently, and with eyes wide open. This isn’t a sure-fire solution to big gains, but it’s a powerful plan to keep you out of trouble. Why’s that important? Because there’s overwhelming evidence that you can’t earn a decent return in the long run unless you have a solid plan for steering clear of big mistakes in the short term. Obvious, perhaps, but too often ignored in practice.

Copyright © Capital Spectator