The Song Remains the Same

March 19 2014

The noisy journey from winter to spring in the United States may mask the underlying strength in the U.S. economy. The risk-on environment should remain intact, despite international tensions.

by Scott Minerd, Chief Investment Officer, Guggenheim Partners LLC

Global CIO Commentary by Scott Minerd

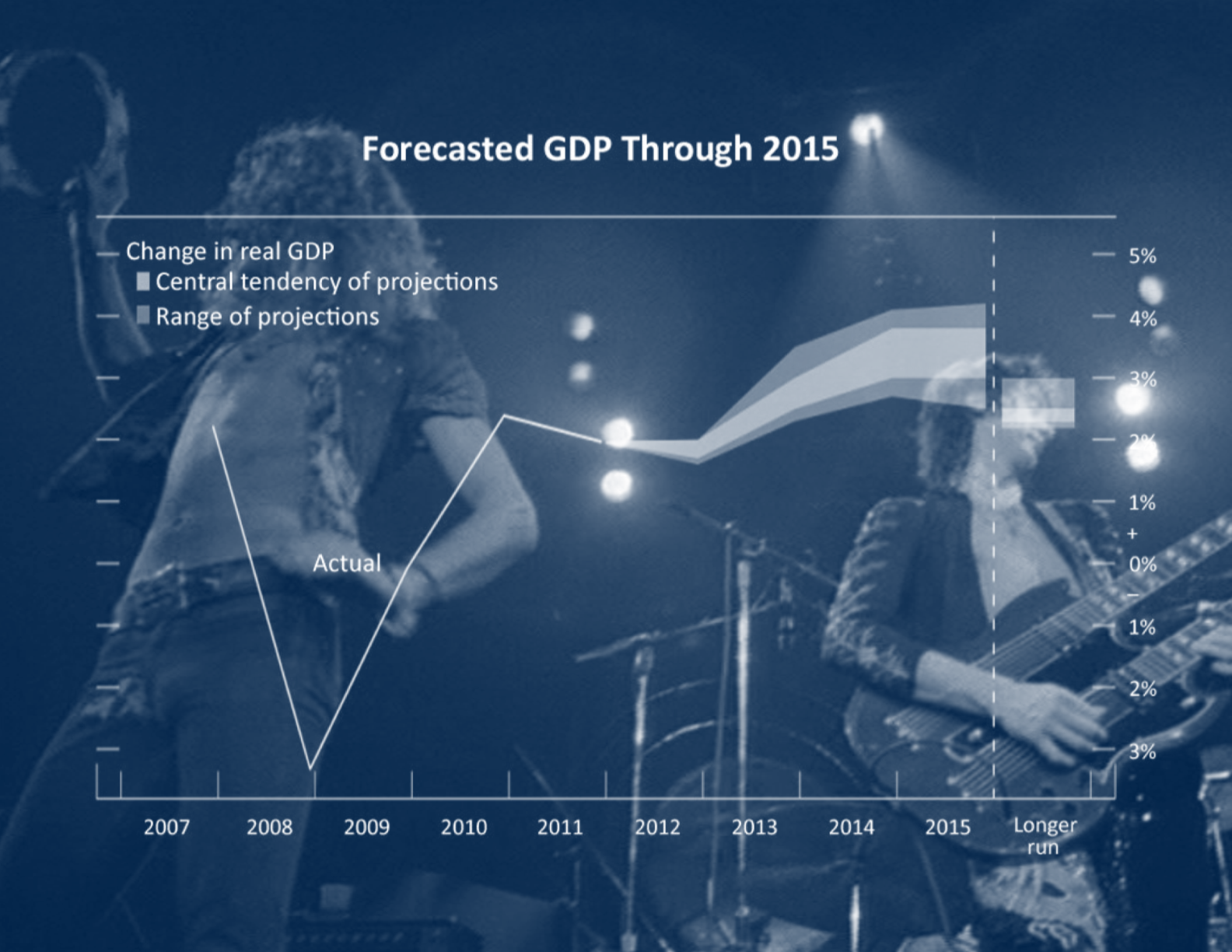

Edging into spring, we should expect a bumpy and rather noisy journey as weak U.S. economic data caused by a severe winter shows up in economic reports. In fact, the U.S. Federal Reserve on Wednesday retooled its forward guidance on the path of interest rates to give it more flexibility to react to shifting data as needed. However, I believe the underlying U.S. economy is in good shape. As the Chilean poet Pablo Neruda once said, “You can cut all the flowers, but you cannot keep spring from coming.”

While a spring rebound should help U.S. markets climb higher, international tensions remain elevated. Relations between the West and Russia have sunk to levels not seen since the Cold War. Russia’s annexation of Crimea confirms that President Vladimir Putin does not respond to threats, so we can expect ongoing instability from the region which is likely to keep U.S. interest rates subdued.

Chinese economic growth has slowed, prompting Beijing to soften its growth forecasts. Interestingly, the People’s Bank of China has widened the renminbi’s official trading band. Increased volatility can now be expected, as policymakers have greater flexibility to depreciate the currency in an effort to boost exports and maintain employment levels.

Abenomic’s “three-arrows” approach to stimulating more robust economic growth in Japan has stalled. Growth momentum is slowing and Abenomic’s third and most important arrow -- undertaking structural reforms -- is not hitting its target. The Bank of Japan may have to do more to stimulate the economy to offset the headwinds from April’s sales tax hike, Japan’s first major tax hike in 17 years.

Now, a couple of months before many investors will start wondering if they should “sell in May,” we remain in a risk-on environment -- U.S. stock prices should go higher, credit spreads should tighten, and any interest-rate increases should be muted. The rumblings in Crimea, China and Japan have done little to change that outlook. In fact, potential Chinese renminbi and Japanese yen devaluations could export deflationary pressure into the United States, potentially pushing 10-year U.S. Treasury yields lower. On balance, for now it appears that the song remains the same.

Chart of the Week

Depreciating Asian Currencies Could Ease U.S. Prices

With China’s economic growth slowing, the People’s Bank of China has widened the official trading band for the renminbi, a sign that Chinese policymakers are willing to accept further depreciation of the RMB, which has fallen 2 percent against the U.S. dollar over the past month. RMB depreciation could set off a round of competitive devaluation in Asia, as Japan and other Asian countries try to keep their exports competitive. This would ultimately benefit the United States, as the strength of the dollar is closely tied to import prices and thus, overall price levels.

BROAD TRADE WEIGHTED U.S. DOLLAR AND IMPORT PRICES

Source: Bloomberg, Guggenheim Investments. Data as of 2/28/2014.

Economic Data Releases

U.S. Economic Activity Begins to Rebound, but Weak Spots Remain

- Retail sales were better than expected in February, rising 0.3 percent after a revised 0.6 percent drop in January. The rebound was spread across most categories, with strong gains in sporting goods and online retailers.

- The NAHB housing market index inched up to 47 in March after plunging in February. Expectations for future sales fell for a third straight month.

- Housing starts were mostly flat in February at 907,000, following an upward revision in January.

- Building permits were encouraging in February at 1.02 million, the highest since October. Multi-family permits jumped over 24 percent, while single-family permits declined slightly.

- U.S. industrial production had a large rebound in February, rising 0.6 percent. Manufacturing output rose by the most in six months as auto production surged.

- University of Michigan consumer confidence fell from to 81.6 to 79.9 in March, the lowest level since November. The decline was unexpected and led by more negative expectations.

- Initial jobless claims continued to fall for the week ended March 7th, reaching 315,000, the lowest amount since November.

- The consumer price index dropped from 1.6 percent year-over-year to 1.1 percent in February. Goods prices fell, while housing and medical costs continued to rise.

- The U.S. producer price index unexpectedly fell in February, decreasing to 0.9 percent year-over-year due to a large decrease in services costs.

Chinese Data Calls Growth Target into Question

- Germany’s ZEW survey of investor expectations dropped lower than expected in March, falling for a third consecutive month to 46, the lowest level in seven months.

- Chinese industrial production dropped from 9.7 percent year-over-year to 8.6 percent in February, the lowest since 2009. The weak number calls into question whether China will meet the government’s growth target of 7.5 percent.

- Retail sales in China fell sharply in February, to 11.8 percent from a year ago. The growth rate is the lowest in nine years.

- Japan’s exports were below expectations in February, rising 9.8 percent from a year earlier vs. 9.5 percent in January. Imports continued to outpace exports for the 20th consecutive month.

Copyright © Guggenheim Partners LLC