“Dear Mr. Smith ...”

by Jeffrey Saut, Chief Investment Strategist, Raymond James

February 18, 2014

Dear Mr. Smith:

Just one more short letter under the general subject of ‘The Major Problems of Investment Management.’ The investor’s first concern should always be the preservation of the capital value of his fund, for the climb back is almost always slower and more difficult of achievement than the road down. The climb back is ‘slower’ because it is the nature of longer-term trends to decline swiftly and to rise slowly. The 1929 to 1930 decline, for instance, in a comparatively short period of thirty three months, erased a gain in common stock prices which had been eight years in the making.

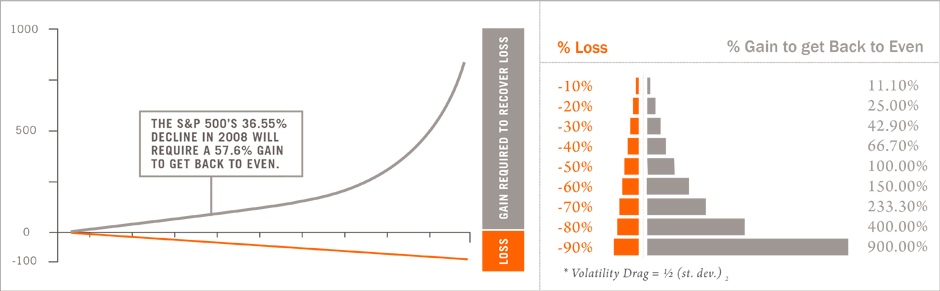

The climb is ‘more difficult of achievement’ because it actually is farther up than it is down. Assuming a fund of $100,000, one might be tempted to believe that a decline, let us say, of $20,000, is no greater than a rise from the remaining $80,000, back to $100,000. But such is not the case, unfortunately. A decline from $100,000 to $80,000 represents a loss of 20%. But a rise from $80,000 to $100,000 REQUIRES A GAIN OF 25 PER CENT! Carried a step farther, a decline of 33 1/3% necessitates an appreciation of 50% to recover the loss; and a decline of 50% requires a gain of hundred percent! It is for the above reasons that a high degree of caution is always advisable in the management of investment funds.

The above is the first half of a letter written in 1939 by H.G. Carpenter, a broker. Now I know you're going to say, “Hey, this guy was forever tainted by the 1929 crash ... that isn't likely to happen again!” Well, I was around in the 1973 to 1974 bear market. True, you couldn't call it a replication of the 1929 crash; but adjusted for inflation, it was as bad as the early 1930s. Now let's read the second half of H.G. Carpenter's letter:

The percentage of earnings-dependent securities should always be restricted to accord with the investor’s own particular circumstances and objectives. ‘The smaller the funds, the greater the caution’ SHOULD be the rule. Unfortunately, the opposite is usually the case. The wealthy man or woman, often with a sounder conception of the risk involved in investment, is frequently far more cautious than his less fortunate brother and sister, who are possessed of more limited means. One reason why relatively few investors are successful in increasing their capital is that they try too hard to increase it! It is difficult in periods when prices are rising to be satisfied with a relatively small percentage of earnings-dependent securities in one's investment account. The wise investor, however, may be consoled with the thought that sooner or later an unlooked-for, sizable and perhaps unpredictable decline will come, which will leave the over-eager investor considerably worse off than the man who has employed a greater degree of caution.

Investment Management should not be a scramble for profits. To be successful it must be, first of all, a sincere competent endeavor to preserve the principal value of the fund. Merely to preserve that value over a period of years is more than nine out of ten investors achieve. To succeed in protecting purchasing power – that is to secure an appreciation over a term of years equivalent to the increase in the cost of living – should be accepted as a most satisfactory performance. The results of an investment management program cannot be determined, or even estimated, over a short period of time. The best protection against serious loss is to have one's investment list reasonably well adapted, by years (not weeks or months), to the economic, political and social characteristics of the period. Competent, cautious investment managers who attempt merely to foresee MAJOR investment market trends will seem to be ‘wrong’ a good percentage of the time, but their NET RESULTS, over any reasonable period, will be better than the short-term trader’s.

Sincerely yours,

H.G. Carpenter

I revisit H.G. Carpenter’s 1939 letter this morning first because of the 1929 “bear market” (crash) analogue comparing the Dow’s current chart pattern with that of 1928 - 1929, which has gone viral and was discussed in Thursday’s Morning Tack. And second, because of the tremendous response I received to the letter “Rich Man Poor Man” written by Richard Russell 50 years ago, and the sage advice it imparts even today, just like Mr. Carpenter’s letter does. Speaking to the 1929 chart comparison, last week I wrote:

“Rather than going into all the fundamental reasons why this is not 1929, let me speak merely to the construction of said chart. First, you can ‘scale’ a chart to do just about anything you want it to do! In this case the scale makes the comparison to 1929 with the present stock market chart pattern appear eerie (see chart 1). However, if you ‘index’ (rebase) that same chart so that you are comparing apples to apples, the correlation to 1929 disappears (see chart 2).”

As for Carpenter’s 1939 letter, the best quote is, “The investor’s first concern should always be the preservation of the capital value for the climb back is almost always slower and more difficult of achievement than the road down.” So, how can you be a competent, cautious investor today? First, you must be aware that the D-J Industrial Average (INDU/16154.39) is up some 9500 points from its “nominal” price low of March 2009 and better by nearly 6000 points since its “valuation low” of October 2011. Moreover, since that October 2011 low there has not been a single 10% correction (see chart 3). Then perhaps you should reflect on Carpenter’s phrase “preserve principal value.” How do you do that? Will you heed the ultimate value investor’s advice: the key to investment success is the margin of safety, never by a security unless its price is substantially lower than the actual value of the company. That principle was preached by Benjamin Graham, Warren Buffet’s mentor. Graham said that on a daily basis stock market prices expressed hopes and fears; i.e., in the short run stock markets are voting machines; but in the long run they're weighing machines, and the gap between price and value will narrow over time.

Last week, however, the gap between price and value widened with the S&P 500 (SPX/1838.63) gaining 2.42% for the week and is now up 5.66% from its February 3rd low. That sharp “throwback rally” leaves the SPX at the top of its normalized trading range (see chart 4) after having probed oversold territory for the first time since June 2013. Of course the recent rally has left the equity markets overbought by all of the indicators I follow with the most overbought sectors being Utilities (1), Healthcare (2), Technology (3), and Materials (4). The only oversold sector, by my work, is Telecom. The sector analysis is interesting because the four sectors that have rallied the most since the February low have been: Materials (+7.13%); Consumer Discretionary (+6.7%); Technology (+6.36%); and Healthcare (+6.12%). Interesting because these were four, out of the five sectors, that declined the most since the January 15th high; the fifth, and the sector that declined the most into the February 3rd low, was Financials (-7.31.%). Meanwhile, 62.9% of reporting companies have beaten their 4Q13 earnings estimates, leaving aggregate profit growth in the 4Q13 at +9.3%. As for revenues, they have bettered revenue estimates by 64.1%. That “beat rate” suggests the bottom up, operating earnings estimate for the SPX is close to the mark at $107.75, leaving that index trading at a P/E multiple of ~17x earnings. If this year’s estimate is accurate ($120.80), with no P/E multiple expansion, a like multiple would give the SPX a year-end price target of 2053 ($120.80 x 17 = 2053.6), or roughly 200 points (+10.9%) higher than it currently trades. So, even though the SPX has traveled back into “no man’s land” between 1813 and 1851, and is overbought (read: extended on a short-term basis), all pullbacks should be viewed as buying opportunities because I think we are in a secular bull market that has years left to run.

The call for this week: Last week the New York Composite Advance/Decline Line rose to a new bull market high. That is not the kind of action one sees at market peaks. Indeed, the 1929, 1973, 1987, and 2000 stock market peaks were all preceded by long periods of deterioration in their respective Advance/Decline Lines. Also, all of those prior peaks were preceded by a parade of other “tops” in the New Highs/New Lows Index, the D-J Transportation Index, the D-J Utility Index, etc. Accordingly, this is NOT 1929! As for if the correction is complete, since the February low there has been a noticeable expansion in the Demand Indicator (read: buyers) with a concurrent contraction in the Supply Indicator (read: sellers), suggesting the 6.2% pullback was a sustainable low. In contrast are my internal energy indicators, which do not seem to know what to make of the recent straight up/straight down type of action. Manifestly, such action has typically been associated with trading “tops,” not trading bottoms. Therefore I remain cautious, yet still willing to buy select stocks. Two stocks that currently align with H.G Carpenter’s conservative metrics and are positively rated by our fundamental analysts are Swift Transportation (SWFT/$24.53/Strong Buy) and LKQ Corporation (LKQ/$28.84/Outperform).

Copyright © Raymond James