by Tom Brakke, Research Puzzle

So we started the year with a little bit of a kerfuffle. It was not a “wipeout” as one Bloomberg headline proclaimed. (This is a wipeout.) It was barely even something.

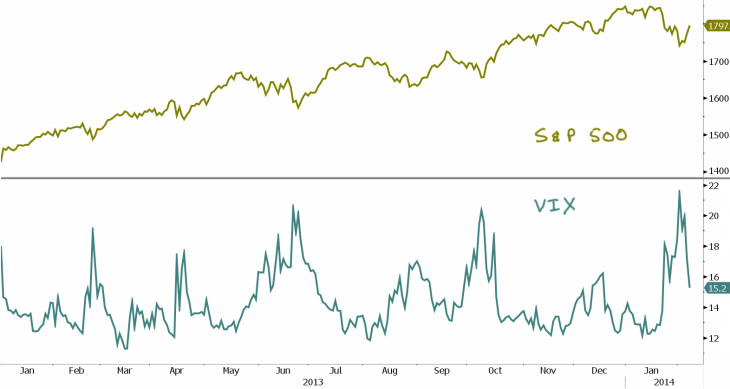

It did, however, move the VIX (the so-called “fear index”) to the top end of its range, from which it promptly retreated, sending stocks up on the week, which was quite an unlikely outcome after Monday’s pummeling.

Perhaps it was a bit too pat, with the VIX reversing in the same vicinity as it has for months. But it seems to work. And if it seems to work, you can bet that others are betting on it.

Many algorithms have the pattern as part of their DNA — and traders have it in their frames too. But let’s take a wider view:

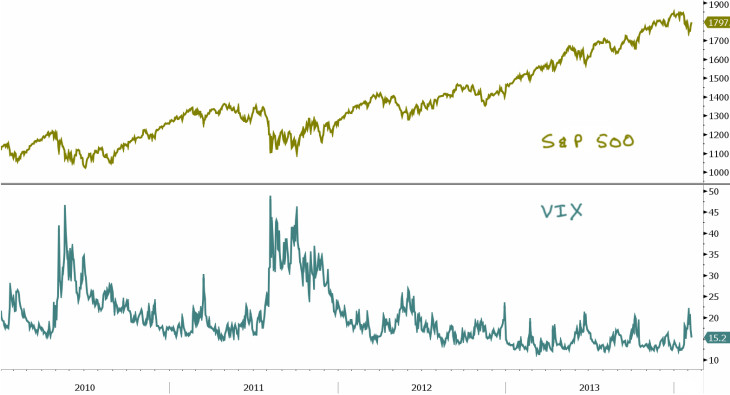

Now we see a new set of bands. What will it take for us to revisit those higher levels of fear? How will algorithms and frames adjust when we do?

I could have gone even wider, to include the readings around 80 during 2008-9, but you get the picture. We adapt to the ranges that we live for a time. It’s good to play “what if” every now and again, if only to remember other possibilities. (Chart: Bloomberg terminal.)

Copyright © Research Puzzle