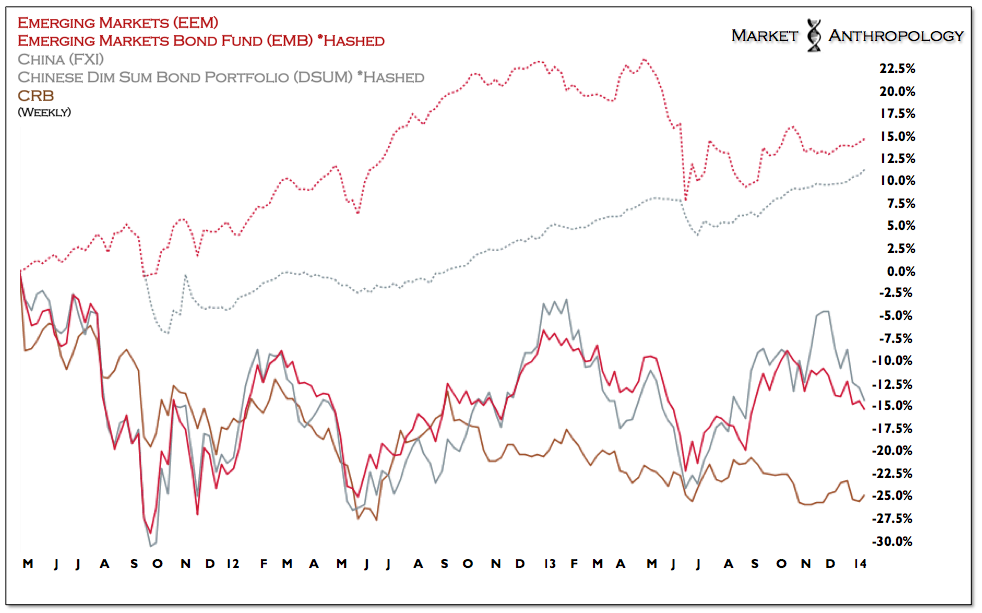

If one was to judge the actions of the markets over the past three years since the pivotal 2011-Q2 high in commodities - and those markets closely associated with; you would come to the conclusion that their respective bond markets, who's thesis timeframes reach a bit further than their more capricious equity leaning cousins, have maintained a stalwart confidence in its longer-term outlook and story.

It just might surprise some how much these debt instruments have consistently maintained a very wide envelope of outperformance (30-40%) over their respective equity markets. While we can appreciate a notable divergence as much as the next impressionable participant, in our eyes the relative strength and stability exemplified here is still broadly bullish over the long-term.