Continuing a Winning Formula for 2014

by Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

January 10, 2014

In any competition, sports or investment management, there are lessons to learn to improve and better results. That’s why football players and coaches sit side-by-side for hours poring over the team’s performance. What worked? What didn’t? Every play, despite whether the game was won or lost, is dissected.

We replay our “game film” of the funds on a daily basis, scrutinizing our stock selection process along with macro factors to analyze what contributed to or detracted from performance.

Here’s one of the many charts we review that compares the Holmes Macro Trends Fund (ACBGX) against its benchmark S&P 1500 Index. You can see the fund’s attractive risk and return profile over the past year, as it outperformed its benchmark while only adding a few basis points of risk. See the fund’s performance history.

click to enlarge

But, just as every great coach or experienced investment manager tries to answer, how is that performance repeated and is it possible to further boost absolute returns?

We believe there’s a way that increases the odds of winning. It’s by combining a bottom-up approach with a top-down strategy: Find great, fast-growing and shareholder-focused companies and focus on the best stocks in the sectors experiencing positive momentum. That’s the approach the Holmes Macro Trends Fund takes.

Bottom-Up: Finding “True Growth” Companies

Fast-growing and shareholder-focused companies are bred with distinct strands of DNA that drive their success. “True growth” businesses typically have revenues growing at more than 10 percent (or about five times faster than U.S. nominal GDP), generate a high 20 percent earnings growth rate, and have at least 20 percent return on equity.

Research shows that companies with these superior growth qualities have outperformed over time.

Top-Down: Emphasis on Strongest Sectors

However, depending on the market cycle, certain sectors can be in or out of favor. Sometimes cyclical stocks outperform; other times, defensive stocks rise in value.

Oftentimes, there are factors that drive or inhibit their performance. It could be government policies, such as Obamacare boosting many health care companies. Or it could be the falling price of a resource that narrows the profit margins of miners.

The result is wide price fluctuations among sectors from year-to-year. If you look at the annual returns over the past decade of each of the 10 sectors in the S&P 500 Index, in any given year the average difference between the best-performing sector and the worst-performing sector has been around 36 percent.

Identifying and overweighting the top-performing sectors increases the odds that the portfolio will outperform its benchmark. Alternatively, it is just as important to minimize investing in the bottom sectors.

Therefore, the goal is to tactically allocate capital to the most robust sectors with identifiable long-term trends and underweight sectors with the weakest trends.

Today, our proprietary model tells us the top sectors are consumer discretionary, health care and industrials and the data is backed by several familiar trends. For consumer discretionary, we see growth in retailers and consumer Internet companies. In health care, there are new products, favorable demographics and visible growth. The synchronized global economic recovery and energy infrastructure are driving industrials.

Over the past several months, we’ve published many times on the great U.S. energy boom, but we continue to believe many investors are underestimating the impact this spectacular renaissance will have on the global oil and gas landscape for years to come. In fact, take a look at the chart in the natural resources section below that highlights the fact that U.S. crude oil production is at a 25-year high!

Our new Special Energy Report expands on this topic as well as what you should look for when investing in the sector. Download your copy here.

Reasons for a Growth-Oriented Market in 2014

Since the Federal Reserve first announced Operation Twist in September 2011, the cheapest stocks gained the most, according to Credit Suisse. During a period of very low interest rates, declining volatility, and extremely low price-to-earnings, there was “strong outperformance of deep value stocks.”

In the face of higher interest rates, “investors can look to transition to a more growth-oriented market,” says CS. This environment gives us even more confidence in our belief that the Holmes Macro Trends Fund has a winning strategy for 2014. Take a closer look at ACBGX today.

While the performance of U.S. stocks demonstrates a stronger domestic economy, I’m eager to get a reading on the global economy and resources from leaders around the world when I travel to five countries across four continents in the next few months.

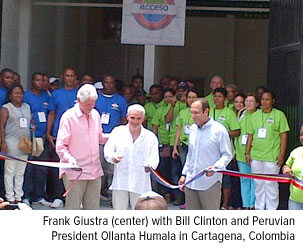

The Vancouver Resource Investment Conference will be my first stop. There I’ll be speaking on a panel alongside resources experts Frank Giustra and Ned Goodman. Frank Giustra is the founder of Lionsgate Entertainment, which is one of the largest independent film companies in the world. He also launched Wheaton River, which was acquired by Goldcorp and Silver Wheaton.

Ned Goodman, founder, president and CEO of Dundee Capital Markets in Toronto, is widely recognized as one of Canada’s most successful investment counselors. He sold DundeeWealth’s asset management unit to the Bank of Nova Scotia back in 2011 and in a Bloomberg News article, he is even “more bullish on gold now than I’ve ever been,” because he believes, “it’s only a matter of time before currencies lose value and inflation rises.”

These two men have been my mentors for years and I’m excited to be able to exchange ideas with them. For all investors, it’s valuable to stay curious and discover how they’ve succeeded in business and life.

After Vancouver, I’ll spend a few days in Los Angeles at a global leadership conference for CEOs, getting ideas and sharing experiences with business leaders.

In February, I’ll fly to Cape Town, South Africa to speak at the 2014 Mining Indaba. This conference brings together national mining ministers and government leaders from all over Africa, as well as hundreds of mining services executives interested in African mining. While on the continent, I plan to visit a few companies that the funds own, kicking the huge tires of mining trucks and getting my boots dirty out in the field.

Then I’ll be heading to Hong Kong for the Mines and Money conference where I’ll be a keynote speaker and I’ll wrap up my global travels with an “adventure investing” trip to Turkey where investors are invited to come along to explore this dynamic economy that offers great growth potential. If you’d like to learn more about this opportunity, feel free to email us at editor@usfunds.com.

So over the next several months, you can look forward to insights from this resourceful road warrior on the psychology and science of resources and world markets.