Inform Act

by Eric Sprott and Etienne Bordeleau, Sprott Asset Management

December 2013

We have long been advocates of fiscal responsibility, as evidenced by previous “Markets at a Glance” such as “The Detroit Template”, “Have we lost control yet?”, “Ignoring the Obvious” and “The Solution…is the Problem” series. The perpetual underlying issue is that governments promise too much, then borrow to try to keep up, but given the scale of the promises relative to their means, inevitably have to renege on those promises. This creates a situation where ordinary citizens are fooled into thinking that the government will provide for them ad infinitum [forever], and as a result do not save enough and consume too much.

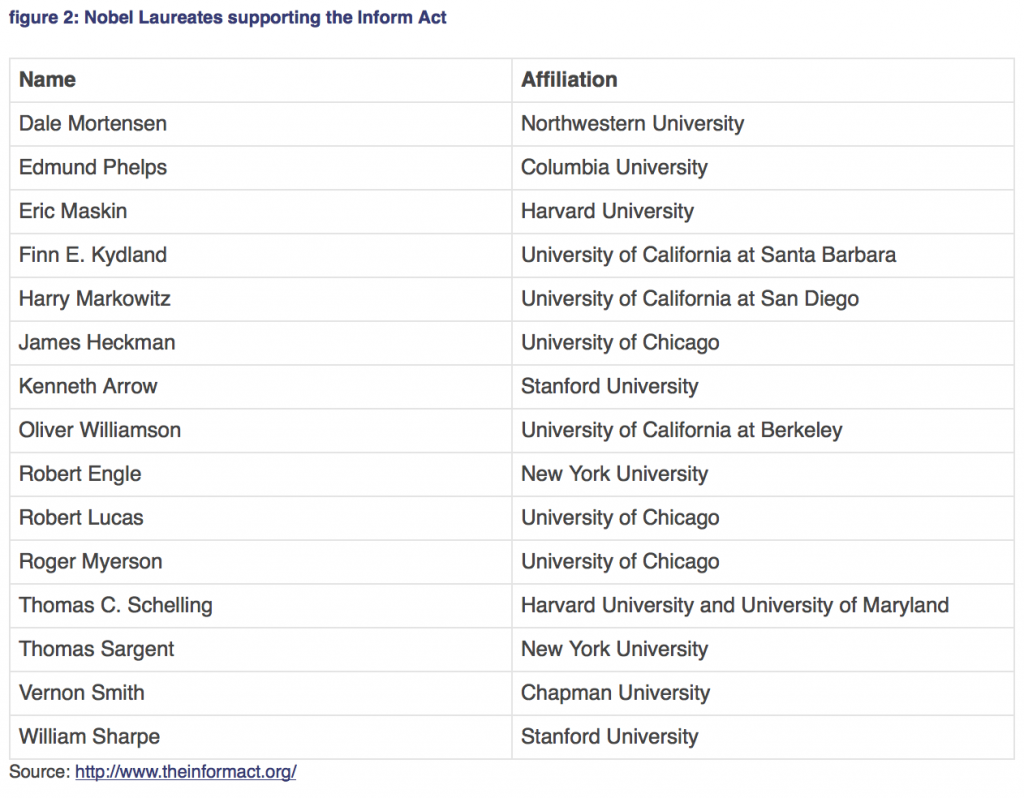

Thanks to Boston University’s Larry Kotlikoff, it now seems like the U.S. might be getting closer to acknowledging that it has a serious fiscal problem; or at least this is what one might infer from the strong support from Congressmen and Senators from both sides of the aisle, as well as from fifteen Nobel Laureates in Economics (see Figure 2 for a complete list) and thousands of business leaders and economists from all stripes, for a new bill called the Intergenerational Financial Obligations Reform Act or “Inform Act”.

We find it appalling that, while some of the world’s brightest economists consider this an issue of paramount importance, notwithstanding its introduction to the Senate and the House, the “Inform Act” completely flew under the radar of the mainstream media. Hopefully, if this becomes law, it will not be possible for people to keep their head in the sand on fiscal responsibility.

The “Inform Act” is a bi-partisan bill that was introduced in the Senate and that will be introduced shortly in the House of Representatives that would require the “Congressional Budget Office (CBO), the General Accountability Office (GAO), and the Office of Management and Budget (OMB) to do fiscal gap accounting and generational accounting on an annual basis and, upon request by Congress, to use these accounting methods to evaluate major proposed changes in fiscal legislation.”1 In other words, it would require the U.S. government to evaluate its budget deficit by estimating the net present value of all its future payments and receipts, instead of arbitrarily deciding which items make it to the budget or not, as is currently the case. Thus, fiscal gap accounting would better represent the present and future liabilities of the government to its citizens and, as the thinking goes, allow for better decision making.

While not perfect, fiscal gap accounting is a huge improvement to the current system of “cash deficit accounting”, which ignores most future obligations the government has and henceforth prevents any meaningful discussion of issues before they occur (i.e. prevents the government from being proactive). For example, while politicians in Washington regularly argue about extending the debt limit, they fail to recognize that most of the Federal government’s obligations are not in the form of public debt, but more akin to pension and benefit commitments.

Another benefit of this method is that it takes into account not just current U.S. citizens but their offspring as well. While it is not politically very rewarding (for obvious reasons), taking into account future generations of taxpayers makes perfect sense when designing multigenerational policies such as social security, medical care and environmental policy. A failure to consider the future impact of policies is most likely what put the U.S. public finances in such a bad shape in the first place.

The direness of the situation is quite obvious in Figure 1 below, which shows the difference between expected spending and revenues, as calculated by the Congressional Budget Office (CBO), and which is also the basis for the calculation of the fiscal gap. While Washington congratulates itself for its slight forecasted decline over the next few years, it should reaccelerate quite meaningfully afterwards if no change is made to future commitments. This is why the Inform Act is so important; it forces politicians to focus on the longer term, not the next few years until re-election.

Figure 1: Total Federal Government Deficit (Spending minus revenues) – Constant 2013 Billion

Source: CBO Long-Term Budget Outlook & Sprott Calculations

But, as discussed in our previous article “The Detroit Template”2, chronic underfunding of future liabilities is a broad problem which affects corporations, municipalities and states as well. Unfortunately, those issues are ignored by the mainstream media until, as in the case of Detroit, it is already too late. As a result, most citizens remain uninformed about the unsustainability of the income or benefits they receive and cannot plan accordingly.

The case of Detroit should not be brushed off as an anomaly but rather should be viewed as a template for what will happen if the government continues to overpromise relative to its means. As calculated by Professor Kotlikoff, the current fiscal gap is about $222 trillion and closing it would require either a permanent tax increase of 64% or a 40% reduction in all expenditures3. Clearly, this cannot end well.

To conclude, we support the “Inform Act” as a first step in the right direction. Once passed, the mainstream media will not be able to ignore those important issues. However, it is only that, a first step, as simply acknowledging the extent of fiscal unsustainability does nothing to remedy the problem. The real pain will come when pensioners see their benefits cut or, alternatively, when the ever shrinking workforce has to contribute more in the form of higher taxes. As evidenced by the case of Detroit, the longer we wait, the worse it gets. So far, the mainstream media seems reluctant, as per normal, to inform us about the “Inform Act”.

For more information on the “Inform Act”, please visit: http://www.theinformact.org/

Source: http://www.theinformact.org/

1 Source: http://www.theinformact.org/

2 http://www.sprott.com/markets-at-a-glance/the-detroit-template/

3 See Professor Kotlikoff’s website at: http://www.kotlikoff.net/