by Lance Roberts of STA Wealth Management,

This past Friday the Bureau of Labor Statistics released the November jobs report which sent the mainstream analysts and economists into an ecstatic state as the numbers were substantially stronger than estimates. However, in reality, the employment report continues to show that employment is being driven almost entirely by population growth rather than real economic strength. I have discussed this previously stating:

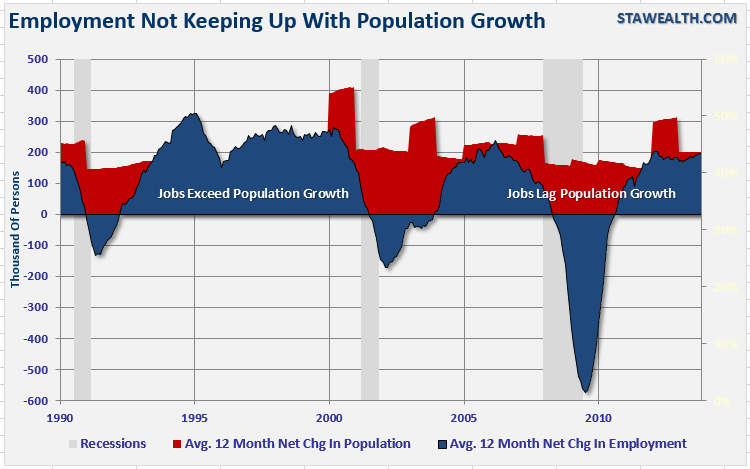

"However, the reality is that, despite better than expected numbers in the report, employment gains to this point have been nothing more than a function of population growth. The chart below shows the 12 month average of the net change in both employment and population. As you can see, there have been very few months since the turn of the century where employment has exceeded population growth."

"This explains two things:

1) Why the employment to population ratio has plunged along with the labor force participation rate; and

2) That employment gains, so far, have been a function of businesses hiring only to meet the demand increases caused by an increase in population rather than from a growing economy.

The latter point is very important and relates directly to an issue that has been lurking silently in the background called 'labor hoarding.'"

Louis Woodhill reiterated this point recently in his column entitled "Curb Your Enthusiasm" stating:

"All that happened in November was that the labor market (as reported by the BLS Household Survey) made up most, but not all, of the ground that it lost in October. During the past two months, America moved 3,000 full-time-equivalent (FTE)* jobs farther away from full employment.

During those 61 days, our working age population increased by 399,000, but 265,000 Americans fled the labor force, continuing the unprecedented exodus from the world of work overseen by President Obama. While the "headline" (U-3) unemployment rate fell by 0.2 percentage points to 7.0%, the "true" unemployment rate, adjusted to the labor force participation rate of December 2008, rose from 10.9% to 11.0%.

President Obama's so-called 'economic recovery' is now 53 months old. During that time, America has moved 1.3 million FTE jobs farther away from full employment, the adjusted unemployment rate has increased from 9.7% to 11.0%, and real household income has fallen by 4.4%."

The problem, as Woodhill so correctly states, is that the "real" economy is not growing and is only, at best, treading water. While mainstream economists and analysts continue to jump on a monthly data point as a sure sign of economic recovery - the reality is quite different.

The solution to solving this problem is something that I have addressed many times in the past when analyzing the monthly National Federation of Independent Small Business Survey which continues to point to government regulations, taxes and poor sales as the top three concerns of small businesses around the country.

"The uncertainty surrounding the economy that currently exists limits the ability for businesses to plan. While the country can continue to run without a budget, as long as there is 'ink for the printing press,' small businesses do not have that luxury. For businesses, their outlook is driven by those silly little economic factors like supply, demand and profits. While it may currently seem to be a statement by businesses on the results of the election - it is more of an outlook on the future of the economy and how their personal livelihoods are going to be affected."

Importantly, Woodhill addresses this issue with his formula for a return to a strong economic America.

"So, what can the government do to encourage capital investment? Well, it can stop discouraging it. Here is the formula for prosperity:

Prosperity = Rule of Law + Economic Freedom + Stable Money + Low Tax Rates + Sane Regulations + Free Trade."

This formula, while not a revolutionary solution to solving the economic mystery, is simply a point of logic. However, it clearly represents the detachment of the current Administration which has little real world experience, along with the bulk of the ivory tower academics advising them, from the issues impeding the economic recovery. However, as I stated previously:

"Business owners are some of the best allocators of capital and resources. They spend money to increase production, expand facilities and hire employees to meet increasing demand. They operate within the confines of the real economic environment, rather than theory, and the results of the recent election point to a tougher economic climate ahead. Until there is improvement in the uncertainty that surrounds the economy, there is likely to be little headway that will be made in the months to come. While further stimulative programs may boost asset markets in the near term it is unlikely that the engines of economic growth will kick in until debt levels are reduced, tax policies are clarified and the regulatory environment is cleared."

Woodhill's formula reiterates what small business owners across this country have been clamoring for over the past five years. Business owners inherently want to grow, employ more people and achieve greater profitability which in turn creates economic growth. It is simply in their best interest to do so. However, the current Administration continues to intervene with more regulations, threats of higher taxes, increased costs and uncertainty about the economic future. Subsequently, business owners continue to fight back against the current fiscal and monetary policy makeup by reducing costs, increasing productivity and suppressing employment and wage growth. As Niall Ferguson noted:

"23 years ago the world seemed much simpler. Francis Fukuyama wrote that the West had won the war of Capitalism. However, 23 years later things have changed. By 2016, the economy of China will exceed that of the U.S. This is not what Fukuyama expected in 1989. It should not be possible that a communistic society could poised to overtake a capitalistic economy. It is quite an amazing turn of events.

The explosion of public debt in Western economies is a symptom of the more profound economic malaise. The argument between stimulus and austerity is very futile. The reality is that by 2050 interest payments on government debt will be above 100% of federal revenues; according to the Alternative Fiscal Scenario (AFS) of the CBO. The AFS are the more realistic of the two assumptions that the CBO produces.

There were '6 Killer Apps' that defined the U.S. during its great economic growth cycle - Competition, Scientific Revolution, Modern Medicine, Consumer Society, Work Ethic and Property Rights

Those issues allowed for growth, innovation and rising economic prosperity during the 20th century. Today, while the rest of the world has slowly been adopting these 'killer apps' the U.S. is slowly losing them.

A critical point is the Rule of Law. In order to have a strong, and prosperous, economic environment the participants in the system must be able to rely on a stable and fair legal system. In the U.S., the rule of law has been under continuous attack over the last 30 years. The decline in the rule of law has been evident in the shift of prosperity in the U.S. economy. If you look at 15 different measures of the rule of law, as they exist in countries all around the world today, unfortunately the U.S. does not rank at the top it any category. However, Hong Kong beats the US on every single rule of law and ranks in the top levels on every single measure.

The problem is that the U.S. has a 'rule of lawyers'. As an example 'Dodd-Frank' is the largest single employment scheme for lawyers in the history of the U.S. However, when it comes to the private sector, which has to live with the implications of the bill, it massively increases costs, reduces competition and impacts future prosperity."

The long term implications of these secular shifts are crucially important to the future of everything from investing, to living and the future of our economy. It is not too late to change our future, but it eventually will be if we do not begin to make changes soon.

Copyright © STA Wealth Management