by Charts, Etc.

Since the start of this month, my near-term outlook for the stock market has been cautious due to several non-confirmations of the S&P 500's new high. More on that tomorrow.

Today I thought I'd say something about the longer-term picture. Needless to say, the market has been in a secular uptrend since the lows of March 2009. All along the way there have been more than a few corrections, but the general uptrend for the market has remained intact in that time.

When considering the longer-term outlook, based on weekly and monthly charts as opposed to daily, a key question at turning points involves the likely severity of the turn. Is this trend change just a short- to intermediate-term counter-move within a larger secular trend, or is this current counter-trend move the start of a change in the overall secular trend? Perhaps the most important question facing investors.

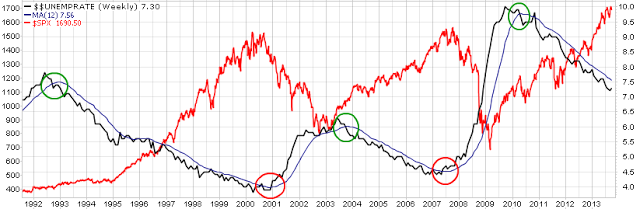

I monitor many longer-term, slower-moving charts that collectively help to get at the answer to this crucial question. One of them involves the unemployment rate vs. the stock market (S&P 500).

Source: Stockcharts.com

The chart above plots the S&P 500 (red line) with the unemployment rate (black line) and the 12-week or 3-month moving average (MA) of the unemployment rate (blue line). Not surprisingly, the S&P 500 and unemployment rate consistently exhibit inverse correlation. In my experience, when the unemployment rate breaks trend in meaningful fashion, i.e. when it clearly crosses through its 3-month MA, it tends to confirm a secular trend change in the stock market (S&P 500). Note the breaks in trend for the unemployment rate in 2000-2001 and 2007 with the rate rising above the 3-month MA (red circles), confirming the high probability of an ensuing bear market for equities. And vice versa when the unemployment rate has broken trend downward as in the early '90s, 2003 and early 2010 (green circles), offering further evidence or recognition of a favorable environment for stocks and that a secular bull market should take hold.

The unemployment rate currently resides at 7.3% and the 3-month MA is 7.56%. At this point for the S&P 500 to gravitate into secular dangerous territory, the unemployment rate would need to increase to 7.7% or higher (again, want meaningful clearance through the MA, not by a hair). Until that happens, it remains clear sailing for equities in the long-term.

Copyright © Charts, Etc.