The Technical Take (November 18, 2013)

Prepared by Ryan Lewenza, and Team, TD Wealth

Here is the latest edition of TD Wealth's, 'The Technical Take'. Highlights of today’s report include:

· Following the significant technical breakout of the S&P/TSX Composite Index (S&P/TSX), the S&P/TSX has been backing and filling as it works off its overbought technical condition. With the S&P/TSX currently at 13,334, we see the potential for a modest pullback to between 13,166 and 13,020, where 13,166 equates to a 38.2% retracement of its recent move and 13,020 being the 50-day MA. Overall, we expect a near-term consolidation/pullback, but given the technical breakout above key resistance of 12,900, we believe the outlook for the S&P/TSX has greatly improved.

· The Reuters/Jefferies CRB Index remains in a clear long-term downtrend and is trading below its declining 50- and 200-day MAs. The index recently sold-off and broke below short-term support of 275.54. We believe a central factor in the weakness was due to a recent surge in the U.S. Dollar Index, which rallied last week on the strong October U.S. nonfarm payrolls number. The CRB Index is now oversold and as such, could lead to a short-term oversold bounce in commodity prices. However, with the trend clearly down, we expect the CRB Index to retest the June 2012 lows of 267.

· Despite increased chatter from some pundits that the market looks “toppy”, the short-, intermediate- and long-term trends for the S&P 500 Index (S&P 500) are upward and very bullish, in our opinion.

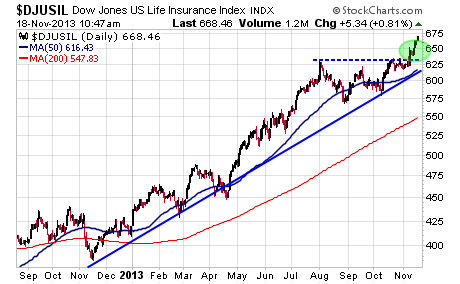

· We are bullish on the U.S. financials sector, particularly on the U.S. life insurance industry. Given the strong price and relative trends we would recommend increasing exposure to U.S. lifeco’s on weakness.

· In this week’s report, we highlight Valeant Pharmaceuticals International Inc. (VRX-T), Kohls Corp (KSS-N) and Regions Financial Corp. (RF-N) as attractive technical buy candidates.

Chart of the Week – U.S. Lifeco’s Breakout to New Highs

You may read or download the entire report in the slidedeck below: