Energy and Natural Resources Market Radar (November 18, 2013)

Strengths

- U.S. oil production surged last week to its highest level since January 1989, almost 25 years ago. Compared to a year ago, U.S. oil production during the first week of November increased by almost 19 percent. In the last two years, U.S. oil production has risen by 2 million barrels and to put this in perspective, Brazil produced 2.1 million barrels per day in June and Nigeria/Venezuela both produced 2.3 million barrels per day in June.

- World Steel Dynamics released its latest SteelBenchmarker assessment, which highlights a steady upward trend in steel prices. At $734 per tonne, the U.S. domestic hot-rolled-coil assessment is now almost $100 per ton above the lows seen in May 2013, and is at the highest level since May 2012.

Weaknesses

- West Texas Intermediate crude posted its sixth weekly decline, the longest in 15 years, as rising supplies in the U.S. countered speculation the Federal Reserve will maintain economic stimulus.

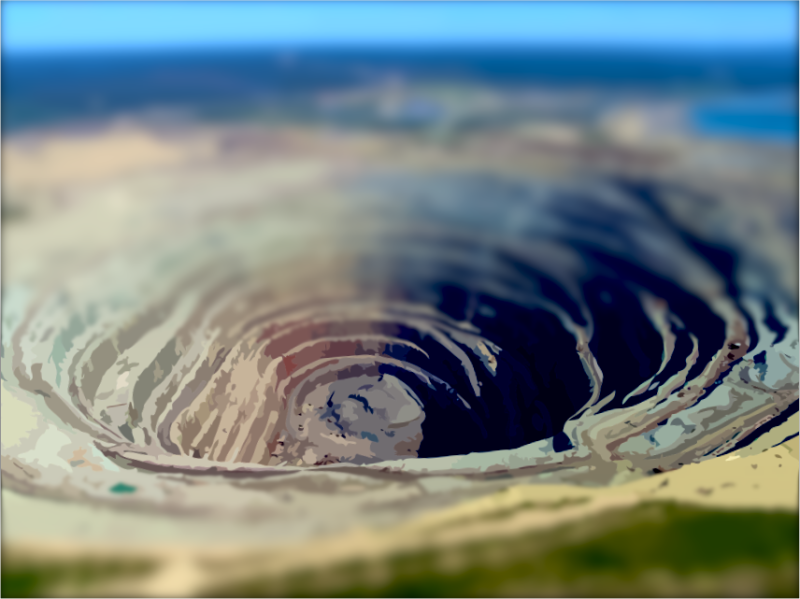

- China's overseas mining investments have slowed after experiencing a rapid period of growth earlier this year, with investors from non-mining sectors being advised to be cautious when investing in the area, reports Shanghai's Oriental Morning Post. At the 2013 China Mining Congress and Exhibition held in Tianjin on November 2, China Mining Association (CMA) vice chairman Wang Jiahua revealed that approximately 80 percent of China's overseas mining investments have failed. Investors in China are also slowing down the pace of their investments in the overseas mining sector amid changing preferences for a particular kind of mine and location, the paper said. "China's mining investment in Australia during the first half of the year dropped to its lowest point in history," said Wang in the days leading up to the expo, adding that the two sides need to find out the reasons and seek effective ways to revive the China-Australia cooperation in the mining sector.

Opportunities

- Refiner Johnson Matthey in its Platinum 2013 Interim Review indicated that the platinum market was expected to show a shortfall of 605,000 ounces this year from 340,000 ounces last year. The company expects palladium will be in a deficit of 740,000 ounces this year.

- The International Energy Agency (IEA) is forecasting higher oil prices for 2014 despite increased non-OPEC production as the IEA cited continued supply losses from the Middle East as well as Northern Africa as catalysts for increased prices.

- Eastman Chemical is converting some of its power generation units from coal to natural gas beginning in 2016. This fuel switching will reduce demand by 850,000 tons per year of Central Appalachian coal.

- China, the world’s top producer of wheat, is likely to import 8 million tonnes of the grain in 2013/14, the highest in nearly two decades, after the domestic harvest was damaged by bad weather, said an official think tank.

Threats

- A 90-car train carrying North Dakota crude derailed and exploded in a rural area of western Alabama early on Friday, leaving 11 cars burning and potentially bolstering the push for tougher regulation of a boom in moving oil by rail. Twenty of the train’s cars derailed and a number were still on fire on Friday afternoon, local officials said. Those cars, which threw flames 100 meters into the night sky, are being left to burn out, which could take up to 24 hours, according to the train owner, Genesee & Wyoming. No injuries were reported. A local official said the crude oil had originated in the booming Bakken shale patch.

- Platts reported that U.S. manufacturers are requesting that the Department of Energy postpone new liquid natural gas (LNG) exports rulings until the agency develops legal standards on the application approval process

- Eight power plants fired by coal in Alabama and Kentucky will be closed, although the exact timetable for the closings was not provided by the Tennessee Valley Authority (TVA). The TVA said it would invest about $1 billion to construct a new natural gas-fired plant in Kentucky to partly replace lost electric power output. The action, announced on Thursday, added to the number of closings previously announced and which are part of a comprehensive understanding between the TVA and the Environmental Protection Agency (EPA) to cut 18 of 59 coal plants. The new announcement increases the number of closures to 26 plants.