Take a look at the following photos:

I don’t think I really have to tell you that there is no Mickey Mouse in the craters on Mercury, nor is that the face of Jesus in a perogie. There are no faces in clouds, smoke, sand, or wood grain, so why do we see them so easily? The answer is that our brains have evolved sophisticated and efficient structures to help us recognize faces. Nearly everyone, except for a few people with a rare brain disorder, can recognize faces quickly and effortlessly. However, presented with random, unstructured patterns, our brains will often force them into the molds and templates we already have. Though these examples work with faces, our brains work very hard to find patterns of other types in other places. (Not just visually, either. Have you heard voices in the static from white noise (like static from a radio tuned between stations) or in a seashell?) To put it plainly—we are basically wired to find patterns, even where none exist.

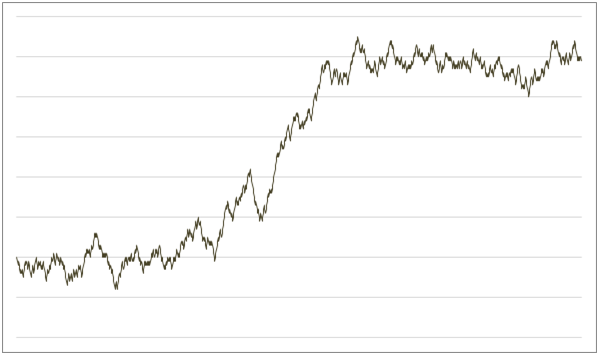

The problem comes when this cognitive machinery misfires and finds patterns where there are none, and this happens frequently in financial markets. We see formations and shapes on price charts, and perceive patterns in purely random data. Most people know this is true, but I think they may underestimate the significance or severity of this tendency. Our brains are so “hungry” for creating patterns out of disorder that we default to seeing patterns where none exist. On purely random charts, you will see trends, levels, and all the standard patterns of technical analysis. Could this explain many of the things we also see on actual price charts? Perhaps many of the waves, cycles, retracement ratios, levels, and intentions we perceive are simply the results of our brains searching for patterns and order in a sea of randomness.

I’m not saying that there are no patterns in markets, or that humans can’t train themselves to find those patterns; they do and they can. What I am saying is that we, even highly skilled, trained, and experienced traders, can easily be misled. Our intuitions and impressions must be backed up by research and solid understanding of how markets move. To do this, we need to be able to look at the market in ways that separate the true from the false, the significant from the random, and the meaningful from the torrent of meaningless noise and conflicting influences in the market. This is why we need to be literate in the language and skills of data analysis—because our minds may mislead us into seeing significance where none exists. Intuition and trading skills do grow with time and proper, structured exposure to the marketplace, but a new trader is unlikely to survive long enough to benefit from the those skills unless she takes steps to protect herself from her own mind’s desire to create patterns from noise.