David Merkel is good about responding to questions from readers. In September, he wrote a posting about two closed-end municipal bond funds that he was asked about: Eaton Vance Muni II Bond Fund (EIV) and BlackRock Municipal Target Term Trust (BTT).

Closed-end funds can be great when the price of the underlying portfolio is going up and the ratio of the market price to the NAV is going up — a double boost, if you will. But when they are both going in the wrong direction, it’s not so fun.

Add some leverage to the mix and it gets really interesting. The current leverage for these two funds is around 40%, according to Bloomberg.

Merkel pointed out the liquidity, credit, guarantor, leverage, and duration risks with the vehicles and, for extra emphasis, added, “These are not trivial risks.”

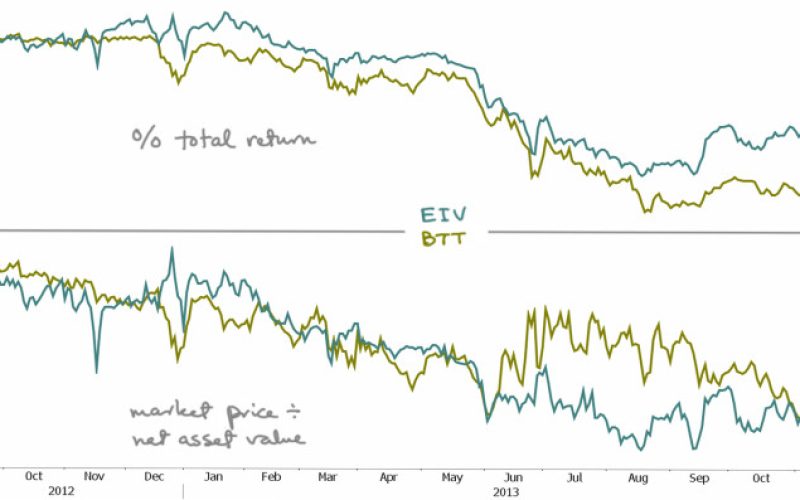

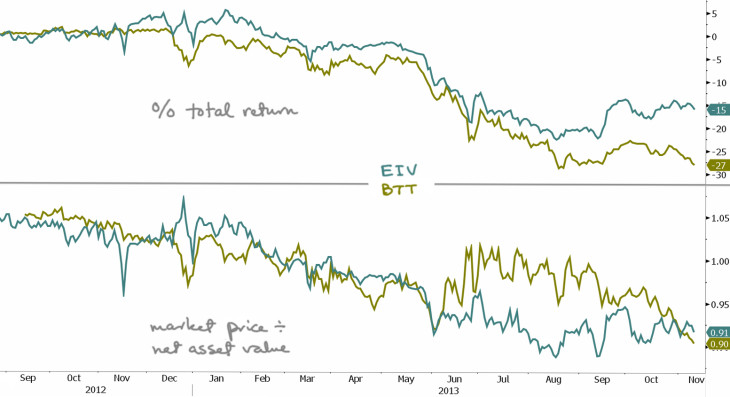

The chart above starts with the inception of BTT (EIV has been around since 2002). The top panel shows the lousy total returns on the funds since then, part of which is explained by the bottom panel, which tracks them going from modest premiums to meaningful discounts in relation to the underlying assets in the portfolios.

Big yields (especially tax-free ones) are so alluring and so dangerous. Most investors can’t parse the risks and, frankly, many of those purporting to provide guidance aren’t going to bother to educate them. (Chart: Bloomberg terminal.)