by Scott Krisiloff, CFA, Avondale Asset Management

I’ve heard this data mentioned by others in the past few days, but haven’t actually seen it anywhere, so I decided to put it together for myself. Based on the anecdotes from others, I knew that the last two months of the year are generally good when the market has been up by 10% or more in the first 10 months. What I didn’t realize was that good may be an understatement. The last two months of the year are generally great when the market has been up a lot already in the first ten months.

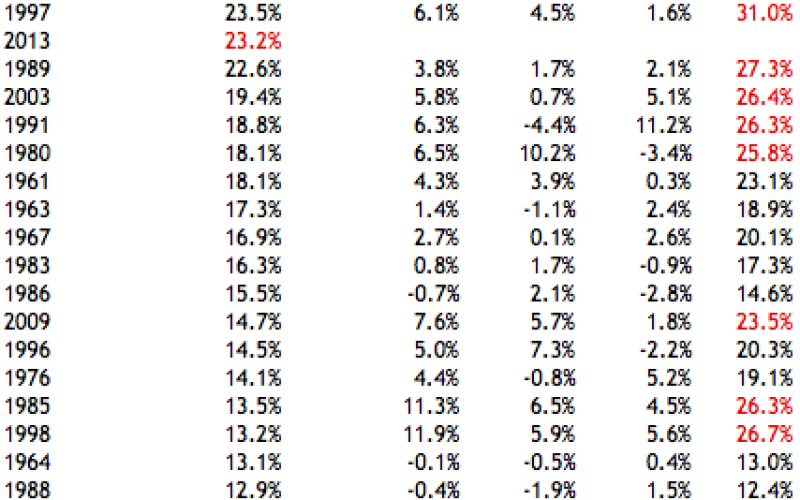

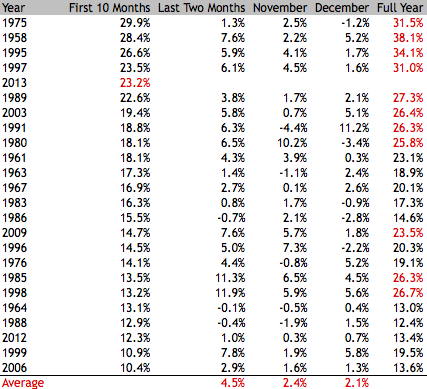

Below is a list of all the times that the S&P 500 has risen by more than 10% in the first 10 months of the year. On average the index has risen by another 4.5% over the final two months. Of the 24 times that this has happened, the index has only fallen in three years, and in those years it has never fallen by more than 70 bps. On the other hand there have also been some monster finishes within the data. In 1985 and 1998 the index was up by more than 11% in the final two months.

Even more amazing, if the year ended right now, 2013 would be only the 11th best year in S&P 500 history. However it’s already in 5th place for best first 10 months. Considering how well the index did in other years with this pace, we can’t rule out the possibility of a 30% increase in 2013!

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.