Among the better ways to get a quick 30,000 ft macro snapshot of the institutional footprint in the market - is the monthly Bank of America Merrill Lynch global fund manager survey. Commonly known as BAML, it's comprised of over 235 panelists who oversee a combined ~$700bn AUM. For market participants, it gives a sentiment and positioning impression that can help investors and money managers qualify the quantitative context of the broader market.

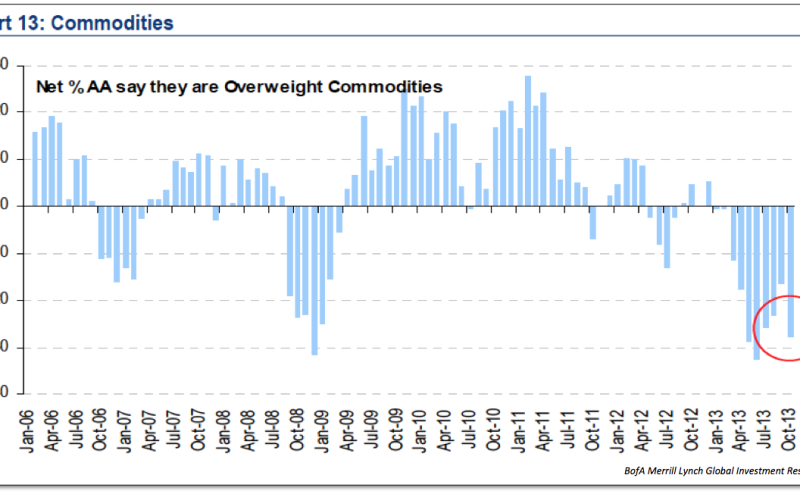

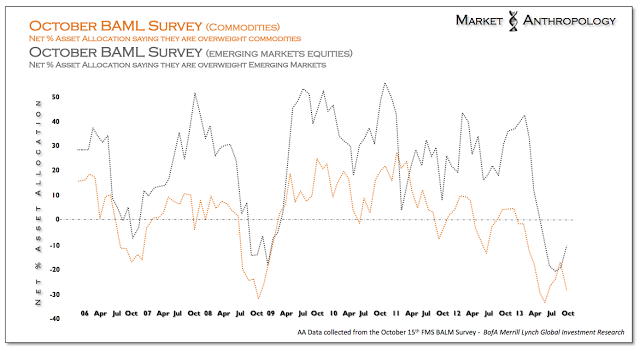

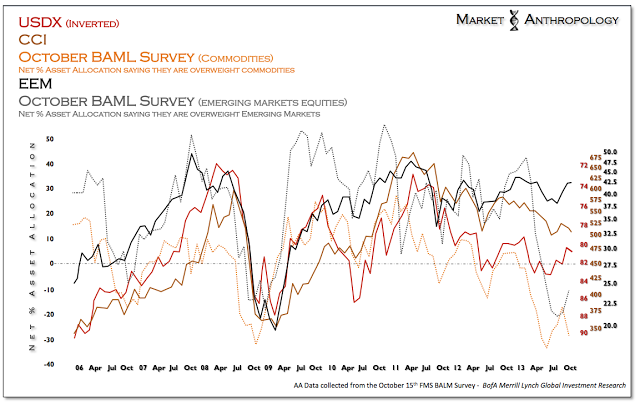

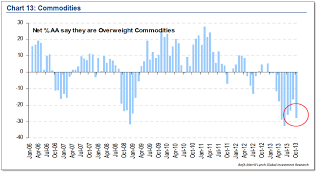

The quick takeaway from the October report (survey period 10/4-10/10) is that fund managers were near record lows for asset allocations in both the commodity sector and in emerging market equities. While not necessarily a contrarian read (they positioned accordingly for the commodity downturn since 2011), one could make the case that the driving force of selling pressure is in the rear view mirror and the only place to go from here is for smart money to increase net exposure as they did at the end of 2006 and 2008.

Taken in context with each respective sectors still sturdy long-term technical underpinnings and the US dollar's slow motion roll into the lower register of its 40 year trading range - the $64,000 question of when global demand will start showing up again appears to be right around the corner in 2014.

Click to enlarge images

Based on how the commodity markets have traded since the last BAML report, we would be willing to guess that panelists asset allocations for November will be at an all-time low for the sector.