by Lance Roberts of STA Wealth Management,

It has been a very interesting week as the Government shutdown/debt ceiling debate debacle moves into the background. The focus has now turned back towards the fundamentals of the market, economic environment and the ongoing Federal Reserve interventions. What is becoming increasingly evident is that market participants are once again potentially throwing "caution to the wind" betting on a belief that the Fed's ongoing Q.E. programs will continue to trump valuations and economics. After all, that has seemingly been the case up to this point. The problem is that no one really knows how this will turn out. However, as I discussed earlier this week, it is likely that we are close to finding out answer.

In the meantime, I will leave you with my weekly list of "things to ponder this weekend."

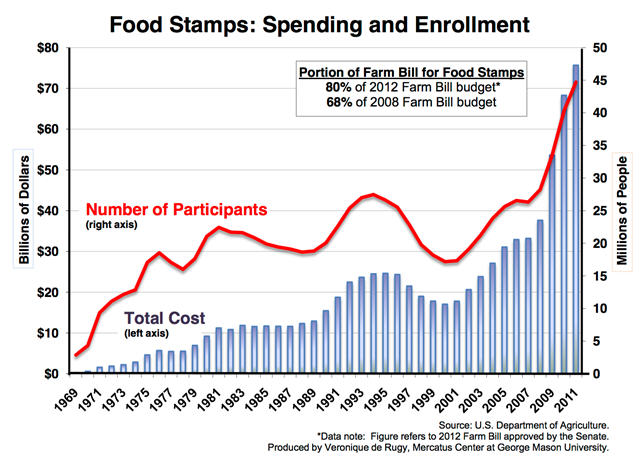

1) What An 81% Increase In Food Stamp Usage Means For The U.S. Economy

My good friend Doug Short, who is a daily must read, recently posted an article by Mohammad Zulfiqar on the impact of welfare, specifically food stamps, on the U.S. economy. He states:

"Each day, there's growing evidence that suggests the American economy isn't experiencing any economic growth. Unequal job creation is just one of the main topics discussed in the mainstream, but sadly, there are many other facts and figures that show a gruesome image of the U.S. economy.

Consider this: since the financial crisis struck in the U.S. economy, the number of people using food stamps has been increasing. In 2007, there were 26.3 million Americans who were using food stamps; fast-forward to July 2013, and that number had enlarged to 47.6 million, an increase of almost 81% at the rate of roughly 13.5% per year."

"Considering all this, one must wonder what's going to happen to the key stock indices that continue to rise in value. Will the companies that sell consumer goods be able to earn revenue at the same pace as they did before?

The conditions in the U.S. economy are suggesting that consumers are struggling. One thing investors have to keep in mind is that when consumers are facing hardships, they tend to pull back on the spending that they don't necessarily have to incur. For example, a person who has lost a job and has very little savings will shy away from buying a new gadget, car, and/or house."

Read Entire Post

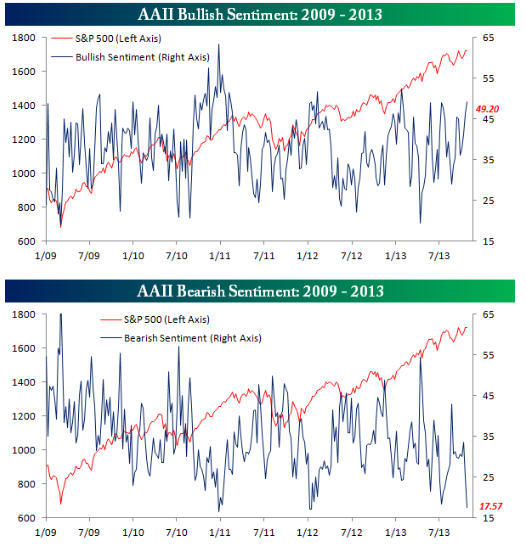

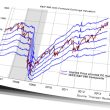

2) Where Did All The Bears Go?

In asking the question "Is A Major Correction Coming?" one my concerns have been the extreme complacency, or lack of fear of a market correction, by investors in the markets. The good folks at Bespoke Investment Group recently pointed to this same issue.

"This morning's release of the individual investor sentiment figures from the American Association of Individual Investors (AAII) showed that bullish sentiment increased from 46.28% up to 49.2%. This is the highest weekly reading since January and represents the fourth straight week of increases. At the same time that bullish sentiment is rising, bearish sentiment plummeted to 17.6%, which is the lowest reading since January 2012! With all the hype in the media regarding the shutdown in October, it is pretty amazing to see that individual investors were unfazed by all the hysteria."

As Bob Farrell's Rule #9 States: "When all experts and forecasts agree; something else is bound to happen"

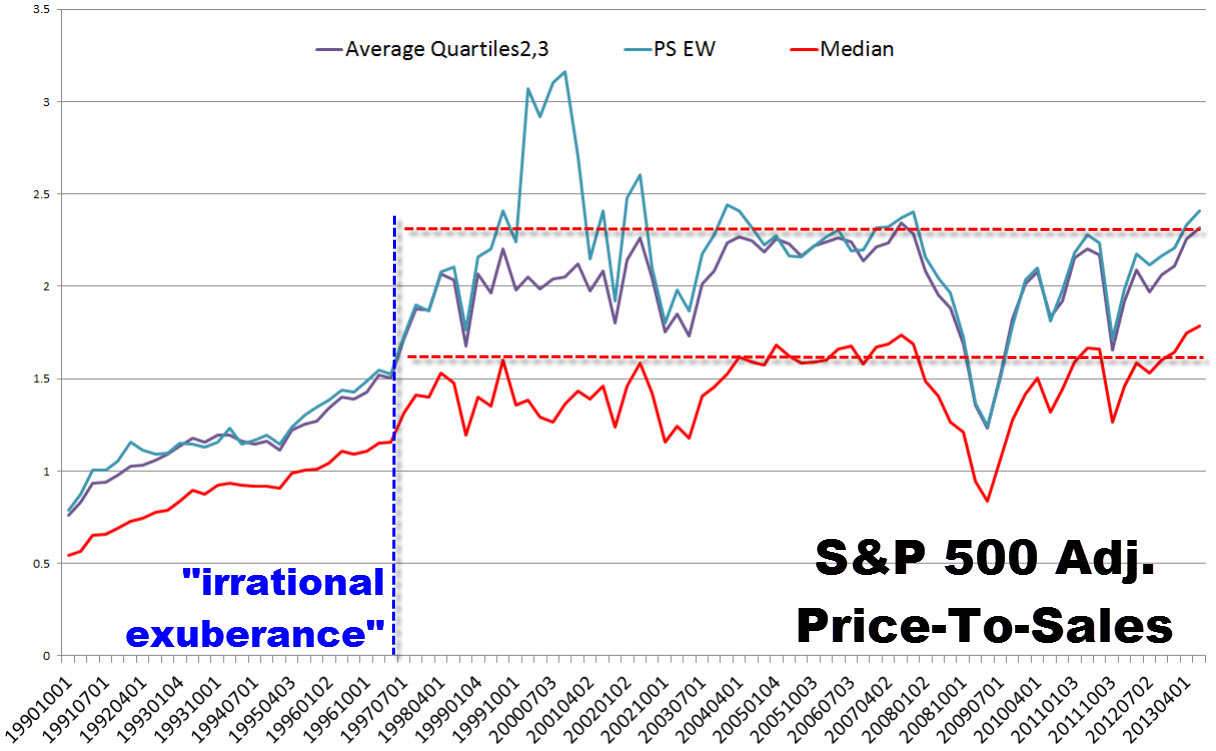

3) Markets More Exuberant Than In 1996

Tyler Durden recently posted an excellent piece of commentary by Damien Cleusix about valuations now versus when Greenspan uttered his infamous phrase of "irrational exuberance."

"'It is really going to end badly,' is the ominous warning that Damien Cleusix has issued to his clients as he believes we are now reaching the top of the secular bull market. Crucially, he sees US stock markets as 'grossly over-valued' but that it is hidden from most people's perceptions because (just as in 2000 and 2007) there are marginal sectors that make the 'aggregate' seem reasonable (not to mention the dreams of forward earnings.)

His novel approach of a point-in-time Price-to-Sales comp shows the median valuation its highest in 23 years.. and Alan Greenspan's infamous 'exuberance' valuations in 1996 were 40% below current levels of elation. Today, the significant difference with 2000 and 2007 is that government and central banks have already spent a lot of firing power to 'make believe' that everything is fine again. He concludes; 'there will be no place to hide when the tide turns.'"

4) The High Cost Of A Cheap Dollar

For the last several months in the weekly missive, I have been discussing that the strength of the dollar earlier this year was fleeting. Furthermore, the real danger to the U.S. economy has been an ongoing "weak dollar" policy.

This past week R. David Ranson of the NCPA (National Center For Policy Analysis) wrote an excellent brief on the impact of a weak dollar on the U.S. economy.

"Milton Friedman demolished this argument more than 30 years ago:

'Another fallacy seldom contradicted is that exports are good, imports bad. The truth is very different... Exports are the price we pay to get imports. As Adam Smith saw so clearly, the citizens of a nation benefit from getting as large a volume of imports as possible in return for its exports, or equivalently, from exporting as little as possible to pay for its imports.'

Those who advocate 'export-led growth' often assert that cheap currency policies will increase exports and national output (gross domestic product) over time. However, there is a 40-year history to the contrary since President Richard Nixon ended fixed exchange rates between the dollar and other countries and allowed the dollar to 'float.'

The question at issue is not whether currency depreciation benefits the United States relative to other economies but whether it benefits the U.S. economy in absolute terms."

"Exports are part of the cost side of the economy; imports are the benefit the country gains in return for that cost. Economic policies that promote exports at the expense of imports, such as currency depreciation, reduce the growth of GDP over time. That shift substantially lessens long-term gains in the real value of exports produced by a cheap dollar. Public policy can manipulate the currency and the economy to increase the amount that exports contribute to national output (GDP). But a country that succeeds in this effort has impoverished itself. The phrase 'beggar my neighbor' is an understatement."

What I'm Thinking About

Next week is once again loaded with economic, and earnings, reports as we head into the end of the year. I believe that the impact of the Affordable Care Act on the U.S. economy is being greatly underestimated as the associated costs are hitting consumers where it hurts the most.

I received an email this week from a listener, Tony in Florida, who stated:

"I have a pre-condition which means that Blue Cross would not give me anything more than their 'Go Blue Plan.' The new plan I am buying from them is plan #1419, which has an annual deductible of $6250. This is the high end 'Silver Plan.'

I have to pay for all doctors visits in full, and only basic wellness is free, including a colonoscopy. I even have to pay for my own blood work.

While I am okay with paying the high deductible; what I have a problem with is that the monthly premium is $613.06. I'm 57, do not smoke and live in South Florida and only have a finite amount of income to live on."

If his story is accurate, the economic drag that will come from the ACA in 2014, and beyond, could be larger than currently expected. What concerns me is that few individuals have given thought about what the financial/economic costs will be by trying to give everyone else something for free.