by David Templeton, Horan Capital Advisors

“We are nicely above the old high, and we’re just getting to a point where the economy is getting back on line. There’s another leg to come in this bull market.”

- John Stoltzfus, Chief Market Strategist at Oppenheimer & Co.

The Quarter

The third quarter of 2013 delivered another period of positive equity returns. The S&P 500 Index was up 5.2% for the quarter. In fact, most asset classes were positive excluding U.S. Real Es tate Investment Trusts and long-term bonds. Eight of the ten economic sectors in the S&P 500 posted positive returns while top-performing sectors included materials, industrials and consumer discretionary. Our second quarter decision to decrease consumer staple exposure and add to more cyclically sensitive stocks such as Fluor (FLR) and Schlumberger (SLB) proved rewarding with each returning more than 20% during the quarter.

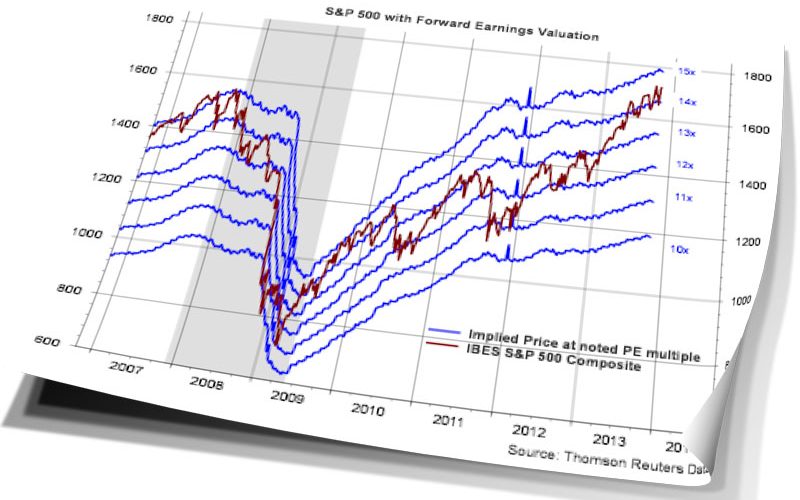

As noted in the accompanying chart at right , i nternational developed equities and emerging equities had a strong quarter reflecting improved economic reports in both developed and developing market economies. We have increase d exposure to these markets and plan to add to these investments over a reasonable timeframe . European multinationals generally sell at discounted valuations and could be revalued higher as positive sentiment builds . Additional ly, f rom a defensive perspective, companies with discount ed valuations tend to hold up better in corrective markets. T he element of higher dividend yield s in European equities adds some downside protection as well. Recover y For some, the financial crisis of 2008 - 2009 might seem long ago. On March 6, 2009, the S&P 500 Index closed at 683. Four and a half years later the S&P has increased a total of 1071 points or a total of 156%. In Jul y of 2009, we wrote an article which appeared on our blog, regard ing markets climbing the proverbial “wall of worry.” This recent market advance may be one of the longer “wall of worry” climbs in history. A quote by one equity trader may sum up investor sentiment when he noted, “The market has only three things it can d o: annoy buyers, torment sellers, or frustrate everyone. Currently, the market is testing sellers and those who have not bought in yet.”

You may read or download this entire letter to investors in the slidedeck below: