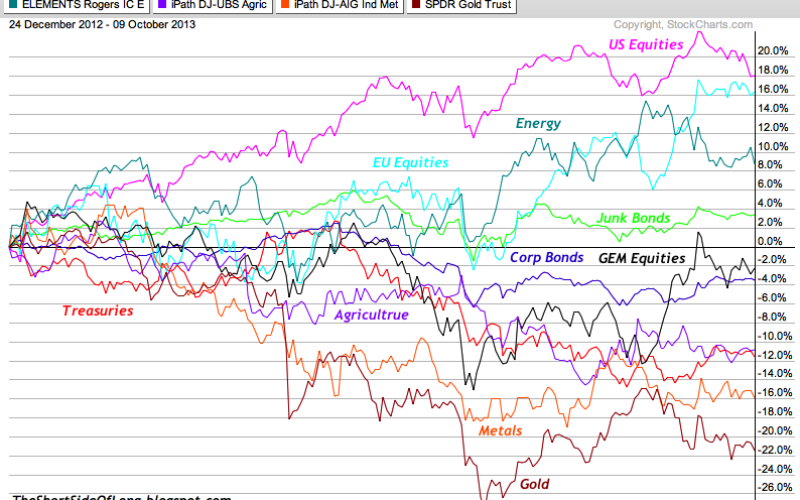

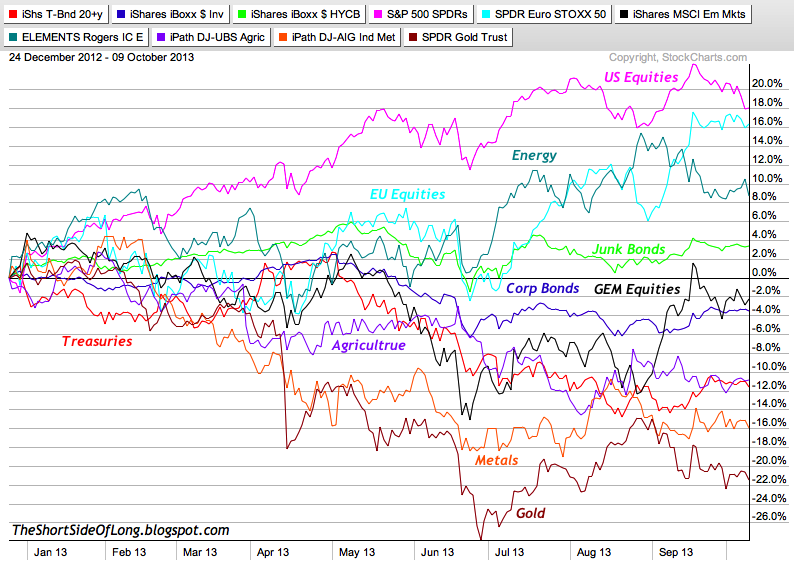

Chart 1: Year To Date Performance Of Various Asset Classes

Let us look at the performance of various asset classes from the year to date perspective.

Let us look at equities first. US equities have outperformed GEM equities by a wide margin. S&P 500 was up almost 20% recently while GEMs are about 3% down for the year. Eurozone equities have done quite well too, up about 18% year to date. Within the bond sector, Treasuries have grossly under-performed, down about 12% year to date. Corporate bonds have fared better, remaining down by about 4% while Junk Bonds have outperformed by posting a positive return YTD.

Moving along towards commodities, and we can see that precious metals disappointed this year. Gold (and Silver not shown here) are under-performing all other assets and at one point almost 30% down YTD. Base metals have not faired much better, down 16% while Agriculture has also disappointed with a negative return of 12% this calendar year. Energy is the only commodity sector to give positive returns, with a gain of 9% this year.

A simple summary shows that developed market equities have done tremendously well this year, while metals have grossly under-performed all other asset classes.