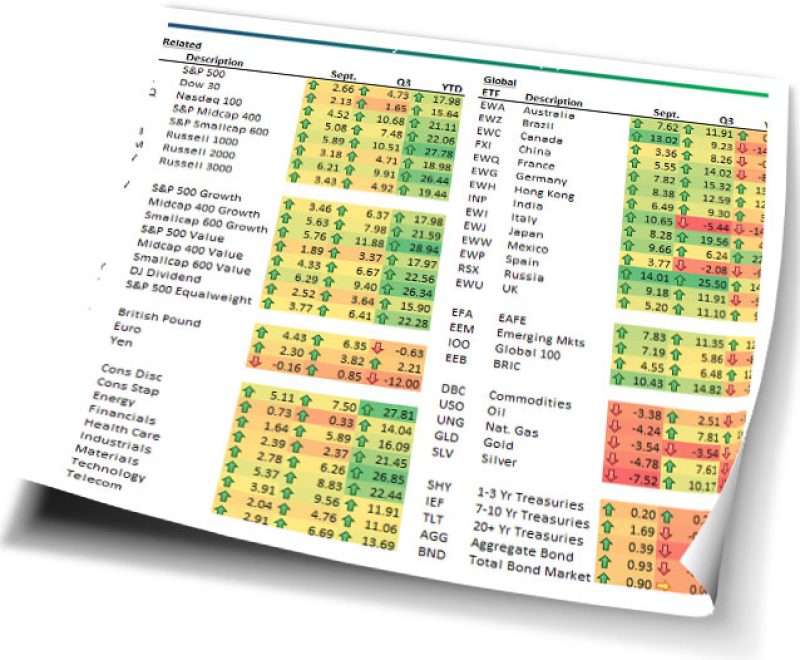

September and the third quarter have now come and gone, and below is our key ETF matrix highlighting the performance of various asset classes during the month and quarter (and YTD). While September ended on a bad note, US equities posted nice gains during the month. Midcaps (IJH) and smallcaps (IJR and IWM) did especially well, more than doubling the performance of the largecap S&P 500 (SPY) and Dow Jones Industrial Average (DIA). For the quarter, the Nasdaq 100 (QQQ) and S&P Smallcap 600 (IJR) were up more than 10%, while the Dow ETF (DIA) was up just 1.65%.

Looking at the ten S&P 500 sectors, Consumer Discretionary (XLY) and Industrials (XLI) were up the most in September with gains of more than 5%. Consumer Staples (XLP) and Utilities (XLU) were up the least with gains of less than 1%.

While September was a good month for US stocks, it was even better international markets. Countries like Brazil (EWZ), India (INP) and Spain (EWP) were up more than 10%, and the BRIC emerging market ETF (EEB) was up 10.43%.

The commodities asset class was the one area that didn't have a good September. As shown, the energy and metals commodity ETFs were all down more than 3%. Fixed income ETF saw a rebound in September, although they were still mostly negative for the third quarter.

Looking at year-to-date performance, US equities are still leading the way with double-digit percentage gains across the board. Through three quarters, the S&P Smallcap 600 Growth ETF (IJT) has been the best performing ETF in our matrix with a gain of 28.94%.

Copyright © Bespoke Investment Group