by Douglas J. Peebles, AllianceBernstein

The US Federal Reserve surprised the market on September 18 when it announced that it wouldn’t “taper” its monthly US$85 billion asset purchase program until the economy strengthens. Many investors saw this as a reprieve. We see it as a chance to position bond portfolios for rising rates.

As we recently noted, the Fed’s credibility has been called into question after it delayed one of the most widely anticipated (and hinted at) moves in its history. In our view, indications of faster economic growth and a falling unemployment rate helped make the case for tapering. In the run-up to the decision, yields on 10-year Treasury bonds leapt by roughly 1%, while equity markets remained near all-time highs and the US dollar stayed relatively stable.

With the market responding appropriately to the Fed’s comments, a move to taper would have been a non-event. Instead, the Fed confused the market with its choice to do nothing and stumbled on its communication efforts. By postponing the decision, policymakers have risked creating more hurdles for the US economy down the road. Each monthly purchase will make it more challenging to unwind the program smoothly, and it will likely take nine to 12 months to end it completely.

We view the Fed’s nonaction as a pause and a second chance for investors to revisit their fixed-income portfolios. Tapering should start early next year, and we project official short-term rates to begin a gradual increase in 2015, moving toward more normal levels over several years. While this will likely dampen bond returns, we don’t believe that it will be a calamity for bondholders—and there are plenty of options available to further buffer this risk.

As we’ve mentioned before, there are a number of ideas to consider when getting ready for the Federal Open Market Committee’s eventual change in policy.

What Investors Can Do

Diversification is the foundation for many portfolios. We believe that investors should diversify their US country risk by looking outside of the US for bond investments. Adding other country and regional bond investments to a single-country portfolio has historically enhanced risk-adjusted returns and expanded opportunities while also helping diversify portfolios. But beware of currency fluctuations—they can create unintended volatility. In our view, investors should adopt a currency-hedged approach to dampen volatility.

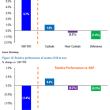

Treasury Inflation-Protected Securities (TIPS) have been popular among inflation-conscious investors. However, TIPS performance over the past three months has been disappointing for reasons investors might not suspect. The Barclays TIPS Index has 50% more duration (or interest-rate sensitivity) than the Barclays US Aggregate Index. This explains the strong performance for TIPS in recent years and highlights the unexpected risk of its higher duration when rates do rise. That’s why we believe that investors are better off with inflation-protection strategies with lower duration.

Another approach is to consider credit exposure. While higher-quality investment-grade corporate bonds have been pretty sensitive to interest rates, lower-quality bonds such as high yield tend to be influenced much more by corporate fundamentals. Credit-sensitive investments can complement other sectors as rates rise, and they typically offer more income along the way. Some high-yield bond strategies focus on securities with a lower duration, which can further limit interest-rate sensitivity.

Credit exposure may also help in the municipal world, along with the favorable tax treatment that munis offer. Recent fund outflows, combined with headlines surrounding fiscal challenges in Detroit and Puerto Rico, have caused rates on muni bonds to spike. This has created a strong relative-value opportunity. In our view, intermediate-term munis offer the best balance of risk and return for investors seeking stability. For investors with high-income needs, adding exposure to BBB rated munis might be an attractive option.

Then there’s the benchmark issue. Broad market fixed-income benchmarks have become riskier—with more interest-rate risk than they’ve had in decades. With rates headed up, that’s not a good thing. They’re also comprised of countries and companies that issue a lot of debt—not necessarily consistent with the objectives of a fixed-income investor. It’s worth considering an absolute-return strategy that has the flexibility to take advantage of opportunities without being tethered to a specific benchmark.

So even though the Fed has adopted a wait-and-see approach to the taper, we believe that investors should be focusing on how they can adapt their bond portfolios now.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Douglas J. Peebles is Chief Investment Officer and Head of Fixed Income at AllianceBernstein.

Copyright © AllianceBernstein