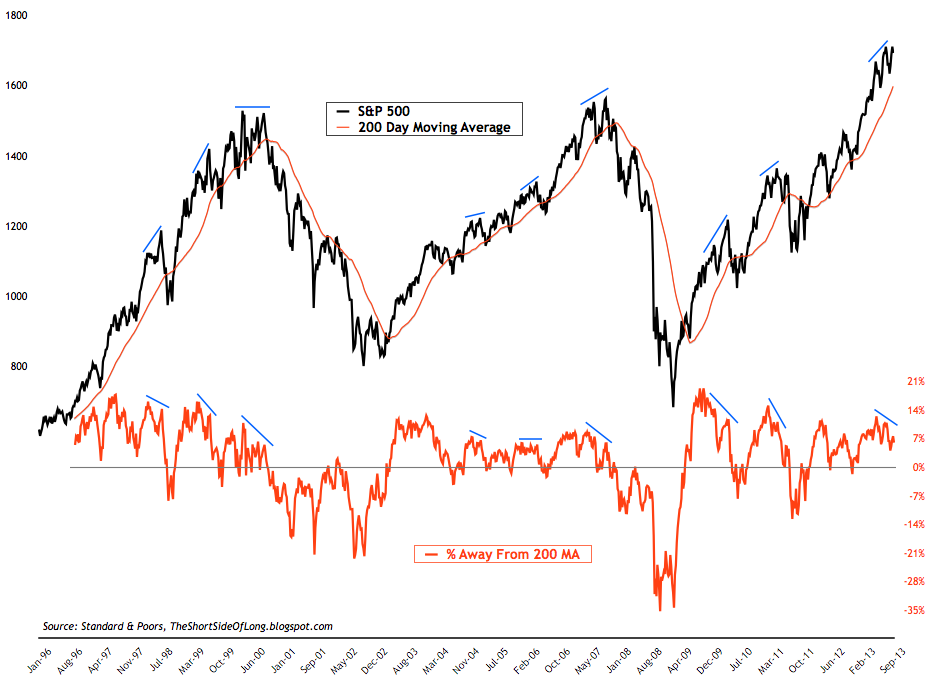

Stock Rally Losing Momentum

Weather the bulls will admit it or not, the stock market rally from November 2012 lows has lost momentum. Since May of this year, majority of the stocks have essentially gone nowhere. The chart above shows that the 200 day moving average is playing catch up while the price of the S&P 500 has barley made any headway.

Chart 1: Since May stocks have gone sideways while 200 MA catches up

Source: Short Side of Long

In plain English: the rally has lost momentum and is giving us a bearish technical divergence. Over the last decade or more, previous instances where we saw similar bearish divergences usually resulted in the index correction. These sell offs were anything from minor pull backs to major tops, therefore it remains to be seen if the current divergence will signal a sell off and by how much.

Copyright © Short Side of Long