by David Templeton, Horan Capital Advisors

One factor S&P Dow Jones indices uses in their stock classifications is an Earnings and Dividend Quality Ranking measurement. The basis for this measurement is to provide investors with a ranking that S&P evaluates based on a company's stability of earnings and dividend over time. The highest ranking is A and the lowest is D (a company in reorganization).

With this as background S&P has constructed indices based on these rankings. The S&P 500 High Quality Rankings Index consists of stocks with a ranking of A and better. The S&P 500 Low Quality Rankings Index consists of stocks with a ranking of B or lower. The high quality index has a larger weighting in sectors like consumer staples that tend to hold up better in a more defensive or "risk off" market. As the below table shows, this year, the low quality index has outperformed the high quality index by a wide margin.

From The Blog of HORAN Capital Advisors

Source: S&P Dow Jones Indices

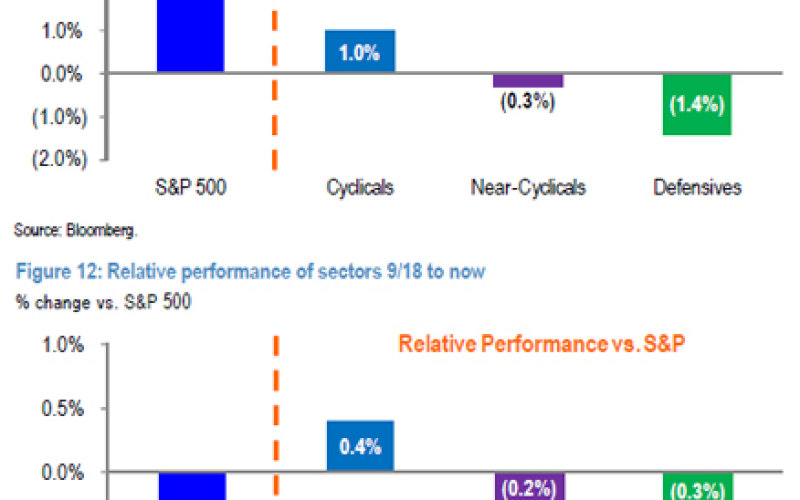

This pattern of the "risk on" and more cyclical stocks outperforming has continued in the the second half of September, in spite of a down equity market.

From The Blog of HORAN Capital Advisors

Source: 361 Capital