Originally posted at Monty Pelerin's World blog,

The Fed’s decision not to taper surprised the financial world. Markets drove higher as a result.

This writer believed some token amount of tapering would have been announced. Recent declines in Federal deficits afforded the Fed discretionary room. For the first time in several years it was possible to taper without infringing on the government’s ability to pay its bills.

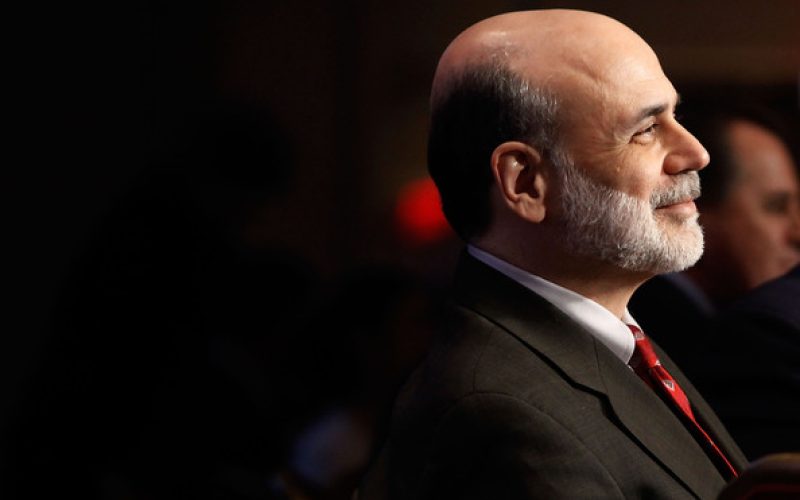

Perhaps Bernanke wanted to leave his post without markets crashing on his watch. Perhaps the economy is worse than the Administration wants to let on (and it certainly is). The Fed may have felt it necessary to come out of the closet regarding this latter charade, trying to prevent another economic downturn. Likely both were considerations, although Bernanke wanting to get out of Dodge before the fecal matter hits the big air-moving contraption was likely more important.

The Aleph Blog provides a series of interesting charts tracking Fed member expectations over time. The charts show consistently declining optimism regarding recovery. As stated:

After almost two years of giving guidance, they are no closer to tightening than when they started. Tightening is 27 months away, if their estimates are right, same as they thought in January 2012.

Tightening seemed further away when more aggressive QE was introduced, but that quickly abated, like a drug addict adjusting to higher doses.

How much are markets overvalued? There is really no way of knowing. Participants will eventually face up to the fact that Fed levitation cannot go on forever. Then a flight to the sidelines will commence with values overreacting on the downside. All market adjustments overshoot, especially those on the downside.

An interesting aspect of yesterday’s decision is the potential risk of a currency war. All developed economies are weak and looking for improvement. Currency depreciation alters the terms of trade among nations and can provide short-term advantages. That happened yesterday. As a result of the Fed’s announced continuation of liquidity injections, the dollar weakened against competing currencies. Trade terms shifted to the advantage of the US at the expense of other nations. A “beggar thy neighbor” card was played by the US. Who, when and how many may follow in an attempt to offset this US move will be known over the next several months. Risk of a currency war raises the risk of world-wide inflation.

Pressures on the Fed to fund continuing government deficits eased recently as a result of deficits shrinking. For the first time in almost two years, the Fed had room to move. They chose not to.

If Bernanke’s legacy was the motivation for yesterday’s decision, it will likely fail. His legacy will not be good. It will be revised downward, just as Greenspan’s was. Both are apt to go lower when the extent of the Fed involvement in the economic crisis is fully understood. Regardless, Bernanke did not want to go out as the Herbert Hoover of the Fed, although history may ultimately judge him and his predecessor in such fashion.

The Fed chose the inflationary policies of the last several years. Moving further down this path makes it more difficult to reverse such policies. Like heroin, the habit becomes harder to break the further into the habit one gets. Politically the pressures to continue mount as the costs of abandoning them increase.

There is no Paul Volcker on the horizon. Nor is there a Ronald Reagan. Both these gentlemen were required to stop the economic debacle of the 1970s. Neither would have succeeded without the other. The likelihood of seeing two men duplicate their feat seems quite unlikely at this juncture. For that reason, I believe that politics eventually leads to high inflation, perhaps hyperinflation.

Just as the economy no longer responds to Fed stimulus, financial markets will eventually reach this point. Whether that occurs sooner or later is anyone’s guess, but the fraud of overvalued financial assets becomes more apparent with each injection of liquidity.

Market participants should be aware of the game that is being played.