by Eddy Elfenbein, Crossing Wall Street

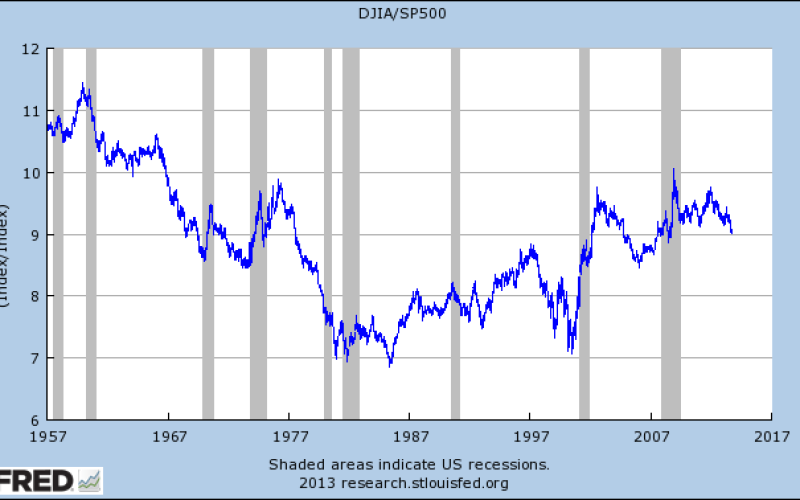

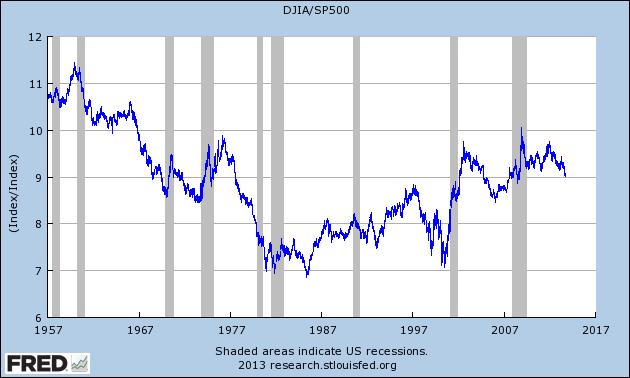

Here’s a look at the Dow Jones divided by the S&P 500 over the last 56 years.

Despite all the problems with price-weighting 30 stocks, the daily changes of the Dow and S&P 500 have shown a 98.28% correlation over the last decade.

Looking at the multi-decade trend, we’re bound to see larger deviations. The ratio peaked at over 11.4 in late 1959 and gradually dropped to less than 6.9 by May 1986.

During the financial crisis, it broke 10.0 for the first time since the 1960s, though it’s skating close to 9.0 these days.

I can’t see any particular trend, though, in the past 15 years; the ratio appears to have a defensive bias (it goes up when people get scared).

Copyright © Eddy Elfenbein