by Scott Minerd, Chief Investment Officer, Guggenheim Partners LLC

September 05 2013

Despite disappointing economic data, there continues to be widespread expectations of a period of stronger economic growth just ahead. This growth mirage draws thirsty investors and increases the likelihood that interest rates will continue rising over the near-term.

Global CIO Commentary by Scott MinerdThroughout this year, the consensus view has been that current economic weakness is justified and we are just one or two quarters away from faster growth. Now, in the third quarter we are hearing the same arguments, although growth targets are starting to dip. I call this the growth mirage. In the heat of the desert, the eye perceives water on the horizon, but the closer one tries to get, the farther away it moves – until the traveler realizes that he has been chasing an illusion caused by shimmering layers of hot and cool air.

The effects of higher mortgage rates continue to flow through to weakness in the U.S. housing sector and although some pundits point to resilience in manufacturing and consumer confidence as positive economic signs, my view is that a meaningful downshift in data could yet occur. Retail sales and chain-store sales disappointed during the critical back-to-school shopping season. And although we have had four fairly strong months of job creation, most of the new jobs have been part-time, explaining why aggregate earnings are flat and why spending has not increased with personal income gains.

Over the coming month, uncertainty and market volatility will likely rise as the U.S. Federal Reserve makes its decision on tapering its asset purchases, Congress begins its fractious budget and debt-ceiling debates, Middle East geopolitical risks increase, and German elections take place (on September 22).

The good news for the U.S. economy is that while economic activity is not robust, the current modest pace of growth is unlikely to be derailed. As one of my favorite economists, Ed Hyman, said, there is not a lot of speed in the economy, but at least there’s a lot of torque. All of this means an increased risk that interest rates will move higher as investors digest new economic data.

Chart of the Week

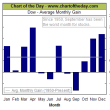

Part-Time Jobs Driving Employment Growth

Growth in part-time jobs has been the main contributor in overall employment increases since the start of 2013. Over the past seven months, the average monthly growth in full-time jobs has been 32,000, while the average number of new part-time jobs was 104,000. After falling from the recession peak of 20 percent, the share of total jobs which are part-time has recently rebounded to 19.6 percent. The increase in part-time jobs may be partially attributable to the upcoming change in healthcare laws, requiring employers to provide health insurance to full-time employees but not for part-time workers. If the trend continues, the increasing share of part-time workers may add downward pressure to aggregate labor earnings and reduce consumption growth.

CHANGE IN HOUSEHOLD EMPLOYMENT – FULL-TIME VS. PART-TIME*

Source: Haver Analytics, Guggenheim Investments. Data as of 7/31/2013. *Note: The seasonally adjusted data for full-time and part-time workers does not add up to the seasonally adjusted total employment because total employment is seasonally adjusted independently of full-time and part-time workers.

Economic Data Releases

U.S. GDP Revised Higher, Recent Data Mostly Positive

- U.S. second quarter GDP grew by 2.5% at an annualized rate after a solid upward revision from the initially reported figure of 1.7%. The revision was led by an improved trade balance.

- Personal income increased for a third consecutive month in July, inching up 0.1%.

- The ISM manufacturing index climbed to 55.7 in August, the highest level in over two years.

- The ISM non-manufacturing index jumped to 58.6 in August, the highest level since December 2005.

- The University of Michigan consumer confidence index was revised higher to 82.1 in August, but remained below July’s six-year high.

- The U.S. trade deficit widened in July to -$39.1 billion. Exports decreased 0.6% while imports rose 1.6% on the back of record auto purchases.

- Initial jobless claims decreased for a second straight week for the week ended August 31st, down to 323,000.

- Factory orders dropped 2.4% in July after rising the previous three months.

- Mortgage applications rose by 1.3% for the week ended August 30th. Refinancings were up while purchase applications fell.

- Construction spending grew 0.6% in July after a flat June. Residential construction spending rose for a ninth straight month.

Euro Zone Emerges from Recession as Confidence Heads Higher, Prices Up in Japan

- Euro zone aggregate GDP increased 0.3% in the second quarter, breaking a string of six consecutive contractions.

- Euro zone retail sales ticked up 0.1% in July, slightly under expectations.

- Euro zone economic confidence continued to trend higher in August, reaching 95.2, the best level in two years.

- German retail sales fell much more-than-expected in July, down for a second straight month at 1.4%.

- The U.K. manufacturing PMI rose to 57.2 in August, the highest level since February 2011.

- China’s PMI official manufacturing PMI increased for a second straight month in August, rising to 51.0. The HSBC manufacturing PMI rose out of contraction to 50.1.

- Japanese industrial production rebounded in July, up 3.2%, the best month in over two years.

- Japanese consumer prices grew 0.7% from a year ago in July, the most since November 2008.

Copyright © Guggenheim Partners LLC