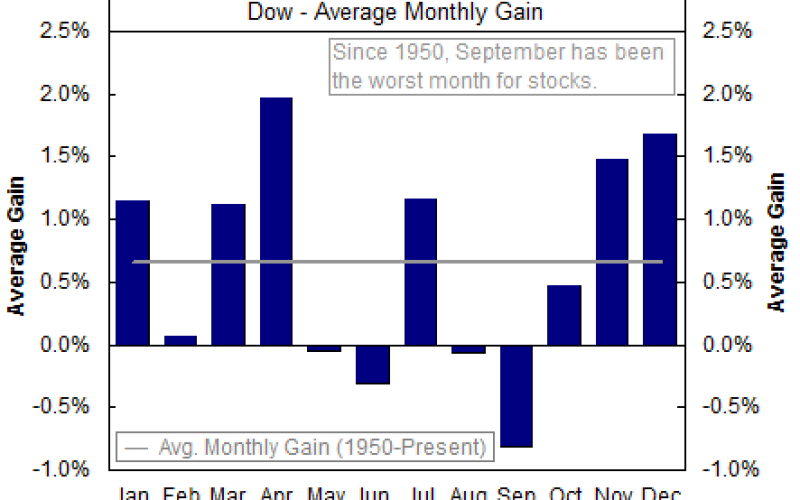

Although investing in stocks is a long term endeavor the following post will provide some insight into returns during the month of September. I am sure as soon as I upload this post to our blog site, any conclusions that are drawn below will prove to be false. Nonetheless, over the course of the past few weeks strategists have been expounding on the fact the month of September has proved to be the worst month for stocks during the course of a year. The recent chart release from the Chart of the Day charting service provided the below commentary and graphic with their report today.

"The stock market has struggled over the past month. Investors are concerned. For some perspective, today's chart presents the Dow's average performance for each calendar month since 1950. As today's chart illustrates, it is not unusual for the stock market to underperform during the May to October time frame with a brief counter-trend rally occurring in July. It is worth noting that the worst calendar month for stock market performance (i.e. September) has just begun."

Source: Chart of the Day

I took a quick look at the monthly returns for the S&P 500 Index going back to 1950 (62 data points). The data, supplied by Commodity Systems Inc., was downloaded from YahooFinance. The data used the opening index price for the month being analyzed. The ending results showed:

- The S&P 500 Index delivered negative returns in 35 out of 62 Septembers. In other words, 56% of the returns in September were negative.

- The overall average price only return for all Septembers was negative .71%.

- The August return was negative 27 out of 62 observations or 44% of the time.

- When August returns were negative, like experienced this year, the return in 14 of the months of September, or 52%, were positive. In other words, a negative August would indicate September is more likely to have a positive return.

- The average positive return for September when August was negative (13 data points) was 3.87%.

A link to some of the data used in the analysis can be found here.

For investors focused on September returns, it appears slightly more than half the months of September have generated negative returns. Further though, when August returns are negative, like experienced in 2013, the average return for the month of September is a positive 3.87%.

Certainly there are potential political and economic headwinds on the horizon that could trip up the market. However, market timing is a difficult endeavor and focusing more on company fundamentals will likely be more beneficial than focusing on the so called September effect.