by Sober Look

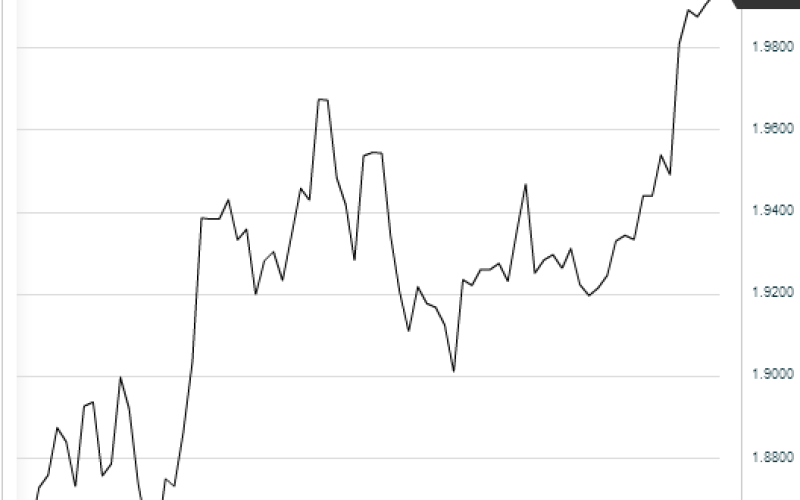

As we look across major emerging economies, even some of the strongest have not been spared. Consider Turkey for example. The lira is now toying with the 2-to-the-dollar level - even after the central bank has taken a number of steps to stabilize the currency.

Hurriyet Daily News: - The Turkish central bank said it would apply more monetary tightening by not holding one-week repo auctions, halting funding from its policy rate and opening forex-selling auctions of at least $350 million.

At this point the central bank is desperate, adjusting its policy each week or even more than once a week. It is however having little success, as the currency slides, ...

Turkish lira to one dollar (source: Investing.com)

... the stock market is now in full retreat, ...

Borsa Istanbul National 100 Index (source: Bloomberg)

... and rates have gone vertical, as the three-year notes punch through 10% - more than doubling in yield since May.

Turkey 3yr government bond yield

How did we get here? How is it that the Fed's actions, which had to take place sooner or later, precipitated a severe market squeeze on one of the strongest emerging economies - among others? An interesting answer came from Donald Kohn, the former Fed vice-chair, who presented at Jackson Hole.

FT: - With cheap capital flowing in, some emerging markets failed to run a disciplined economic policy, or carry out reforms to boost future growth. Those are the economies that now face the greatest difficulties.

One argument at Jackson Hole, although expressed with much diplomacy and politesse, was whether those imbalances in emerging markets are an inevitable result of easy monetary policy in the US and elsewhere, or the fault of developing country policy makers.

“The recipient countries have considerable control over how this works out and what stability conditions are inside their own countries,” said Donald Kohn, the former Fed vice-chair, now at the Brookings Institution. “One of the ways that monetary policy from the United States was transmitted to the rest of the world was by resistance to exchange rate appreciation in many other countries.”

By holding down their currencies, these nations allowed semi-hot money to flood their economies. In a fully flexible exchange rate mechanism these currencies would have appreciated sufficiently to make it less attractive (more expensive) for this capital to enter. That would limit the semi-hot money and force these nations to grow in a more sustainable manner. Unfortunately this hasn't been the policy for a number of nations. Now the semi-hot money is rapidly exiting, leaving these countries with economic damage that could potentially become severe.

Copyright © SoberLook.com