by Seth J. Masters, AllianceBernstein

Seth J. Masters (pictured) and Ding Liu

A lot of people worry about what will happen when the Federal Reserve lets interest rates rise. Our research suggests that’s not the big risk.

Bond markets around the world have been agitated since the Federal Reserve hinted in late May that it might reduce its bond purchases earlier than expected. Amid dire forecasts of the economic and market impact, the yield on the 7-year US Treasury bond shot up nearly 100 basis points to 2.27% on August 19, and its price volatility more than tripled. Interest rates and volatility also spiked in Europe, the UK and emerging markets.

In our view, the knee-jerk reaction has been way out of proportion to the actual risk, in part because most people focus on one possible outcome, as if it were bound to occur. We take a different approach: We model the range of possible outcomes. In this case, we looked at the range of potential returns for cash and bonds over the next 10 years, varying when the Fed ends its current unorthodox policies from just a few months to 20 years. We did the same for major sovereign-bond markets around the globe.

More Pain Up Front than Longer Term

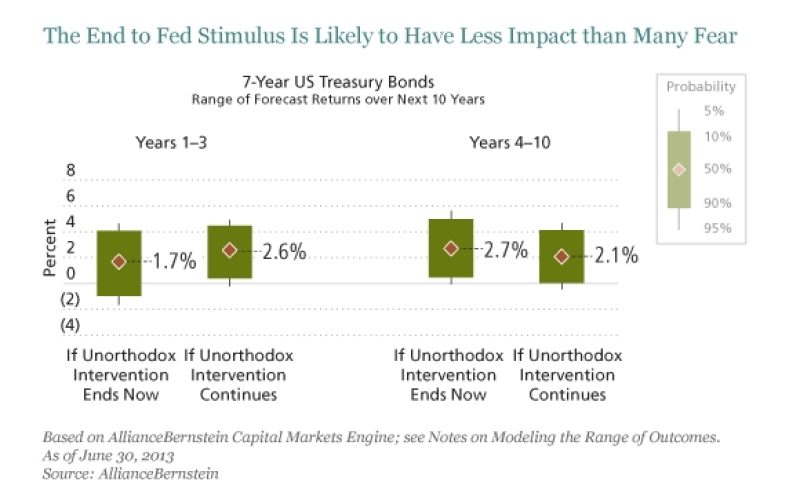

As the market expects, an immediate end to the Fed’s unorthodox policies would hurt bond returns over the next three years: We project that annualized returns for 7-year US Treasuries (representing intermediate-term portfolios) will range from (1)% to 4%, excluding the best and worst deciles of outcomes, as shown by the green bar at the far left of the display below. Our median forecast is 1.7%. If, however, the Fed keeps rates low at least a while longer, we project that the range of annualized bond returns for the next three years will be somewhat higher, with a median return of 2.6%.

Note that Treasury bond market losses over the past three months have been close to the bottom of our forecast range for the next three years—if the Fed abandons its unorthodox policies very soon. But the Fed has consistently said that it will soon begin to taper (not end) its stimulative bond purchases—and that short-term rates will remain low for an extended period, probably until 2015.

Note that Treasury bond market losses over the past three months have been close to the bottom of our forecast range for the next three years—if the Fed abandons its unorthodox policies very soon. But the Fed has consistently said that it will soon begin to taper (not end) its stimulative bond purchases—and that short-term rates will remain low for an extended period, probably until 2015.

Over the longer term (years four through 10), we project that the odds of negative annualized returns on bonds are quite low, whether or not the Fed ends its current unorthodox policies. Nonetheless, our forecast suggests that a quick end to these policies would ultimately be better for longer-term bond returns. As the third green bar from the left shows, if the Fed ends its unorthodox policies now, 7-year bond returns are likely to range from 0.5% to 5.0% (excluding the worst and best deciles), with a median of 2.7%. Even the worst 5% of outcomes is barely negative.

If the Fed’s intervention continues, we forecast that bond returns will range from 0.1% to 4.1% (excluding the best and worst deciles), with a median of 2.1%. The worst 5% of returns would be a bit more negative, at (0.5) %. That would be bad, but hardly catastrophic—and by definition, it’s extremely unlikely.

It makes sense than an immediate end to the Fed’s policies would hurt bond returns in the short term, but help in the long term. While rising interest rates initially push down bond prices, they also increase expected returns from income thereafter. The pain from the price drop comes quickly, while the benefit of higher income accrues gradually over time.

After 30 years of falling interest rates, many people have forgotten that they can lose money on bonds. But let’s have some perspective here. Treasury bond returns are unlikely to be truly terrible in almost any scenario, at least in nominal terms. Bond-market volatility is almost always much lower than stock-market volatility.

Remember Why You Own Bonds

Traditionally, most investors have owned bonds for income and stability, and to diversify equity-market risk. Short-term interest rates near zero and quantitative easing have robbed bonds (especially Treasuries) of much of their income benefit and have created the potential for instability when these policies end. But the diversification benefit of bonds remains strong. Indeed, with the stock market testing new highs (though fairly priced), we think investors need bonds to cushion the impact, if the stock market retraces some of its gains.

In the recent bond market sell-off, some leveraged investors facing margin calls were forced to sell at distressed prices. This had an outsize impact on bond prices, because dealers were unwilling or unable to provide liquidity. Frightened mutual fund investors also fled bonds, creating additional market stress. That’s too bad: Distress sales in illiquid markets provide an opportunity that longer-term investors can profit from.

Whether to own bonds (or stocks) should not be a yes-or-no question. We think it’s tragic that all too many investors sold their stocks at the bottom in late 2008, thereby missing the equity markets’ subsequent recovery. In our view, the big risk today is that fearful investors might stampede out of bonds, which could prevent them from meeting their risk and return objectives going forward.

Notes on Modeling the Range of Outcomes

This analysis used the AllianceBernstein Capital Markets Engine, which starts with initial conditions for economic growth (now slow but improving), inflation (low), corporate profitability and dividend yields (high), cash and bond yields (extremely low) and other fundamental building blocks of returns. It then uses a Monte Carlo model to simulate 10,000 plausible paths from this starting point. Each path recognizes the fundamental linkages between the economy and capital markets. For example, interest rates tend to rise with economic growth and inflation, which in turn influence stock and bond returns. So a path with rising inflation is highly likely to produce weak bond returns.

Central banks seeking to stimulate the economy have imposed constraints on the usual linkages in recent years by suppressing interest rates. Since we don’t know how long these policies will last, we modeled the impact of current low rates persisting for various time periods, from a few months to 20 years. Given Fed guidance, we estimated that the most likely outcome was that monetary policy would tighten in about two years. In all cases, we assumed that interest rates would rise sharply when policy first changed, and then rise more slowly to approach normal levels, with varying impacts from fluctuations in the other building blocks of return.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Seth J. Masters is Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein, and Chief Investment Officer of Defined Contribution Investments and Asset Allocation at AllianceBernstein. Ding Liu is a Senior Quantitative Analyst at Alliance Bernstein.

Copyright © AllianceBernstein