by Scott Krisiloff, Avondale Asset Management

The Dow is looking to make it seven straight down days tomorrow, and you have to love the symmetry considering that earlier this year we got a streak of 10 straight up days.

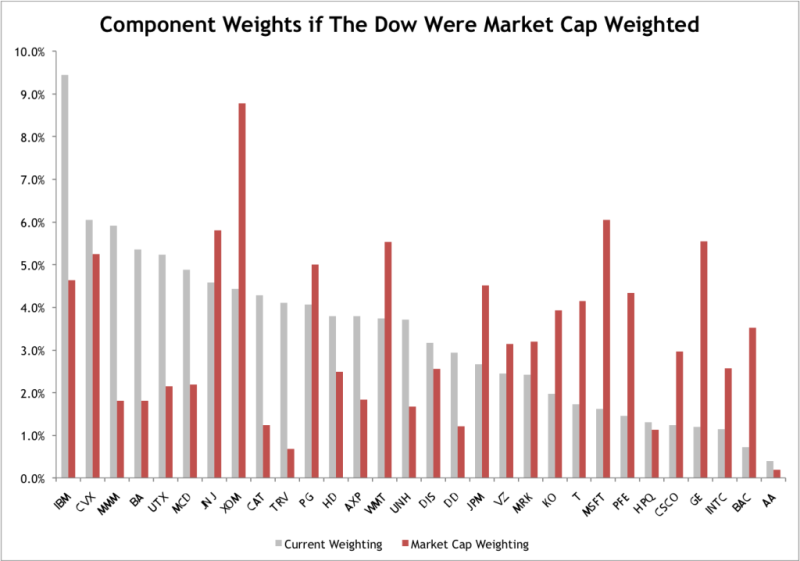

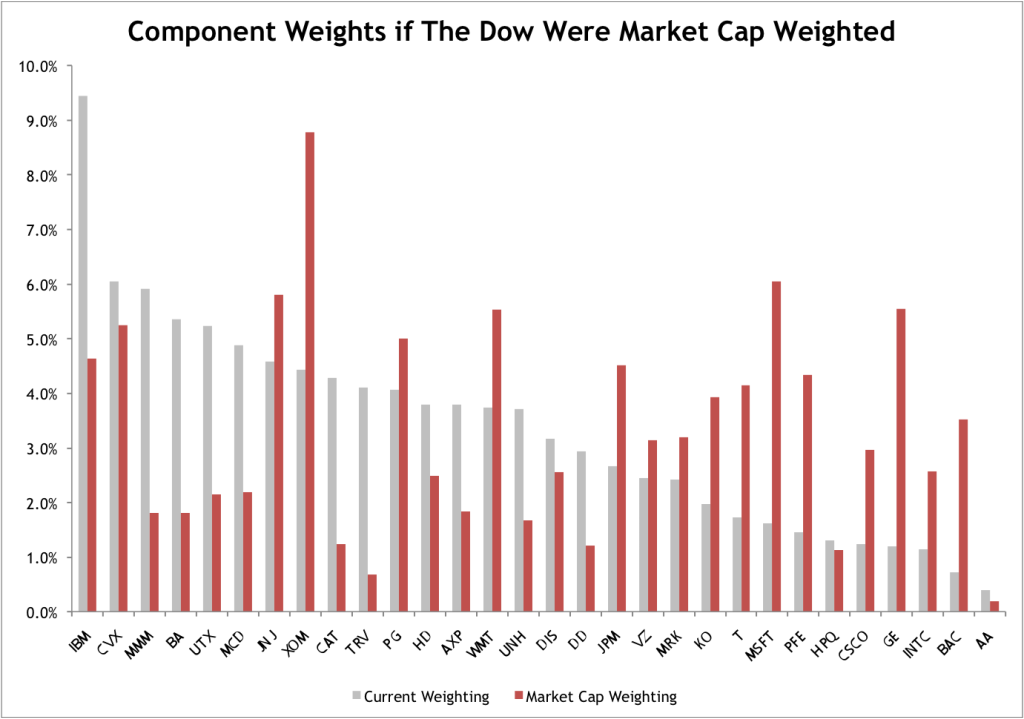

Following the recent losing streak, the Dow is now underperforming the S&P 500 by 1.5% year to date (ex-dividends), which comes after trailing the $SPX by a woeful ~600 bps in 2012. One notable factor contributing to the divergence between the indexes is that the Dow is price weighted, while the S&P 500 is market cap weighted. In order to take a look at how the Dow is tilted, below is a chart of the current Dow weightings and what they would be if they were weighted according to market cap.

By price weighting, IBM has the largest current weight within the Dow at 9.4% of the index. If the index were market cap weighted though, IBM’s weight would fall to only 4.8%. As a market cap weighted index, XOM would be the largest holding at 8.8% vs. 4.4% currently.

Overall if the $DJIA were market cap weighted, the Industrial Average would be a lot less Industrial. The weighting of the Industrial sector would fall from ~22% to ~10% (depending on how you categorize some of the components). Even with IBM, Tech would gain much of what the industrial sector lost. MSFT is currently the most “underweighted” company in the Dow–it would be 6% of the index, but instead is only 1.6%.

The outsized industrials weight could help explain why the Dow has underperformed the $SPX over the last year and a half. In the short term, this could be taken as an indication that market cap weighting is a superior construction for an index. However, there likely will come a time when Industrials outperform, at which point the Dow will look great again. More than a statement on index construction, perhaps it’s another reminder of the obvious: two different portfolios will attain two different rates of return. If the S&P and Dow were two active managers it’s likely that one would be called a genius and the other a failure. Even two indexes can have widely different performance. As long as someone has to decide which index to use (in addition to how much and when) there’s really no such thing as passive investment management.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Copyright © Avondale Asset Management