by Jamie Hyndman, Mawer Investment Management

The rapid decline of BlackBerry (formerly Research in Motion) over the last few years has seen the popular press pose a question about whether it has moved from being a growth stock to a value stock. It has reminded me of how much I hate this question.

Every time I get asked, “Is Mawer a growth or value investor?” I draw in a long breath because the answer won’t be brief. But before launching in, I start with a punchy one-liner to lighten the mood and say, “There are only two styles of investors, good ones and bad ones – we’re the good ones.”

But then the heavy lifting begins.

Generally, we believe investors would be wise not to limit themselves to only part of the investment universe because there may be attractive investment opportunities in any area of the market. If you’re looking to catch a bunch of good fish, better to fish in a big pond.

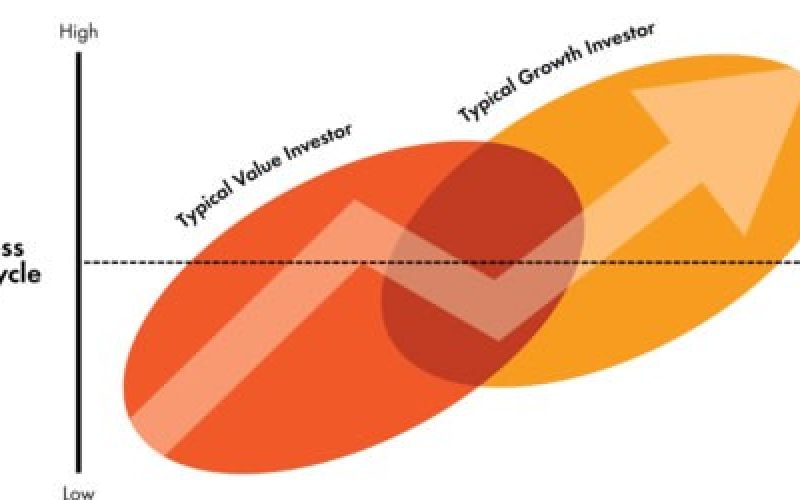

The difference between the two categorizations usually comes down to earnings growth rates and valuation. Those companies with high growth rates and high valuation are lumped into the growth camp, while low growth, low valuation companies are bucketed into the value camp. Underlying these two categorizations is an unspoken belief that the growth stocks are the good ones and the value stocks are the dinosaurs, soon to become extinct.

Seem a bit too simplistic? We think so. Specifically, it’s important to understand that some important investment metrics, such as strong business models and quality management teams, can exist in both the growth and value realm. It should also be noted that low growth “value” companies can still be wealth creating, that is, have a return on capital greater than their cost of capital – something we believe to be the quintessential concept in successful investing.

Furthermore, “attractive” sectors that have significant growth potential may also have a lot of competition as numerous companies vie for their slice of the growing profits. This of course leads to a great deal of uncertainty over which companies will ultimately be successful and which will fail – and many do fail, so growth investing is far from a sure thing.

Compare and contrast that to a scenario in which there is a more mature company in an industry that isn’t growing much. Take the cheese business for example. There are not too many companies gunning for world dominance in the cheese business. As such, the incumbent cheese makers face little competition and therefore have a decent chance at profitability and longevity, all else being equal. Returns here may not be in the double-digits, but they can be decent, and perhaps more importantly, dependable.

To be clear, we are not suggesting all growth stocks are bad investments. The challenge for an investment manager is determining if Mr. Market has correctly valued a security given its growth profile. A growth stock may very well have a sustainable competitive advantage and be worth the lofty valuation the market has assigned it – perhaps it will even grow at higher rates than the market expects and deserves a richer valuation. Conversely, a company with a low valuation is not inescapably doomed to a life of mediocrity – it may only have a short-term issue or be temporarily out of favour and its earnings and/or interest may rebound at a later date. Thorough, bottom-up fundamental analysis helps us sift through companies one by one and deal with these challenging questions.

So while having style is normally a good thing, getting pre-occupied with investment styles can lead to losing sight of what’s really important: selecting good stocks.

Jamie Hyndman

Copyright © Mawer Investment Management